The world of travel is evolving faster than ever, and so is travel insurance. As global mobility increases, travelers are seeking flexible, affordable, and tech-enabled protection. This has given rise to On-Demand & Pay-Per-Day Travel Insurance. It is a groundbreaking model. This model reshapes how Indians and international travelers protect themselves while on the move.

In 2025, On-Demand & Pay-Per-Day Travel Insurance isn’t just a trend—it’s becoming the future of smart insurance coverage. Let’s explore why this model is gaining momentum, how it works, and why Indian travelers should pay attention.

Introduction: Why On-Demand & Pay-Per-Day Travel Insurance is Trending

Travelers today don’t want one-size-fits-all solutions. You need insurance that adapts to your journey. This applies whether you’re a student, a digital nomad, or a family planning a week-long holiday. The coverage should not work the other way around.

That’s where On-Demand & Pay-Per-Day Travel Insurance comes in. Unlike traditional annual or fixed-duration policies, this flexible model lets you buy coverage only when you need it. This ensures optimal affordability. It also provides convenience.

What is On-Demand & Pay-Per-Day Travel Insurance?

Definition & Concept

On-Demand & Pay-Per-Day Travel Insurance is a flexible and short-duration insurance plan. It activates when you travel. It charges you per day of coverage.

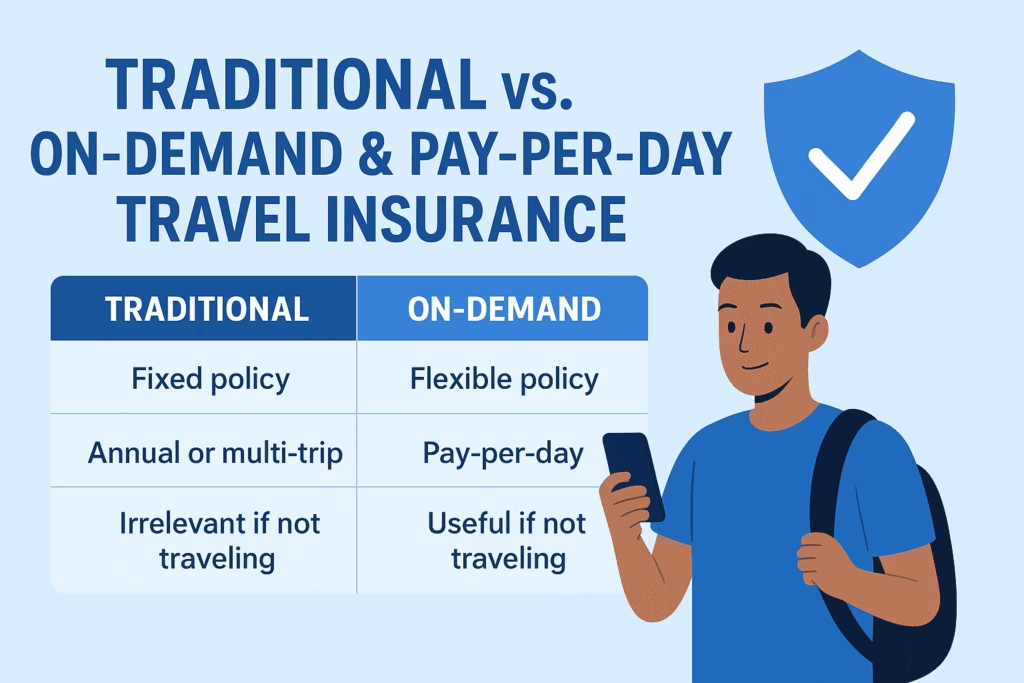

How It Differs from Traditional Travel Insurance

- Traditional Insurance: Fixed-duration, often 7 days, 30 days, or yearly.

- On-Demand Model: Buy instantly, pay only for the days you need.

This makes it a perfect fit for short trips, last-minute plans, and cost-conscious travelers.

The Rise of On-Demand Insurance in 2025

Global Adoption

Globally, on-demand insurance is seeing huge adoption. Many airlines and booking apps are embedding insurance directly at checkout.

