Let’s be real—insurance used to feel boring, paperwork-heavy, and something only your parents worried about.

But 2025 is different.

Welcome to Term Insurance 2.0—the smarter, digital-first upgrade of traditional term plans.

Think of it like moving from a basic phone to a smartphone. The purpose (protection) stays the same, but the experience is modern, flexible, and built for today’s lifestyle.

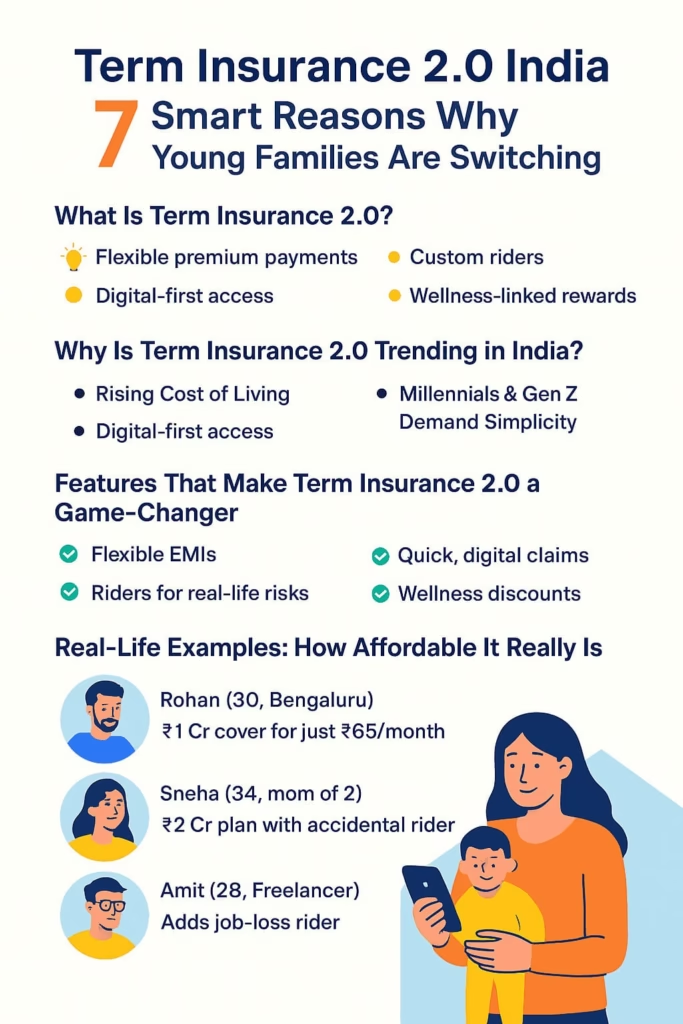

What Is Term Insurance 2.0?

Here’s what makes it stand out in India 2025:

💡 Flexible premium payments – Pay yearly, monthly, or even via EMIs.

💡 Custom riders – Cover accidents, critical illness, disability, or even job loss.

💡 Digital-first access – Buy, manage & claim—all from your phone.

💡 Wellness-linked rewards – Discounts for staying fit with steps & health checkups.+

👉 Confused about affordability? Check our guide on Calculate Term Insurance Premium Online in 2025 and see how smart protection fits every budget.

Why Is Term Insurance 2.0 Trending in India?

A few big shifts are fueling its rise:

🔹 Rising Cost of Living – Families want big cover, but at budget-friendly premiums.

🔹 Millennials & Gen Z Demand Simplicity – No one has time for long forms or branch visits.

🔹 Mobile-First Generation – From food delivery to home loans—everything’s online, so why not insurance?

Features That Make Term Insurance 2.0 a Game-Changer

✅ Flexible EMIs – Affordable even for young earners.

✅ Riders for real-life risks – Accident, illness, income loss.

✅ Quick, digital claims – No waiting weeks—instant online settlement.

✅ Wellness discounts – Track steps, earn rewards.

✅ Simple language – Policies written for humans, not lawyers.

👉 Insurance no longer feels like a burden—it feels like a service built around you.

Real-Life Examples: How Affordable It Really Is

👨💻 Rohan (30, Bengaluru) – ₹1 Cr cover for just ₹650/month.

👩👧 Sneha (34, mom of 2) – ₹2 Cr plan with accidental rider, still fits the family budget.

🎨 Amit (28, Freelancer) – Adds job-loss rider to manage income uncertainty.

👉 Different lifestyles, one common thread: affordable peace of mind.

Benefits of Term Insurance 2.0 in 2025

- 💰 Affordable Protection – Crores of coverage for a few hundred rupees.

- 📜 Tax Benefits – Save under 80C & 10(10D).

- 🎯 Custom Security – Pick riders that match your life goals.

- 🧘 Peace of Mind – Cover health risks & loans without stress.

💡 Example: A critical illness rider can save lakhs in hospital bills. Read our guide on When Critical Illness Insurance in India Can Save You Lakhs.

Who Should Buy Term Insurance 2.0 in 2025?

✔️ Millennials starting careers – Begin small, scale later.

✔️ Young parents – Secure kids’ future.

