Introduction: Why Bike Insurance Needs a Smart Upgrade

Usage-Based Bike Insurance India is transforming the way two-wheeler owners think about coverage in 2025. For years, traditional bike insurance charged the same flat premium. It did not matter if you rode daily in heavy traffic or just took your scooter out on weekends. This one-size-fits-all model often felt unfair to safe riders and occasional users.

Now, with the rise of telematics and IoT devices, premiums are becoming smarter, personalized, and more transparent. Usage-based insurance rewards good riding habits, ensures affordability for low-mileage users, and gives delivery executives or gig workers flexible options. In short, it’s making bike insurance fairer, cheaper, and future-ready for millions of Indian riders.

If you’ve already read about Usage-Based Car Insurance in India 2025: Save Big with Telematics, then you’ll understand why this trend is equally important in the bike insurance space.

What is Usage-Based Bike Insurance India?

Usage-Based Insurance (UBI) is a modern approach where premiums are linked to riding patterns rather than static factors.

Instead of paying a flat yearly amount, insurers calculate your policy based on:

- Kilometers driven

- Time of use (day vs night riding)

- Speeding and braking patterns

- Road type and traffic conditions

This is possible thanks to telematics devices or mobile-based apps that monitor riding behavior and send the data to the insurer.

The Rise of Telematics in Insurance

Telematics is the backbone of usage-based policies. In India, leading insurers are already adopting IoT-enabled trackers to improve fairness and reduce fraudulent claims. These devices not only record distance but also analyze driving style to create a rider risk profile.

Pay-As-You-Ride vs. Pay-How-You-Ride Models

- Pay-As-You-Ride (PAYR): Premiums depend on how much you ride. Best for occasional users or those who own multiple bikes.

- Pay-How-You-Ride (PHYD): Premiums depend on driving behavior like braking, cornering, and speed. Perfect for safe riders who deserve lower premiums.

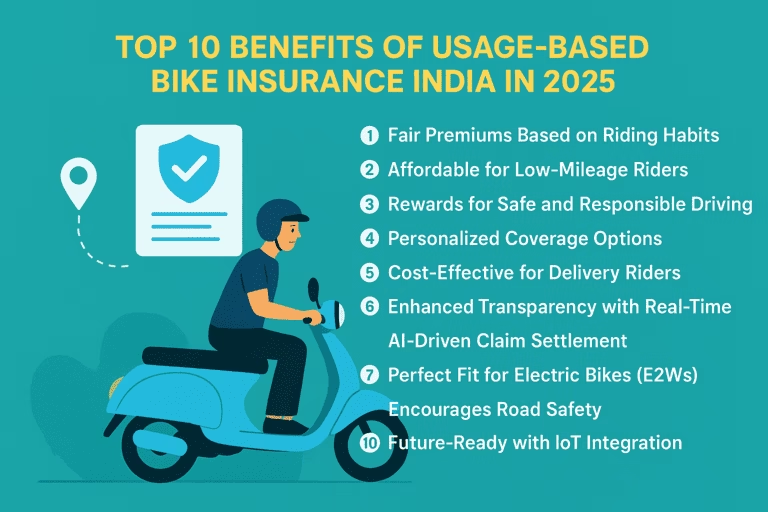

Top 10 Benefits of Usage-Based Bike Insurance India

1. Fair Premiums Based on Riding Habits

No more blanket pricing. Safe and occasional riders finally pay fair premiums.

2. Affordable for Low-Mileage Riders

If you only ride weekends or short commutes, you’ll save big compared to traditional policies.

3. Rewards for Safe and Responsible Driving

Telematics-based policies encourage safe driving with discounts and cashback offers.

4. Personalized Coverage Options

Custom add-ons can be designed around your usage pattern—ideal for students, professionals, and gig workers.

5. Cost-Effective for Delivery Riders

Delivery executives and gig workers benefit from daily/micro-duration cover, ensuring affordability and flexibility.

6. Enhanced Transparency with Real-Time Data

Both insurers and customers can track claims and riding history in real-time.

7. AI-Driven Claim Settlement

With AI and telematics, insurers can assess accident reports instantly, making claims faster and more accurate.

8. Perfect Fit for Electric Two-Wheelers

EVs are rising, and usage-based insurance aligns well with battery-specific risks and low-mileage use.

9. Encourages Road Safety

Since riders are monitored, there’s a natural push towards responsible riding.

10. Future-Ready with IoT Integration

From GPS trackers to mobile apps, UBI is ready for integration with India’s digital insurance ecosystem.

Usage-Based Bike Insurance India: Common Issues and Limitations

1. Data Privacy Concerns – Riders worry about how insurers handle their driving data. Transparency is essential.

2. Device Costs – GPS or telematics devices add extra cost, which may deter some users.

3. Low Awareness – Many bike owners don’t know how usage-based insurance works, slowing adoption.

4. Limited Availability – In 2025, only a few insurers offer UBI policies in India, restricting options.

Who Should Buy Usage-Based Bike Insurance?

- Daily Commuters – Save with pay-how-you-drive.

- Occasional Riders – Only pay for what you use.

- Students – Affordable premiums tailored to limited riding.

- Delivery Executives – Flexible micro-duration coverage.

For a smoother experience, check out Acko Bike Insurance: Fast, Easy, and Digital Experience, which is pioneering digital-first bike insurance models.

How to Buy Usage-Based Bike Insurance in India

Leading Insurers Offering Telematics Policies

Several insurers, including digital-first ones, have launched usage-based bike insurance pilots in 2025.

Steps to Get Started

- Choose a UBI-enabled insurer.

- Install the telematics device or app.

- Share consent for tracking.

- Ride smart, and enjoy discounts on renewal.

FAQs on Usage-Based Bike Insurance India

Q1. What is Usage-Based Bike Insurance India and how does it work?

Usage-Based Bike Insurance India is a policy. Premiums are determined by your riding habits. They are also based on kilometers traveled and overall driving behavior. Telematics devices or mobile apps record your data, and insurers use it to calculate fair and personalized premiums.

Q2. Is usage-based bike insurance cheaper than traditional policies?

Yes. For safe riders, students, and low-mileage users, it often works out cheaper than flat-rate traditional policies.

Q3. Can delivery riders and gig workers benefit from usage-based bike insurance?

Absolutely! They can opt for micro-duration or pay-as-you-ride models, making coverage more flexible.

Q4. Does usage-based insurance apply to electric two-wheelers in India?

Yes. Insurers are tailoring policies specifically for electric bikes (E2Ws), covering batteries and unique EV risks.

Q5. Which insurers are offering usage-based bike insurance in India?

Several digital-first insurers and leading companies have started pilot programs in 2025. For more insights, you can explore Acko Bike Insurance: Fast, Easy, and Digital Experience.

Conclusion: Smarter, Safer, and Cost-Effective Riding

The future of two-wheeler coverage in India lies in Usage-Based Bike Insurance India. It’s a model where riders pay based on how much and how safely they ride. It not only rewards responsible riders but also makes insurance more affordable for low-mileage users and flexible for delivery executives.

AI-driven claims, telematics devices, and EV-ready policies are on the rise. As a result, usage-based bike insurance is set to dominate India’s insurance market. This trend will begin in 2025 and continue beyond. For riders looking for fairness, savings, and innovation, Usage-Based Bike Insurance India is the smarter choice.

To explore the bigger picture, you can check the IRDAI’s official motor insurance updates for evolving regulations in India.

Last Updated on August 21, 2025 by Singh Sumit

2 thoughts on “Top 10 Benefits of Usage-Based Bike Insurance India in 2025: The Future of Smarter Riding”