Understanding Life Insurance Riders in 2025 is crucial for anyone looking to enhance their policy benefits without buying a new plan. Riders are optional add-ons that offer extra protection tailored to your needs—whether it’s critical illness, accidental death, or premium waivers.

🧠 Why Choose Riders in 2025?

- 🔍 Protection Beyond Death: Safeguard against critical illness, accidents, or disability.

- 💳 Low Extra Premium: Often less than 5% of base policy cost.

- 🎯 Tailored Coverage: Select only what you need—waiver of premium, income benefits, or child protection.Bajaj Allianz Life Tata AIA Life Insurance ICICI Prudential Life Insurance

📝 Top Riders Available in India (2025)

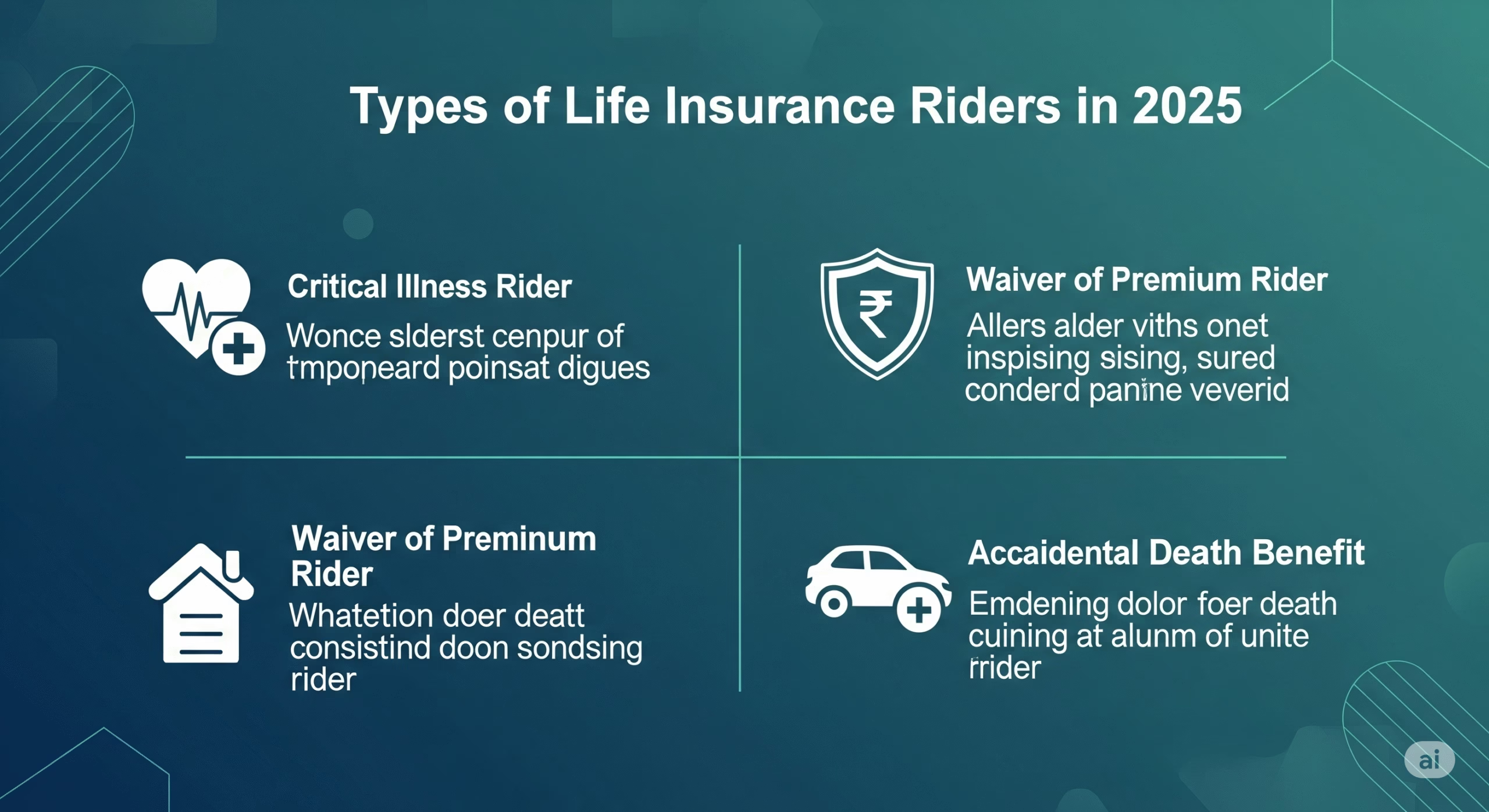

1. Accidental Death Benefit (ADB) Rider

Pays an extra sum if death occurs due to an accident, on top of the base death benefit. Ideal for high-risk individuals or frequent travelers.

2. Waiver of Premium (WOP) Rider

Waives future premium payments if you become critically ill or disabled, keeping your policy active. Perfect for peace-of-mind protection.

3. Critical Illness Rider

Offers a lump sum payout upon diagnosis of covered critical illnesses (like cancer, heart attack, stroke), helping manage medical expenses or income loss.

4. Permanent & Partial Disability Rider

Provides a lump sum or periodic payments if you’re permanently or partially disabled due to an accident or illness.

5. Income Benefit / Family Income Rider

Instead of a lump-sum, this rider pays regular income (monthly/annual) to your family after your demise. It’s a great option for ongoing financial support.

6. Guaranteed Insurability Rider (GIR)

Allows you to increase your sum assured at specified life events (e.g., marriage, childbirth) without further medical checks. Ideal if your coverage needs are likely to grow.

6. Guaranteed Insurability Rider (GIR)

Allows you to increase your sum assured at specified life events (e.g., marriage, childbirth) without further medical checks. Ideal if your coverage needs are likely to grow.

7. Child Term Rider

Provides temporary life coverage for your child at nominal cost and can often be converted later to a full policy.

✅ How to Decide Which Rider to Add

| Rider Type | Best For | Why You Might Choose It |

|---|---|---|

| Waiver of Premium | Parents, breadwinners | Keeps policy active despite income loss |

