Introduction: Why Compare Pet Insurance India Plans?

The bond between Indians and their pets has grown deeper over the past decade. Today, dogs and cats are no longer just animals living in our homes—they’re family members. Be it a Beagle in Bengaluru, a Labrador in Delhi, or a Persian cat in Mumbai. The love pet parents give is immense. Their care for these animals is undeniable. But with love comes responsibility, and one of the biggest challenges for pet owners in India is managing veterinary expenses.

In 2025, the cost of veterinary treatments is rising faster than ever before. A basic consultation may cost ₹1,000–₹2,000, vaccinations can total ₹6,000 annually, and a single surgery may easily cross ₹50,000–₹80,000. For families, these sudden expenses can create financial strain. This is where Pet Insurance India plays a vital role.

But here’s the catch: not all pet insurance policies are equal. Some offer comprehensive coverage, while others cover only accidents. Some are affordable upfront but add hidden fees later. That’s why comparing policies before you buy is essential. In this article, we’ll give a detailed comparison of pet insurance plans in India in 2025. We highlight premiums, deductibles, exclusions, and providers. This will help you make an informed choice.

How Pet Insurance India Works

Pet insurance in India works very similarly to health insurance for humans. Pet parents pay an annual premium to an insurance company. In return, the insurer covers a part of the medical expenses when the pet requires treatment. The coverage includes accidents, illnesses, hospitalizations, or even surgeries depending on the plan chosen.

The important thing to note is that coverage is not unlimited. Insurance companies place caps, deductibles, and exclusions to manage risk. For example, a policy may cover up to ₹1,00,000 annually. However, the pet owner may still need to pay ₹5,000 as a deductible before insurance benefits kick in.

For beginners, if you’re wondering whether pet insurance is truly worth it, consider checking out our dedicated guide. Pet Insurance India Explained: Is It Really Worth It? We break down its pros and cons for first-time buyers.

Key Factors to Compare in 2025

When evaluating pet insurance in India, these three components matter most: premiums, deductibles, and exclusions. Let’s break them down.

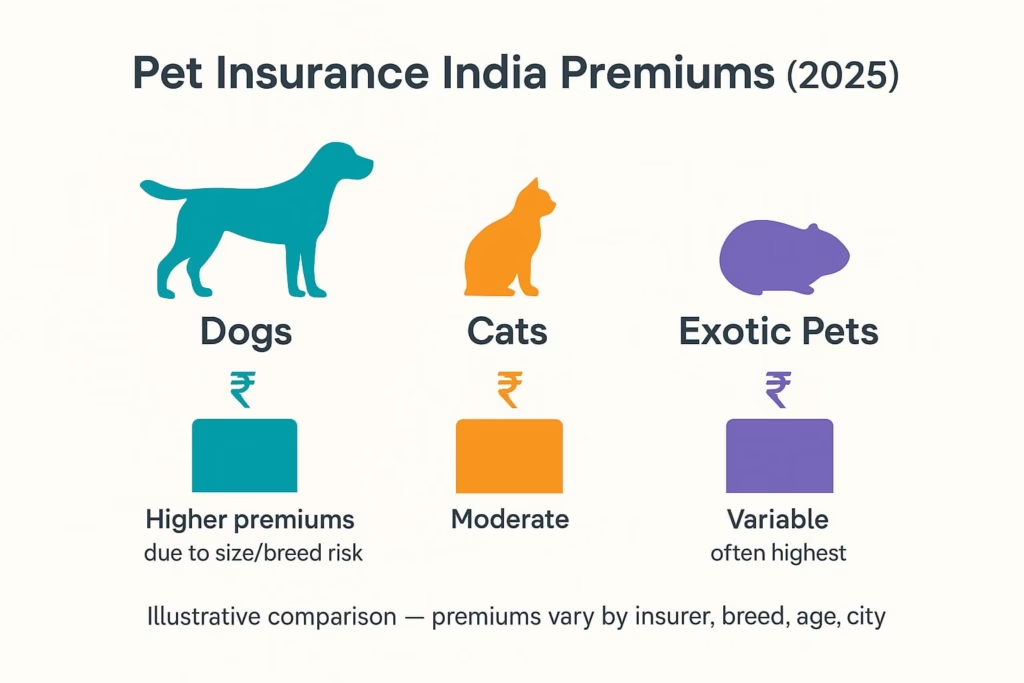

Premium Ranges by Pet Type

Premiums are the backbone of pet insurance cost. They represent the yearly fee you pay for coverage. In India, premiums vary depending on several factors:

- Type of pet (dog, cat, exotic pets)

- Breed (pedigree breeds often cost more)

- Age (older pets are costlier to insure)

- Location (vet costs are higher in metros than in small towns)

Here’s a breakdown of average premiums in 2025:

| Pet Type | Premium Range (Annual) | Example Breeds |

|---|---|---|

| Small Dogs | ₹4,000 – ₹8,000 | Pug, Beagle |

| Medium Dogs | ₹7,500 – ₹15,000 | Labrador, German Shepherd |

| Large Dogs | ₹12,000 – ₹25,000 | Rottweiler, Great Dane |

| Domestic Cats | ₹3,000 – ₹6,000 | Indian DSH |

| Pedigree Cats | ₹5,000 – ₹10,000 | Persian, Siamese |

| Exotic Pets | ₹8,000 – ₹20,000 | Rabbits, Parrots, Reptiles |

For a complete cost analysis, check out our full breakdown in Pet Insurance India Cost Breakdown 2025: Premiums, Deductibles & Hidden Fees.

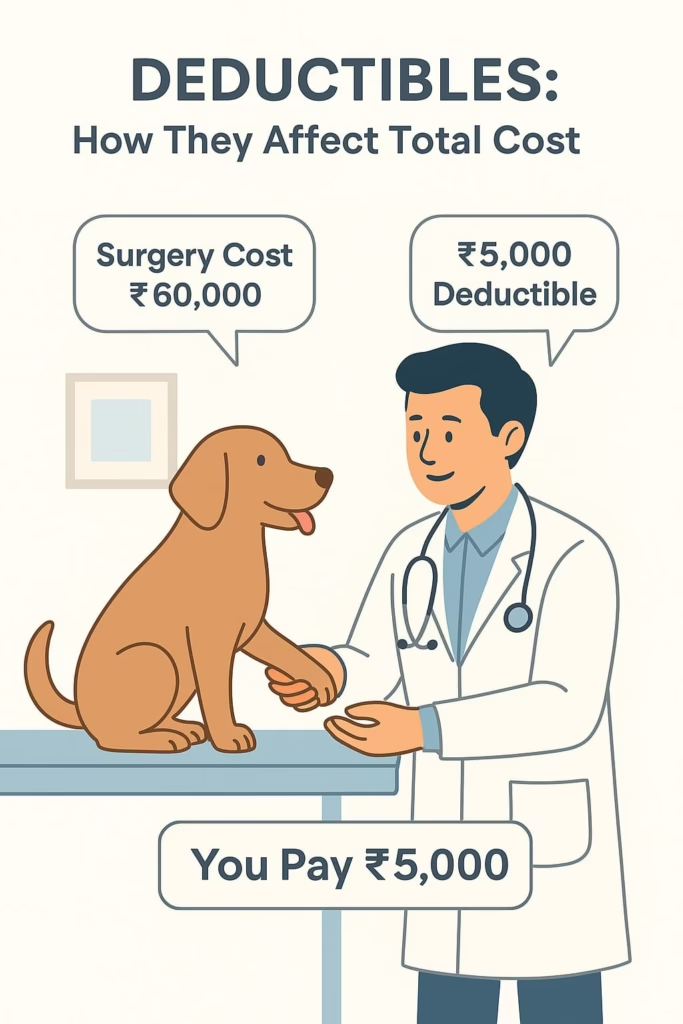

Deductibles & Co-Payments

A deductible is the amount you pay before the insurance starts covering expenses. Some insurers use a flat deductible (₹2,500–₹5,000), while others use a percentage model (10–20% of the claim amount).

Example:

- Surgery cost: ₹60,000

- Deductible: ₹5,000 (flat)

- Insurance pays: ₹55,000

In contrast, if the deductible is 20%, you’d pay ₹12,000 out-of-pocket, and the insurer covers ₹48,000.

