Introduction

The insurance industry is undergoing a dramatic transformation in 2025. As climate change intensifies, traditional indemnity-based insurance is struggling to keep pace. Long claim settlements, disputes over losses, and rising premiums have made policyholders seek alternatives. This is where Parametric Insurance 2025 comes into the spotlight.

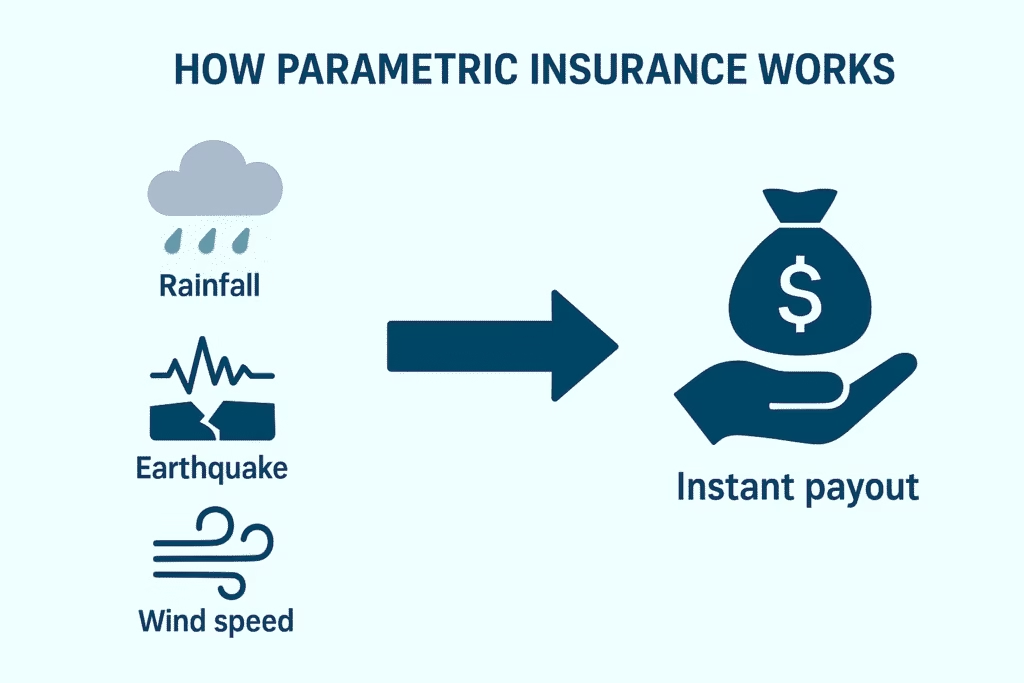

Parametric insurance is emerging as one of the most important insurance innovations of the decade. It does not depend on lengthy damage assessments. It uses predefined triggers—such as rainfall levels, wind speeds, or earthquake magnitudes—to release payouts instantly. This makes coverage faster, fairer, and more transparent.

In India, insurers are already experimenting with parametric models for extreme heatwaves and rainfall events (Times of India). Globally, governments, businesses, and individuals are embracing this model as a climate-resilient safety net.

What Is Parametric Insurance 2025?

Parametric insurance is a policy where payouts are triggered by objective data points rather than proof of financial loss.

Example:

- If rainfall in Mumbai crosses 300mm in 24 hours, affected policyholders receive automatic payouts.

- If an earthquake of 6.0 magnitude or higher strikes a region, compensation is released instantly.

Traditional insurance can take weeks or months to settle claims. Parametric Insurance 2025 ensures immediate financial relief when disasters strike.