| Critical Illness | Individuals with medical history | Covers serious treatment costs |

| Accidental Death | Risk-travelers, industrial workers | Extra protection for accidents |

| Income Benefit | Families dependent on steady income | Provides continuing financial support |

| Guaranteed Insurability | Young adults planning life events | Allows future coverage increases without tests |

📍 Pro Tips for Choosing Riders

- Always compare claim settlement ratios on platforms like Policybazaar or Coverfox.

- Be mindful: some advisers recommend avoiding Critical Illness riders unless essential—it’s often cheaper to buy a standalone policy.

- Selecting too many riders can dilute value—choose only what aligns with your risk profile and goals.

📎 Internal & External Links

- 🔗 Internal: Best Term Insurance Plans for Salaried Employees (2025 Edition)

- 🔗 External: Learn more about riders from [ICICI’s Insurance Blog on Riders] (https://www.icicibank.com/blogs/general-insurance/important-term-insurance-riders-you-must-have-for-comprehensive-protection)

- 🙋 Frequently Asked Questions (FAQ)

- Q1. Are rider premiums tax-deductible?

- Yes. Premiums for riders like WOP or accidental death qualify under Section 80C, while critical illness riders may fall under Section 80D, subject to limits.

- Q2. Can insurers reject riders?

- Yes—especially Critical Illness and WOP riders may be declined based on medical history. Some Reddit users reported this with companies like HDFC or Axis.

- Q3. Can I purchase multiple riders at once?

- Yes. Most policies allow multiple riders together, though each may increase your premium.

- Q4. Do riders apply to all policy types?

- Most riders are available with term, ULIP, endowment, or whole-life plans—but availability varies. Riders must be confirmed at the time of purchase.ICICI Prudential Life Insurance

🏁 Final Takeaway

Understanding life insurance riders empowers you to tailor your coverage—without overpaying. Whether it’s premium waivers, income protections, or extended death benefits, a thoughtful rider strategy adds real value in 2025.

✅ Choose smart. Pick riders that match your family’s goals, not your agent’s pitch.

Last Updated on August 15, 2025 by Singh Sumit

Super rider

Thanks

definitely

yes

take this

very important

👍

Thanks

sure

foollow