Understanding deductibles is critical. Two policies with similar premiums may result in very different out-of-pocket costs. This variation occurs when you actually make a claim.

👉 We’ve explained this with real-life case studies in our detailed Cost Breakdown Article.

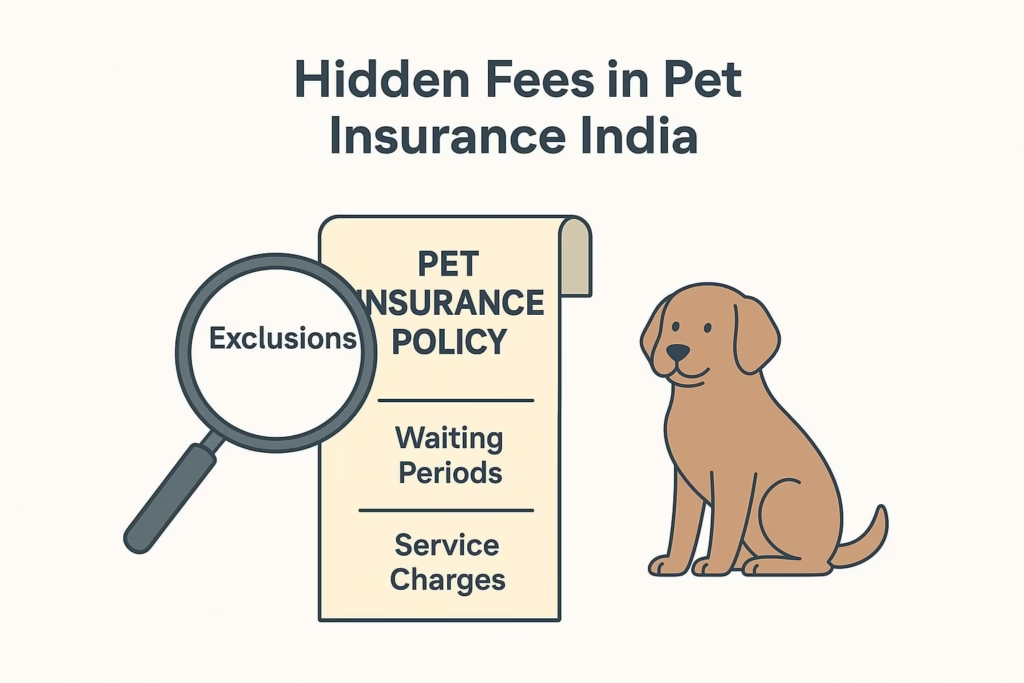

Exclusions & Hidden Fees

Not all treatments are covered. Common exclusions include:

- Vaccinations

- Preventive care (dental cleaning, grooming, flea treatments)

- Pre-existing illnesses

- Breeding-related issues

Additionally, insurers often add hidden charges like waiting periods (15–30 days before coverage starts), policy issuance fees, or administrative costs.

👉 For a closer look at exclusions, see Pet Insurance India Cost Breakdown 2025: Premiums, Deductibles & Hidden Fees.

