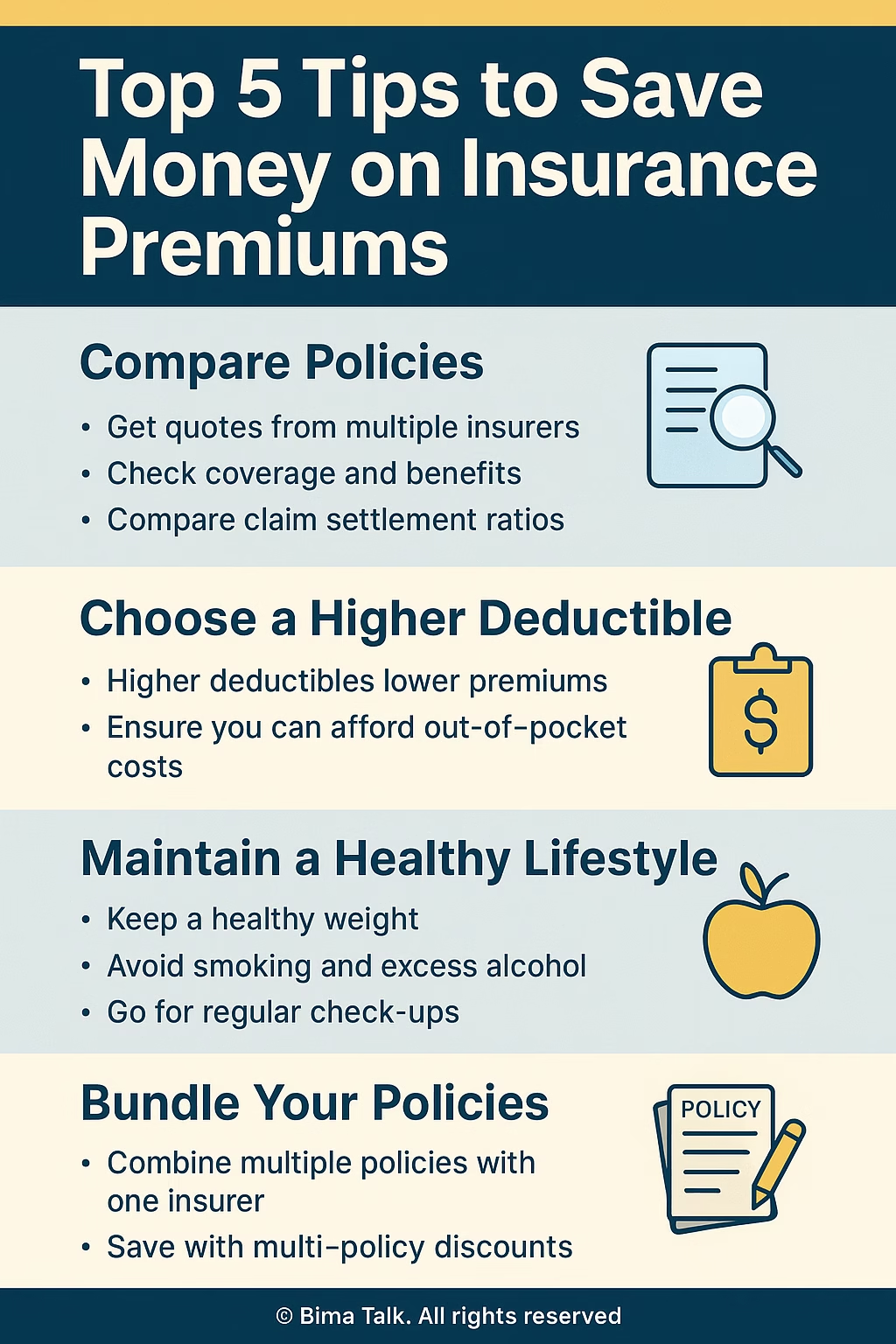

Introduction: Save Money on Insurance Premiums the Smart Way

Save money on insurance premiums — it’s possible without cutting essential coverage or benefits. Whether you’re paying for life, health, motor, or home insurance, the key is to make informed choices that protect you financially while reducing costs.

In this guide, you’ll learn five proven strategies to save money on insurance premiums, from comparing policies to reviewing your coverage annually.

1. Compare Policies Before You Commit

One of the most common mistakes people make is buying the first policy they come across — often recommended by a friend or agent.

Instead, always compare multiple policies before making a decision.

How to do it:

- Use trusted insurance aggregator websites like Policybazaar or Coverfox to compare quotes.

- Check claim settlement ratios on the IRDAI official website.

- Look for hidden charges, exclusions, and extra fees.

💡 Internal link suggestion: “Term vs Whole Life Insurance in India 2025: Which One Suits You Best?”

2. Opt for a Higher Deductible

A deductible is the amount you pay from your pocket before your insurer covers the rest.

Choosing a higher deductible means your risk is slightly higher — but in return, your premium can drop significantly.

Example:

If your health insurance premium is ₹12,000 annually with a ₹5,000 deductible, increasing the deductible to ₹10,000 might lower your premium to ₹9,000 — saving ₹3,000 a year.

Tip:

Only choose this option if you have an emergency fund to cover out-of-pocket costs.

3. Maintain a Healthy Lifestyle

For life and health insurance, your personal health plays a major role in premium calculation. Insurers check your BMI, medical history, and habits like smoking or drinking.

How to reduce premiums through health:

- Maintain a healthy weight and exercise regularly.

- Quit smoking — it can reduce your premium by 20–30% after a few years.

- Limit alcohol intake and go for regular check-ups.

Some insurers even offer wellness rewards for staying fit, such as discounted gym memberships or cashback on premiums.

4. Bundle Multiple Policies with the Same Insurer

If you have life, health, home, and vehicle insurance, consider buying them all from the same insurer. Many companies offer multi-policy discounts of 5%–15%.

Advantages:

- Easier policy management.

- Single point of contact for claims.

- Lower combined premium cost.

Example: Bundling car and home insurance could save you ₹2,000–₹5,000 annually, depending on the insurer.

5. Review Your Policy Every Year

Your financial situation and lifestyle can change — and so should your insurance.

Review your policy annually to check if:

- You have duplicate or outdated coverage.

- You’re paying for unnecessary add-ons.

- A competitor offers the same coverage at a lower price.

Tip:

Never blindly renew — always compare before you pay.

Quick Recap Table

| Tip | Why It Works | Risk Level |

|---|---|---|

| Compare Policies | Get the best deal & coverage | Low |

| Higher Deductible | Reduces annual premium | Medium |

| Healthy Lifestyle | Lower risk = cheaper rates | Low |

| Bundle Policies | Discount for loyalty | Low |

| Annual Review | Prevent overpaying | Low |

Frequently Asked Questions (FAQ)

Q1: Will increasing my deductible always save money?

Yes, but it means you’ll pay more out-of-pocket in a claim. Only choose this if you can handle the extra cost during emergencies.

Q2: Does quitting smoking lower premiums?

Yes, most insurers reassess premiums after 1–2 years of being smoke-free, which can lead to significant savings.

Q3: Can I negotiate my premium?

Yes, especially if you’re a loyal customer or buying multiple policies from the same insurer.

Q4: Is it safe to switch insurers for a better deal?

Yes, as long as the new insurer is IRDAI-approved and coverage is equal or better.

Conclusion: Small Steps, Big Savings

Saving money on insurance premiums isn’t about cutting coverage — it’s about being informed and strategic. By comparing policies, choosing the right deductible, staying healthy, bundling policies, and reviewing coverage yearly, you can keep your premiums affordable while staying protected.

Start applying at least one of these tips today — even a 5–10% savings can add up to thousands over the years.

Last Updated on August 15, 2025 by Singh Sumit

2 thoughts on “Top 5 Tips to Save Money on Insurance Premiums Without Compromising Coverage (2025 Guide)”