Why Parametric Insurance 2025 Is Trending

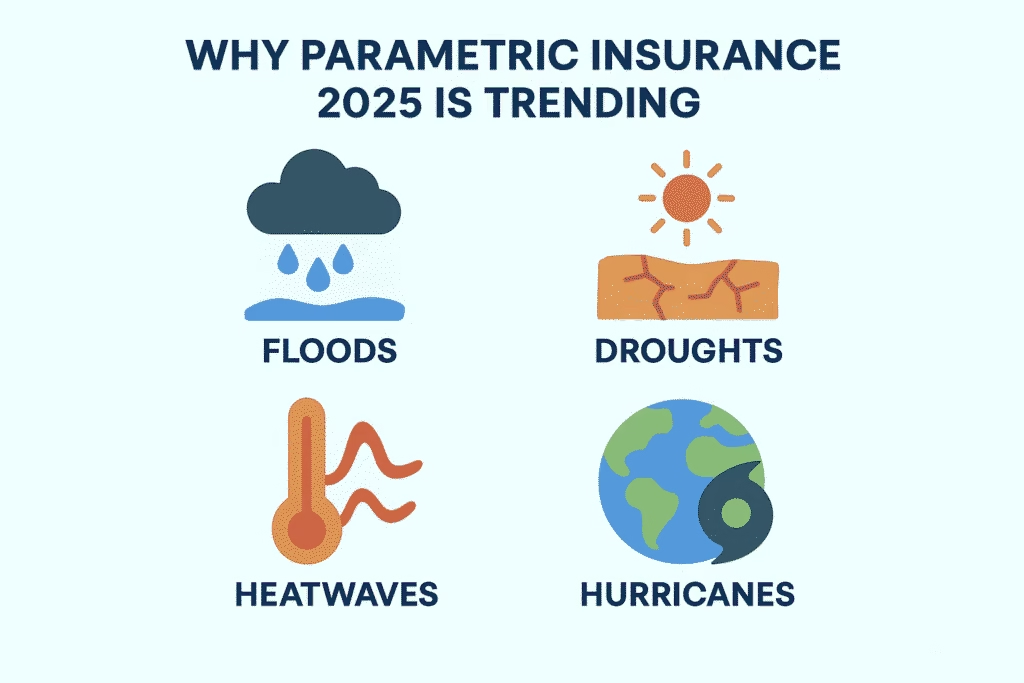

1. Rising Climate Risks

Floods disrupt life in North India. Cyclones affect the East Coast. India is among the most vulnerable nations to climate change. Global studies show that extreme heatwaves, heavy rainfall, and droughts are intensifying. Parametric Insurance 2025 is trending because it provides reliable financial support in these uncertain times.

2. Technology Integration

AI, IoT sensors, and satellite data now allow insurers to track real-time environmental conditions. Reports from EY highlight how parametric models are becoming easier to design and scale in 2025 (EY Insurance Report).

3. Faster Payouts

Policyholders no longer have to wait months for claim approvals. Once a trigger is met, payouts are automatic and instant, reducing stress during emergencies.

4. Consumer-Centric Models

Just as on-demand insurance gained popularity among travelers and gig workers—see On-Demand & Pay-Per-Day Travel Insurance in 2025 – The Future of Smart, Affordable Protection and Rising Demand for On-Demand Insurance Among Gig Workers in 2025—parametric models represent the next evolution. They are simple, flexible, and built for real-world risks.

Real-World Examples of Parametric Insurance 2025

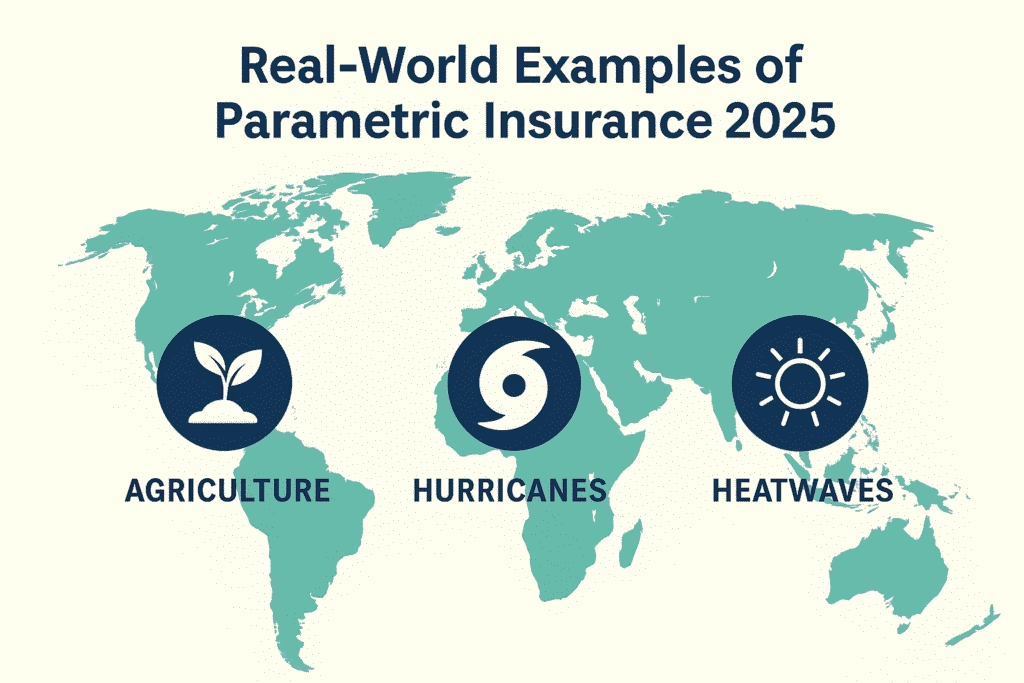

- Caribbean Catastrophe Risk Insurance Facility (CCRIF): Provides hurricane and earthquake payouts within weeks.

- Indian Crop Insurance Pilots: Farmers in states like Maharashtra and Odisha are testing rainfall-triggered policies to protect against crop failure.

- Coral Reef Coverage in Mexico: Parametric insurance releases funds to repair reefs after hurricanes, protecting ecosystems and tourism.

- Urban Heatwave Covers: Insurers in Kolkata and Delhi are piloting heatwave-triggered payouts for vulnerable populations.

