Introduction

If you’ve ever wondered how to calculate term insurance premium online in 2025, you’re in the right place. Today’s digital tools make it incredibly simple to calculate your premium in minutes without meeting agents or filling out endless forms. Whether you’re planning to buy your first term plan or reassessing an old one, knowing how to calculate term insurance premium online in 2025 is essential.

This knowledge not only helps you find affordable coverage but also ensures your family’s long-term financial security. In this guide, we’ll walk you through the complete process, explain key factors, and share expert tips for lowering your premium.

What is a Term Insurance Premium?

A term insurance premium is the amount you pay regularly—monthly, quarterly, half-yearly, or annually—to keep your life insurance active.

Key factors that influence premium:

- Age – Younger = cheaper premiums.

- Coverage Amount (Sum Assured) – Higher coverage = higher premium.

- Policy Term – Longer terms cost more annually but secure rates for decades.

- Lifestyle Habits – Smokers and heavy drinkers pay up to 40% more.

- Health Conditions – Pre-existing illnesses like diabetes or hypertension can increase costs.

💡 Quick Fact: The earlier you buy term insurance, the lower your premium—because you’re statistically less risky to insure.

Why Use an Online Term Insurance Premium Calculator in 2025?

Learning how to calculate term insurance premium online in 2025 gives you access to tools that make the process easy, fast, and accurate.

Benefits of online calculators include:

- Speed: Get instant results instead of waiting for quotes.

- Comparison: Check premiums from multiple insurers side by side.

- Clarity: Understand how different sums assured or terms affect premiums.

- Budgeting: Select a plan that fits your pocket without compromising on benefits.

👉 Try calculators like BimaTalk’s Term Insurance Premium Calculator, LIC’s Calculator, or HDFC Life Premium Calculator for reliable estimates.

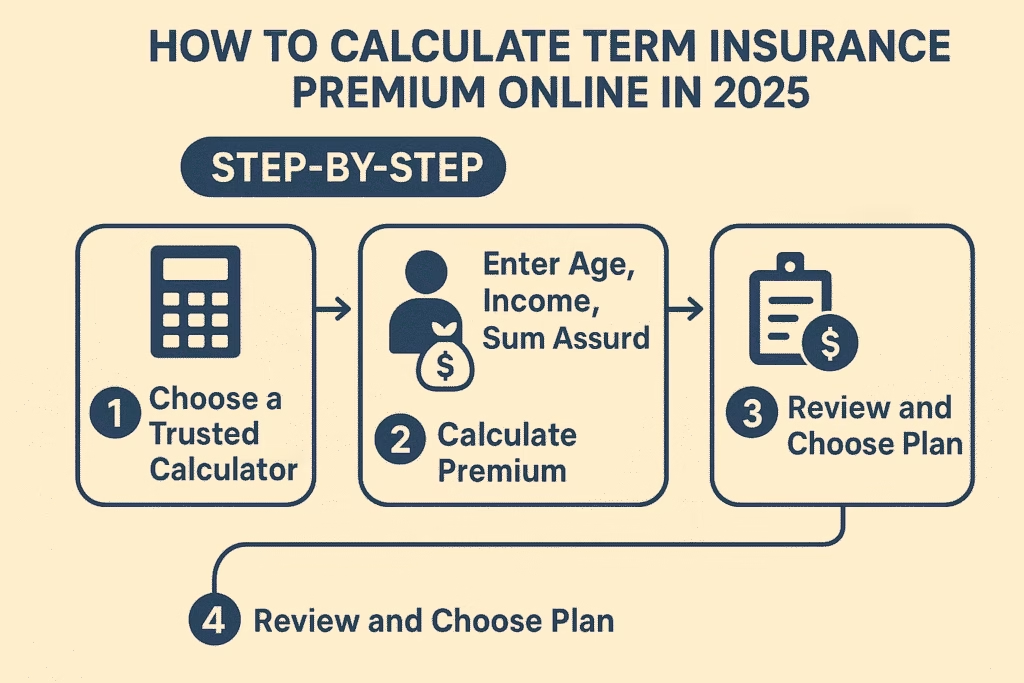

Step-by-Step Guide: How to Calculate Term Insurance Premium Online in 2025

When learning how to calculate term insurance premium online in 2025, follow these steps for accurate results:

1. Choose a Trusted Calculator

Start with a reliable tool. Options include:

- BimaTalk Premium Calculator (recommended)

- HDFC Life Premium Calculator

- LIC Term Insurance Calculator

“Some popular options include the HDFC Life Term Insurance Calculator, LIC Term Plan Calculator via Policybazaar, and the IndiaFirst Life Term Insurance Calculator.”

2. Fill in Your Personal Information

Most calculators ask for:

- Age

- Gender

- Smoking status

- Annual income

- Occupation

This data builds your risk profile, which directly impacts your premium.

3. Select Your Sum Assured & Policy Term

Experts recommend a sum assured of at least 10–15 times your annual income.