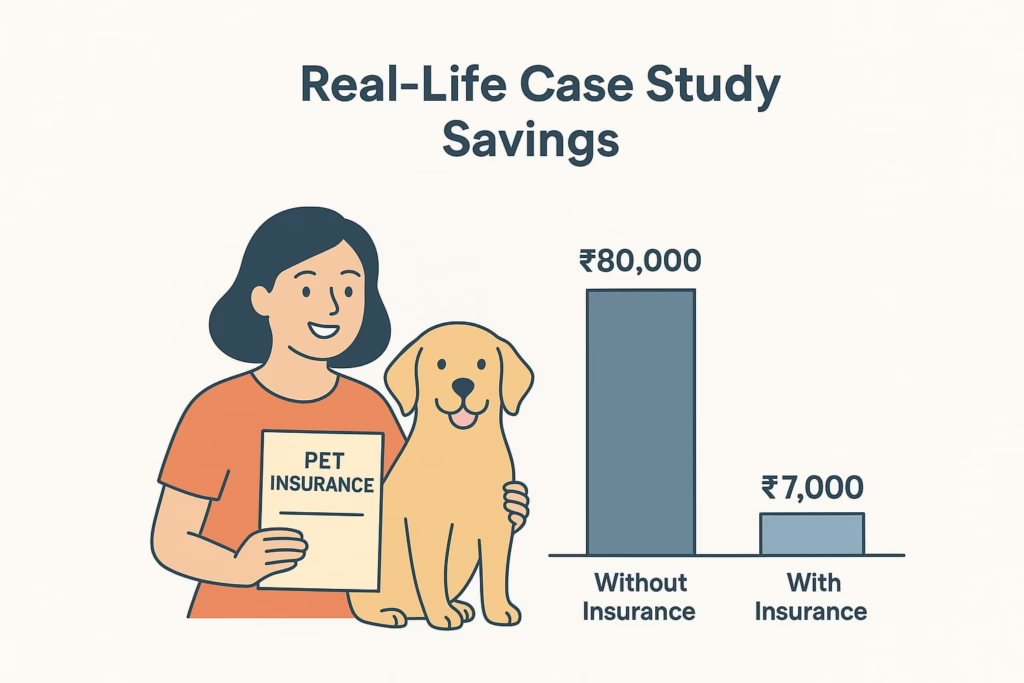

Real-Life Examples: Annual Vet Bills vs Insurance Costs

To understand the impact of pet insurance in India, let’s look at a real-world scenario.

Case Study: Labrador in Delhi (2024–2025)

- Annual vet consultations & vaccinations: ₹12,000

- Emergency surgery for hip dysplasia: ₹80,000

- Post-surgery medications & follow-ups: ₹8,000

Total Annual Vet Cost Without Insurance: ₹1,00,000

Now, with a mid-range pet insurance plan (premium: ₹10,000 annually, deductible: ₹5,000):

- Owner pays: ₹10,000 (premium) + ₹5,000 (deductible) = ₹15,000

- Insurance covers: ₹85,000

Total Annual Cost With Insurance: ₹17,000

👉 Savings: More than ₹80,000 compared to paying out-of-pocket.

This example shows how a single unexpected surgery can justify the value of insurance for pet parents in India.

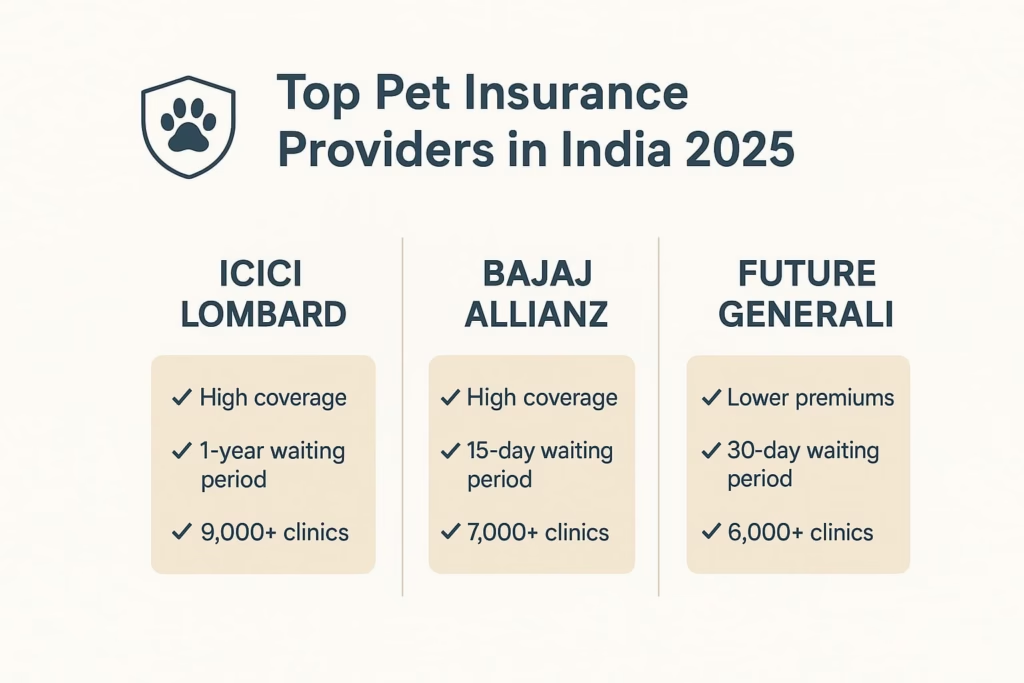

Top Pet Insurance Providers in India 2025

In 2025, more insurers have entered the pet insurance space, each offering unique policies. Here’s a side-by-side comparison of the leading providers.

ICICI Lombard Pet Insurance

- Covers dogs & cats

- Premiums: ₹4,500 – ₹15,000 annually

- Coverage: accidents, illnesses, third-party liability

- Strength: Strong brand trust, wide coverage

Future Generali Pet Insurance

- Covers surgeries, hospitalization, and major illnesses

- Premiums: ₹6,000 – ₹20,000 annually

- Add-ons available (boarding, loss/theft)

- Strength: Comprehensive coverage with flexible add-ons

Bajaj Allianz Pet Dog Insurance

- Covers dogs only

- Premiums: ₹5,000 – ₹18,000 annually

- Accident-only plans available at lower cost

- Strength: Affordable entry-level plans

Digit Pet Insurance (New Player in 2025)

- Covers dogs, cats, and exotic pets

- Premiums: ₹7,000 – ₹22,000 annually

- Offers multi-pet discounts

- Strength: Innovative coverage, great for families with multiple pets

Comparison Snapshot

| Provider | Coverage | Premium Range | Best For |

|---|---|---|---|

| ICICI Lombard | Dogs & Cats, Illness + Accidents | ₹4,500–₹15,000 | Balanced plans |

| Future Generali | Dogs & Cats, Illness + Surgeries + Add-ons | ₹6,000–₹20,000 | Comprehensive coverage |

| Bajaj Allianz | Dogs only, Accident + Illness | ₹5,000–₹18,000 | Budget-friendly |

| Digit Insurance | Dogs, Cats, Exotic Pets | ₹7,000–₹22,000 | Multi-pet families |

Which Plan Offers Best Value?

If you’re a first-time buyer, a mid-range plan between ₹7,000–₹12,000 annually usually balances affordability and coverage.

- Budget-conscious pet owners: Bajaj Allianz accident-only plans

- Comprehensive coverage seekers: Future Generali or ICICI Lombard

- Multi-pet households: Digit Pet Insurance

Your choice depends on your pet’s breed, age, and health history.

IRDAI Guidelines & Consumer Protection

The Insurance Regulatory and Development Authority of India (IRDAI) is actively working to standardize pet insurance policies in India. In 2025, new guidelines are expected to address:

- Transparency in exclusions

- Timely claim settlements

- Cap on administrative charges

For official updates, always refer to the IRDAI website.

FAQs on Pet Insurance India Plans

Q1. Which company offers the cheapest pet insurance in India?

Bajaj Allianz accident-only plans are among the cheapest.

Q2. Is pet insurance for cats cheaper than dogs?

Yes, cat insurance is typically 30–40% cheaper than dog insurance.

Q3. Can I insure an older pet?

Yes, but expect higher premiums and possible exclusions.

Q4. Are exotic pets covered?

Some insurers like Digit and Future Generali are offering exotic pet coverage.

Q5. Does insurance cover routine vaccinations?

No, most policies exclude preventive care like vaccinations and grooming.

Conclusion: Choosing the Right Pet Insurance India Policy

Choosing a pet insurance policy in India in 2025 requires more than just looking at the premium. You need to consider deductibles, exclusions, and hidden fees as well. By comparing multiple providers, you’ll find a plan that suits your pet’s needs and your budget.

Remember to revisit our detailed breakdown in Pet Insurance India Cost Breakdown 2025: Premiums, Deductibles & Hidden Fees and our beginner’s guide Pet Insurance India Explained: Is It Really Worth It? before making a final decision.

With the right plan, you’ll save money. You will also guarantee that your furry family member receives the best care possible. This happens without financial stress.

1 thought on “Pet Insurance India Comparison 2025: Best Policies Reviewed”