Growth in India

In India, On-Demand & Pay-Per-Day Travel Insurance is growing rapidly. Insurers are partnering with digital platforms to offer instant, app-based coverage.

According to Finance Yahoo’s Travel Insurance Outlook, embedded and on-demand insurance models are among the top drivers of global market growth in 2025.

Key Features of On-Demand & Pay-Per-Day Travel Insurance

Instant Policy Activation

Coverage starts within minutes via mobile apps.

Flexible Duration Options

Choose 1 day, 3 days, or 10 days instead of paying for longer coverage.

Digital-First & App-Based Models

Claim filing, policy activation, and payments happen entirely online.

Key Features of On-Demand & Pay-Per-Day Travel Insurance

Instant Policy Activation

Coverage starts within minutes via mobile apps.

Flexible Duration Options

Choose 1 day, 3 days, or 10 days instead of paying for longer coverage.

Digital-First & App-Based Models

Claim filing, policy activation, and payments happen entirely online.

Limitations & Challenges

Limited Coverage Options

Some plans may not offer extensive benefits compared to traditional annual policies.

Technology Dependence

Requires internet access and app literacy, which can be a barrier for older travelers.

Pay-Per-Day Travel Insurance for Different Segments

Students Traveling Abroad

Perfect for short stays or semester exchanges.

Senior Citizens

Tailored daily plans help avoid paying for unused coverage.

Families & Groups

Family bundles with pay-per-day pricing reduce costs for joint travel.

How On-Demand Models are Shaping the Future of Insurance

AI & Personalization

Smart algorithms analyze your travel history to suggest tailored coverage.

Parametric & Automated Claims

Policies now trigger automatic payouts for delays, cancellations, or weather disruptions.

Comparing Traditional vs. On-Demand Travel Insurance

| Feature | Traditional Travel Insurance | On-Demand & Pay-Per-Day Insurance |

|---|---|---|

| Duration | Fixed (7/30/365 days) | Flexible (per trip/day) |

| Cost | Higher upfront premiums | Pay only when traveling |

| Flexibility | Limited | High |

| Claim Filing | Manual, paperwork-heavy | Digital & instant |

Real-Life Examples & Case Studies

Indian Travelers Using On-Demand Plans

Many Indian students studying abroad now use pay-per-day insurance for short visits home.

International Trends & Lessons

In Europe, airlines like Ryanair have embedded on-demand coverage directly into ticket bookings.

Internal Resources for Readers

- 🔗 Best Travel Insurance Plans for Indians Travelling Abroad in 2025 – Your Complete Guide

- 🔗 Can NRIs Buy Insurance in India? A Complete Guide (2025 Update)

FAQs on On-Demand & Pay-Per-Day Travel Insurance

Q1. Is On-Demand & Pay-Per-Day Travel Insurance cheaper than traditional plans?

Yes, especially for short trips—it ensures you only pay for actual travel days.

Q2. Do these policies cover medical emergencies abroad?

Most do, but always check exclusions.

Q3. Can NRIs purchase On-Demand & Pay-Per-Day Travel Insurance from India?

Yes, NRIs visiting India can purchase such plans before traveling.

Q4. Is this insurance valid for Schengen visa requirements?

Some pay-per-day plans meet Schengen visa minimum requirements—confirm with your insurer.

Q5. Are claims easy to file?

Yes, digital-first models allow quick, app-based claims.

Q6. Who benefits most from these plans?

Students, senior citizens, families on short trips, and frequent flyers.

Conclusion – The Future of Travel Protection

As travel becomes more dynamic, On-Demand & Pay-Per-Day Travel Insurance offers a perfect blend of affordability. It also provides flexibility. While it does not replace traditional policies entirely, it’s an excellent choice for Indians who value smart, tech-driven solutions.

For 2025 and beyond, this model promises greater personalization, seamless claims, and instant peace of mind. Travelers who adopt it will enjoy freedom, savings, and smarter protection.

2 thoughts on “On-Demand & Pay-Per-Day Travel Insurance in 2025 – The Future of Smart, Affordable Protection”