✔️ Freelancers & entrepreneurs – Riders protect against unstable income.

✔️ NRIs – Lower costs than abroad, with solid Indian coverage.

✔️ Loan borrowers – Ensure family isn’t left with EMI burdens.

How to Choose the Best Term Insurance 2.0 Plan

When comparing, don’t just chase the lowest premium. Look at:

- ✅ Premium vs Coverage

- ✅ Claim Settlement Ratio (CSR)

- ✅ Digital experience (app, support)

- ✅ Rider options

Top Companies Offering Term Insurance 2.0 in India (2025)

🏆 LIC Tech Term – Trusted + digital.

🏆 HDFC Life Click 2 Protect – Flexible riders.

🏆 ICICI iProtect Smart – High CSR.

🏆 Max Life Smart Term Plan – Feature-packed, affordable.

🏆 InsurTech Startups – Simple, app-first experience.

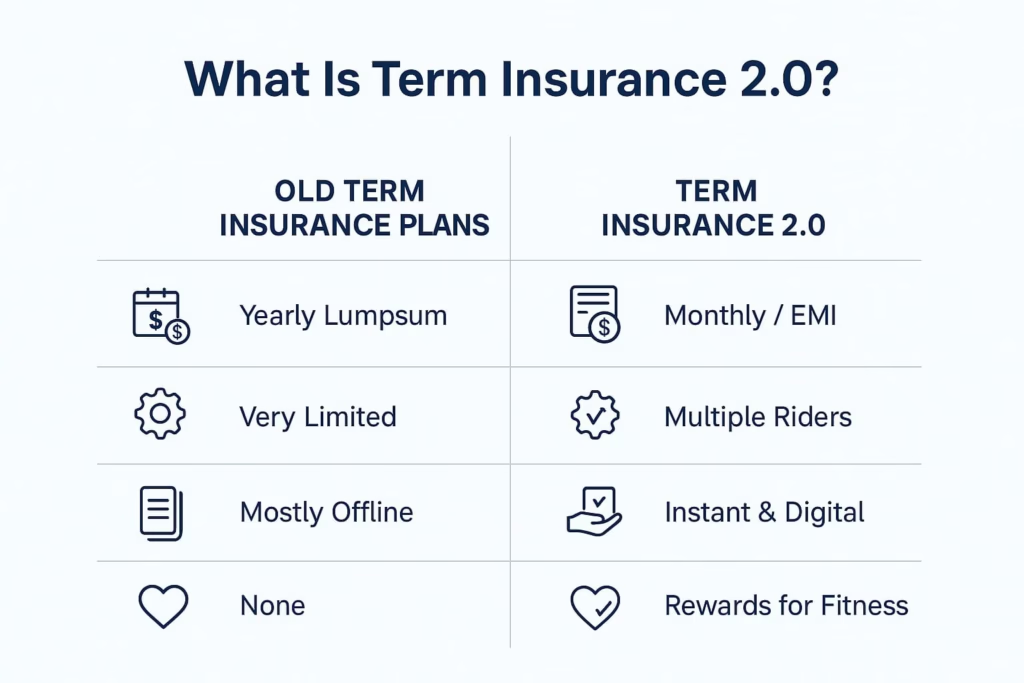

Term Insurance 2.0 vs Old Plans

| Feature | Old Term Plan | Term Insurance 2.0 |

|---|---|---|

| Payment | Yearly lump sum | Monthly / EMI |

| Customization | Limited | Multiple riders |

| Claims | Offline, slow | Digital, instant |

| Health Benefits | None | Fitness rewards |

| User Experience | Paperwork | App-based |

👉 Clearly, Term Insurance 2.0 = built for India’s 2025 lifestyle.

Future of Term Insurance in India

🚀 AI-driven underwriting – Faster approvals, fewer medical tests.

🚀 Wearable-linked premiums – Fitness trackers cut costs.

🚀 IRDAI reforms – Transparent, fast claim rules.

🚀 Bundled products – Term + investments.

🚀 Global portability – NRIs using Indian plans abroad.

FAQs About Term Insurance 2.0 India (2025)

Q1. Is it more costly?

👉 No, similar cost but with extra features.

Q2. Can I buy 100% online?

👉 Yes, most insurers now offer fully digital journeys.

Q3. Best riders to add?

👉 Critical illness, accidental death, waiver of premium.

Q4. Does it give tax benefits?

👉 Yes, under 80C & 10(10D).

Q5. Is it only for young buyers?

👉 No, anyone with dependents should consider it.

Q6. What if I miss a premium?

👉 Grace periods & flexible options exist.

Q7. Can NRIs buy Term Insurance 2.0?

👉 Yes, at lower costs vs abroad.

Q8. Do I need a medical test?

👉 Sometimes, but wearables & AI reduce the need.

Conclusion: Why Term Insurance 2.0 Is the Future

In 2025, Term Insurance 2.0 is more than just insurance—it’s affordable, flexible, and digital-first.

👉 If you’ve been delaying, now’s the best time. Compare, choose smart, and secure your family’s future.

🔗 External Resource: IRDAI Official Website

Gd