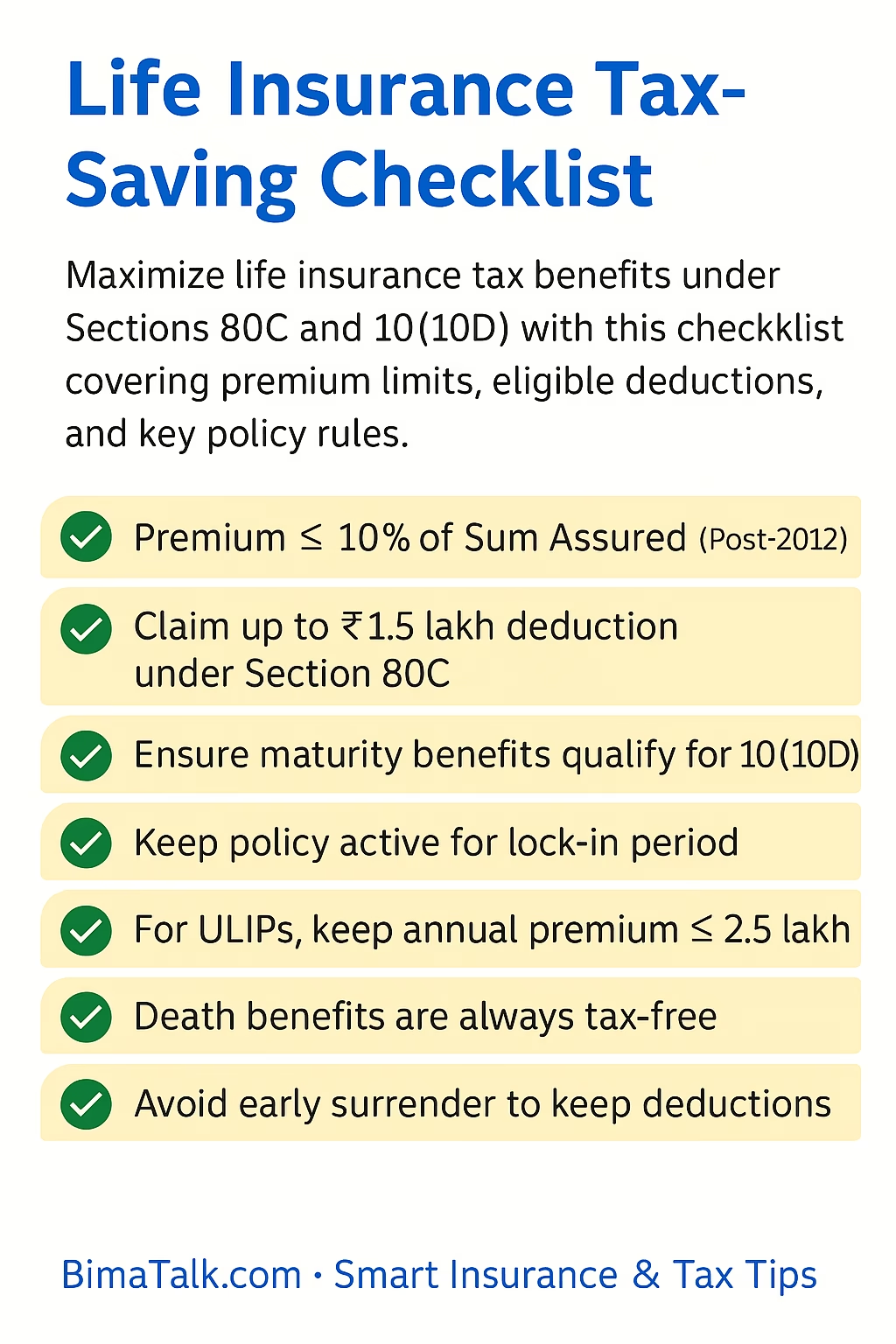

Quick Answer: Life insurance tax benefits can help you save big on taxes. Quick Answer: Life insurance premiums can qualify for a tax deduction of up to ₹1.5 lakh under Section 80C. Payouts (maturity or death benefits) may be tax-free under Section 10(10D), provided premium conditions are met. For policies issued after April 1, 2012, premiums must not exceed 10% of the sum assured to retain these benefits.

Introduction

If you think life insurance is only about protecting your family, you’re missing half the story. In 2025, the right life insurance policy can reduce your taxable income. It can help you earn tax-free returns. Meanwhile, it safeguards your loved ones.

Thanks to Sections 80C and 10(10D) of the Income Tax Act, you can legally save more money. You can also invest smartly. This helps create a tax-efficient financial plan. Let’s break it down step-by-step.

Understanding Section 80C – The Deduction You Can’t Ignore

Section 80C is one of the most popular tax-saving provisions in India. Under this section:

- Deduction Limit: You can claim up to ₹1.5 lakh every financial year.

- Eligible Payments: Life insurance premiums, EPF contributions, PPF, ELSS, tuition fees, and more.

- Life Insurance Rule: For policies issued after April 1, 2012, your annual premium must not exceed 10% of the sum assured. This is a requirement. It is necessary to comply. This rule applies to ensure compliance. Your premium has to meet this need. This is necessary to qualify.

💡 Example: If your sum assured is ₹10 lakh, your annual premium must be ₹1 lakh or less. This is required to claim the deduction.

👉 Related: Best Health Insurance Plans for Senior Citizens in India

Section 10(10D) – Tax-Free Payouts

Section 80C helps during the premium payment phase. Section 10(10D) ensures you don’t pay tax on the maturity proceeds (or death benefits). This occurs when the policy ends.

Key Points:

- Applies to: Maturity benefits, survival benefits, death benefits, and bonuses.

- Conditions:

- Premium ≤ 10% of sum assured (for policies after April 1, 2012).

- For ULIPs, annual premium ≤ ₹2.5 lakh (as per Finance Act 2021).

- Death Benefits: Always tax-free, irrespective of premium amount.

📌 Pro Tip: Keep your premium-to-sum-assured ratio within the limits from day one.

👉 Related: Term vs Whole Life Insurance in India 2025: Which One Suits You Best?

Common Mistakes That Can Cancel Your Tax Benefits

Many policyholders unknowingly lose their tax benefits due to simple errors:

- Paying High Premiums: Exceeding the 10% (or 15% for older policies) limit.

- Early Surrender: Surrendering the policy before completing the lock-in period.

- ULIP Premiums Over ₹2.5 Lakh: These may now be taxed as capital gains.

- Not Filing Properly: Forgetting to declare premiums in your ITR.

Example: How the Benefits Work Together

Imagine you buy a term plan with:

- Sum Assured: ₹50 lakh

- Annual Premium: ₹40,000

- Policy Term: 20 years

Tax Impact:

- You claim ₹40,000 under Section 80C each year.

- If you survive the term, the maturity is tax-free under Section 10(10D).

- If the policy pays a death benefit, it is always tax-free for your nominee.

External Resource

For official details, you can read the Income Tax Department’s guidelines here: Income Tax India – Life Insurance Exemptions

FAQs – Life Insurance Tax Benefits

1. Can I claim both 80C and 10(10D) benefits?

Yes. 80C applies when you pay premiums; 10(10D) applies at payout.

2. Are death benefits always tax-free?

Yes, regardless of premium amount or policy type.

3. What if my premium is more than 10% of the sum assured?

You can still buy the policy, but tax benefits may not apply.

4. Do ULIPs get the same tax benefits?

Yes, but with a ₹2.5 lakh annual premium limit for tax-free maturity under 10(10D).

5. Can I claim 80C for policies bought for family members?

Yes, for your spouse and children (dependent or independent).

Final Thoughts

Life insurance isn’t just a safety net—it’s a tax-saving tool when used smartly. Stay within the premium limits. Choose the right policy type. Hold it for the long term. This way, you can secure your family’s future while keeping more of your money.

When planned right, Sections 80C and 10(10D) can be your best friends at tax time.

Last Updated on August 15, 2025 by Singh Sumit

1 thought on “How to Save Big on Taxes with Life Insurance – 80C & 10(10D) Made Simple”