Introduction to On-Demand Insurance in the Gig Economy

On-Demand Insurance for Gig Workers in 2025 is transforming how independent workers secure financial protection in a fast-changing economy. With the rise of freelancing, delivery services, and rideshare driving, millions are turning to gig work for flexibility and independence. But with freedom comes uncertainty—traditional insurance models fail to address the unpredictable income and risks faced by gig workers.

This is where on-demand insurance for gig workers in 2025 steps in. It offers affordable, pay-per-use coverage. This coverage can be activated only when needed. Whether it’s health, accident, or liability protection, policies are tailored to match the irregular schedules of gig workers.

Platforms like Uber, DoorDash, and Fiverr are integrating instant insurance options into their apps. This development is no longer just a trend. On-demand insurance for gig workers in 2025 is a necessity for financial stability. It also ensures long-term security in the gig economy.

Evolution of the Gig Economy and the Need for On-Demand Insurance

From Traditional Jobs to Gig Work in 2025

For decades, employment meant stability—steady paychecks, employer-provided health benefits, and built-in insurance protection. But the rise of digital platforms such as Uber, DoorDash, Fiverr, Swiggy, and Upwork disrupted this model.

Today, gig work offers flexibility, independence, and global opportunities, but it also strips away the safety nets of traditional employment.

Why Traditional Insurance Fails Gig Workers

Most insurers still operate on long-term contracts with fixed monthly premiums. For someone with irregular earnings, paying for unused coverage is impractical.

Gig workers need:

- Short-term, task-specific coverage

- Pay-per-use flexibility

- App-based activation

- Affordable micro-premiums

This demand is exactly what gave rise to on-demand insurance.

What Is On-Demand Insurance for Gig Workers in 2025?

Core Features of On-Demand Insurance

On-demand insurance refers to short-term, flexible policies gig workers can activate for specific tasks, trips, or projects.

📌 Example:

- A delivery driver buys accident coverage only during high-traffic dinner hours.

- A freelancer activates professional liability insurance for one project.

How It Differs from Traditional Policies

- Flexibility → Activate/deactivate via apps.

- Cost-efficiency → Pay only when you use.

- Customization → Tailored to gig type, project, or duration.

This adaptability makes it the perfect fit for gig workers in 2025.

Rising Popularity of On-Demand Insurance for Gig Workers in 2025

Growth Statistics and Market Trends

The global on-demand insurance market is projected to reach $15 billion by 2025. Gig workers account for a large portion of this demand, with India, the U.S., and Southeast Asia leading growth.

📌 Gig work is on track to become a leading employment model of the decade. This is according to the World Economic Forum. This trend is pushing insurers to redesign policies.

Role of Digital Platforms and Apps

Gig platforms are integrating insurance directly into their apps:

- Uber & Lyft → Liability cover per trip.

- DoorDash → Accidental death and injury coverage for riders.

- Fiverr & Upwork → Optional professional indemnity insurance.

Seamless integration has been key to adoption.

Key Benefits of On-Demand Insurance in 2025

1. Flexible Pay-Per-Use Coverage

Unpredictable earnings make fixed premiums unfeasible. On-demand models let gig workers pay only during high-earning periods.

2. Pay-Per-Use Coverage

Policies are billed per trip, per mile, or per hour, ensuring fair pricing.

3. Platform Partnerships

Embedded insurance means gig workers don’t need to hunt for policies separately.

4. Digital-First Convenience

Mobile-first gig workers value instant policy activation and paperless claims.

Challenges Without On-Demand Insurance for Gig Workers

- Income instability → A single accident can erase months of savings.

- Healthcare costs → Many gig workers skip medical care due to affordability.

- Liability risks → Freelancers handling client data face potential lawsuits.

- Exclusions → Traditional policies often exclude gig-related activities.

Benefits of On-Demand Insurance for Gig Workers in 2025

- Cost-Effective → No wasted premium on unused coverage.

- Instant Activation → Switch on coverage for a trip, project, or day.

- Tailored Options → Accident, health, liability, and income protection.

- Peace of Mind → Gig workers can focus on work without financial stress.

Real-Life Examples of On-Demand Insurance for Gig Workers in 2025

- John (Delivery Driver) → Uses accident cover only during evening shifts.