Who Benefits from Parametric Insurance 2025?

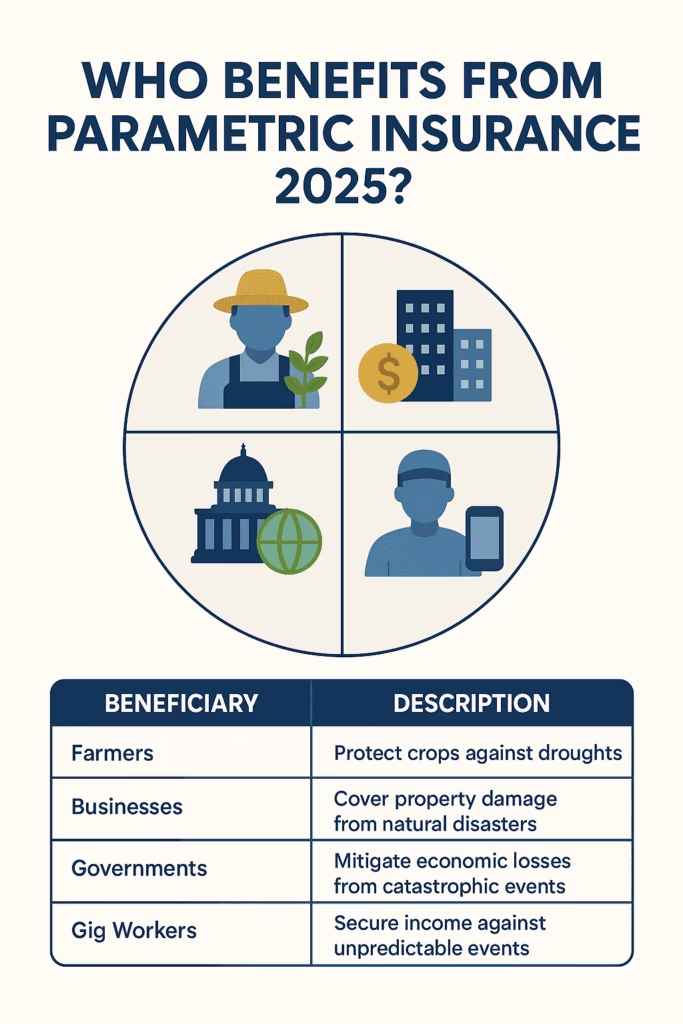

| Beneficiary | Benefit |

|---|---|

| Farmers | Immediate payouts during floods, droughts, or unseasonal rains. |

| Businesses | Supply chain protection against extreme weather disruptions. |

| Gig Workers | Affordable, flexible protection—similar to on-demand models. |

| Governments | Faster disaster relief, reducing fiscal pressure. |

| Insurers | Lower fraud risk and simplified claims process. |

Challenges Facing Parametric Insurance 2025

While promising, parametric models aren’t without challenges:

- Basis Risk: Sometimes payouts don’t match actual losses. For example, if rainfall triggers a payout but the farmer’s crops aren’t damaged, or vice versa.

- Regulation: The IRDAI in India is still building guidelines for parametric coverage, which may slow adoption.

- Data Accuracy: Reliable satellite and sensor data is critical; without it, payouts may be disputed.

Even with these challenges, reports from the Financial Times suggest that parametric insurance is being pitched globally as a fairer model for climate victims (FT report).

People Also Ask (PAA) – Parametric Insurance 2025

Q: Why is parametric insurance popular in 2025?

➡️ Because Parametric Insurance 2025 offers fast payouts, objective triggers, and protection against climate risks.

Q: How is parametric insurance different from traditional insurance?

➡️ Traditional insurance relies on claim assessments. Parametric insurance pays out based on data-driven triggers, eliminating delays.

Q: Where is parametric insurance used in 2025?

➡️ It’s widely used in agriculture, heatwave coverage, flood protection, and business continuity insurance.

Q: Can individuals also buy parametric insurance?

➡️ Yes. Farmers, gig workers, and even urban families can buy policies linked to rainfall, temperature, or seismic activity.

Conclusion

Parametric Insurance 2025 is not just another trend—it is the future of insurance in a climate-uncertain world. With faster payouts, transparent models, and technology-driven triggers, it is reshaping how individuals, businesses, and governments approach risk.

As India embraces parametric models for floods, heatwaves, and agriculture, insurers are showing how innovation can deliver fair, smart, and customer-first solutions. Much like the success of on-demand insurance, parametric coverage represents a shift towards policies that are flexible, simple, and designed for modern risks.

With climate change accelerating, Parametric Insurance 2025 ensures financial protection when it matters most. The question is not whether it will become mainstream—but how fast it will spread.

🔗 External Sources:

- Climate change on radar, insurers line up extreme heat, rain cover – TOI

- Insurers pitch ‘fairer’ model for victims of climate catastrophe – FT

- EY Insurance Trends Report 2025

🔗 Internal Links: