What is sum assured in health insurance? It’s a term you’ll see on every policy document, but many buyers aren’t sure what it really means. In this guide, we break it down in simple terms so you can choose the right coverage confidently.

Let’s break it down in simple words.

💡 Tip: How Much Sum Assured Should You Choose?

There’s no one-size-fits-all. But here’s a quick guide:

| Family Type | Recommended Sum Assured |

|---|---|

| Individual | ₹5 – ₹10 lakh |

| Couple | ₹10 – ₹15 lakh |

| Family of 3–4 | ₹15 – ₹25 lakh (floater) |

| Senior Citizens | ₹5 – ₹10 lakh per person |

Factors to consider:

- City you live in (urban = higher medical cost)

- Type of hospital you prefer (private vs. government)

- Existing illnesses (pre-existing conditions)

- Inflation in healthcare costs

If you’re new to insurance, our Understanding Life Insurance Riders in 2025 guide explains how add-ons can complement your sum assured.

🚫 Sum Assured vs. Sum Insured — What’s the Difference?

Though often used interchangeably, technically:

- Sum Assured = used in life insurance

- Sum Insured = used in health/general insurance

But in practice, both terms are used for coverage amount in health policies in India.

✅ How to Check Sum Assured in Your Policy

You can find your sum assured:

- In the policy document

- On your insurer’s app or customer portal

- On your e-card

- By calling customer care

📝 Related: See HDFC ERGO’s guide on Sum Assured in Health Insurance for additional examples and benefits.

🔚 Final Thoughts

What Is Sum Assured in Health Insurance is one of the most important factors to consider when buying a policy. It ensures your hospital bills are covered and your savings remain protected. Avoid choosing too low an amount just to save on premiums — or too high without reason. Instead, strike the right balance based on your needs and medical risks.

🙋 Still Confused?

Talk to an IRDAI-licensed advisor or use online premium calculators.

Make sure you’re protected — not just insured.

❓ Frequently Asked Questions (FAQs)

✅ What is sum assured in health insurance?

Sum assured is the maximum amount your health insurer will pay for medical expenses during the policy period. It’s also called the coverage limit of your policy.

✅ Is sum assured and sum insured the same?

Technically, sum assured is used in life insurance and sum insured in health/general insurance. However, many health insurance providers use the term “sum assured” interchangeably to refer to coverage amount.

✅ How do I choose the right sum assured?

The right sum assured depends on factors like:

- Size of your family

- Age and health conditions

- City and cost of hospitalization

- Preferred hospital type (private vs. government)

As a general rule, opt for a minimum ₹5–10 lakh for individuals, and ₹15–25 lakh for families in metro cities.

✅ Can I increase the sum assured later?

Yes, many insurers allow you to upgrade your coverage at the time of renewal. You may need to undergo a medical check-up or pay a higher premium.

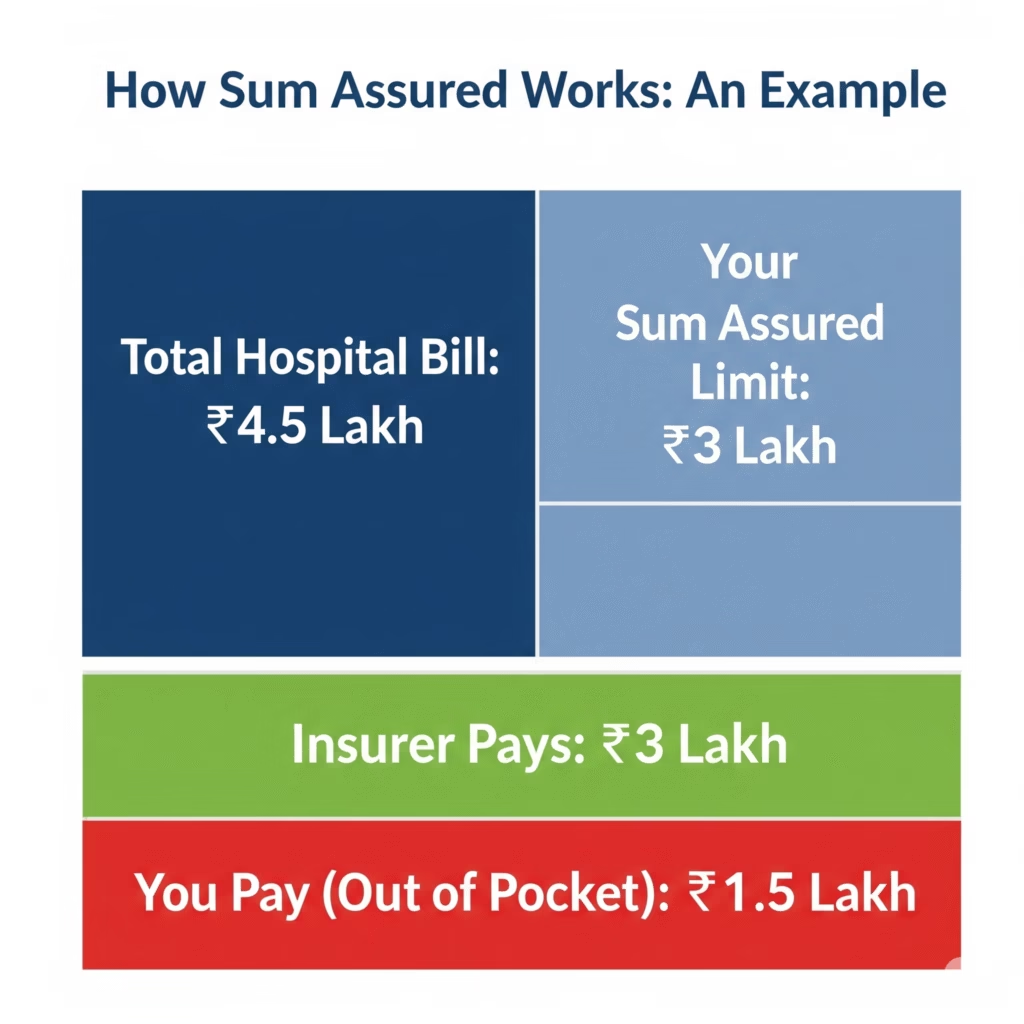

✅ What happens if medical expenses exceed the sum assured?

If your total hospital bill is more than your policy’s sum assured, the insurer will only pay up to the covered amount. You’ll need to pay the rest from your own pocket unless you have features like restore benefit or top-up plans.

✅ Where can I find my sum assured details?

You can find the sum assured in:

- Your policy document

- The insurer’s mobile app or online portal

- Your e-policy card

- By contacting your insurer’s customer support

✅ Does a higher sum assured mean a higher premium?

Yes, generally, a higher sum assured means a higher premium. However, many policies offer customization options, family floaters, and top-up plans to make higher coverage more affordable.

Now that you understand What Is Sum Assured in Health Insurance, you can choose a policy that offers enough protection for you and your family.

Last Updated on August 4, 2025 by Singh Sumit

Informatics

Thanks

please follow my websites