- Sophia (Freelancer) → Activates liability cover for high-value projects.

- Ahmed (Rideshare Driver) → Relies on in-app accident cover while driving.

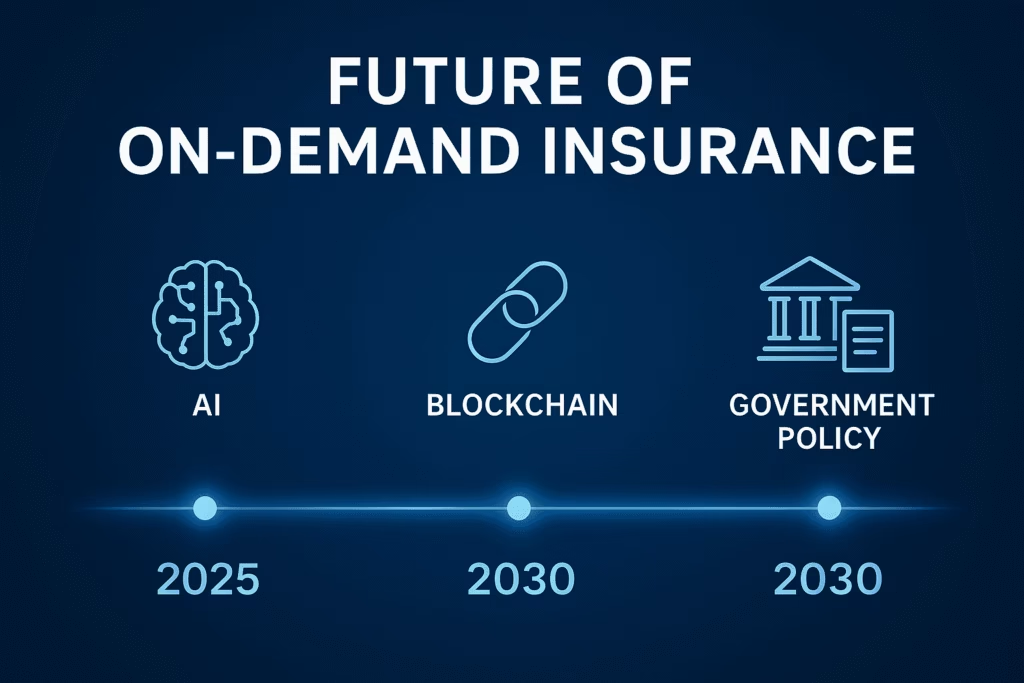

Future of On-Demand Insurance for Gig Workers in 2025

- AI & Predictive Risk Management → Dynamic pricing based on driving habits or zones.

- Blockchain & Smart Contracts → Instant claims, reduced fraud.

- Government Intervention → Countries exploring mandatory baseline insurance for gig workers.

📌 Internal Link: Read our full guide → [ Transforming the Future: How AI in Health Insurance Is Revolutionizing the Industry]

FAQs on On-Demand Insurance for Gig Workers in 2025

1. What is on-demand insurance?

Flexible, pay-per-use coverage activated via mobile apps.

2. Why is it popular in 2025?

Because gig workers want affordable protection without long-term commitments.

3. How to buy?

Through insurer apps or gig platform integrations.

4. What coverage is available?

Health, accident, liability, device, and income protection.

5. Is it affordable?

Yes—since workers only pay during active periods.

6. Will governments regulate it?

Yes—many nations are considering mandatory gig worker protections.

Why On-Demand Insurance Is Essential for Gig Workers in 2025

On-demand insurance represents more than a trend—it’s a fundamental shift in financial security for gig workers. By 2025, as millions worldwide embrace freelancing, ridesharing, and digital side hustles, traditional insurance models fall short.

Instead, on-demand coverage delivers flexibility, affordability, and peace of mind, empowering gig workers to thrive in a volatile economy.

The gig economy isn’t slowing down—and neither is the demand for smarter, worker-first insurance solutions.

📌 Internal Links:

- [When Critical Illness Insurance in India Can Save You Lakhs – Complete Guide]

- [No Medical Test Term Insurance in India: Safe or Risky in 2025?]

📌 External Reference: World Economic Forum – The Future of Gig Work