- Example: If your annual income is ₹8 lakh, you should aim for ₹80 lakh – ₹1.2 crore coverage.

Choose a policy term that protects your income until retirement (usually age 60–65).

4. Review Premium Options

The calculator will instantly show estimated premiums. Adjust tenure or sum assured until the plan fits your budget.

5. Compare & Finalize

Don’t buy the first option. Compare:

- Premium amount.

- Claim Settlement Ratio (CSR).

- Extra benefits (riders like accidental death, critical illness).

💡 For more detailed comparisons, see our guide: Best Term Insurance Plans in India 2025 – BimaTalk.

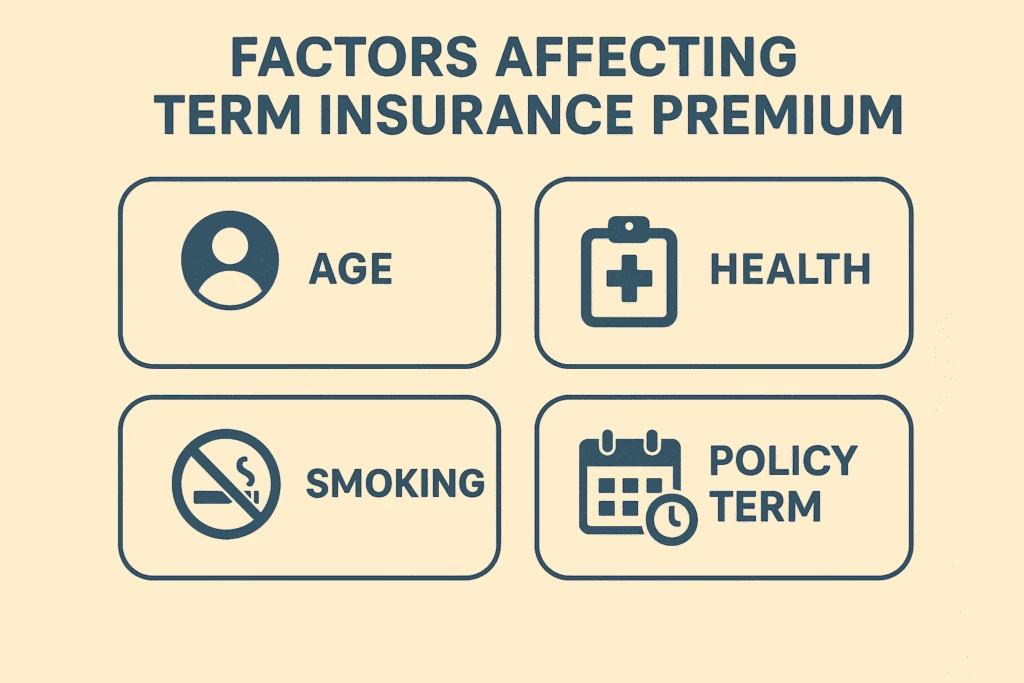

Factors That Affect Term Insurance Premium in 2025

When calculating term insurance premium online in 2025, these factors matter most:

- Age – Younger = cheaper.

- Smoking habits – Smokers pay 30–40% extra.

- Health conditions – Chronic illness increases premiums.

- Policy tenure – Longer = more expensive but safer.

- Coverage amount – Higher cover = higher premium.

- Payment mode – Annual payments often get discounts.

People Also Ask (PAA) – Term Insurance Premium in 2025

Here are quick answers to common questions about how to calculate term insurance premium online in 2025:

Q: How do I calculate term insurance premium online in 2025?

➡️ You can calculate your premium by entering details such as age, income, lifestyle habits, and coverage amount into an online term insurance premium calculator. Tools like BimaTalk, LIC, or HDFC Life calculators instantly show estimated costs.

Q: Which factors affect term insurance premium in India?

➡️ The main factors include age, sum assured, policy term, smoking status, and health conditions. For example, non-smokers pay up to 40% less than smokers, and younger buyers enjoy significantly lower premiums.

Q: Can I reduce my term insurance premium in 2025?

➡️ Yes. Buy young, stay healthy, avoid smoking, choose annual payment mode, and compare multiple plans using calculators like BimaTalk or HDFC Life to get the lowest premium.

Q: Is it safe to use an online term insurance premium calculator?

➡️ Absolutely. Trusted platforms like LIC, HDFC Life, ICICI Prudential, and BimaTalk are secure. Just ensure you’re on the official site before entering your details.

Q: What is the minimum term insurance premium in India?

➡️ Premiums start as low as ₹300–₹500 per month for young non-smokers buying a ₹1 crore cover. However, costs rise with age, health issues, and lifestyle risks.

Pro Tips to Reduce Your Premium

When figuring out how to calculate term insurance premium online in 2025, use these strategies to lower costs:

- ✅ Buy young: Lock in low premiums early.

- ✅ Stay healthy: Avoid smoking, keep BMI in check.

- ✅ Pay annually: Save more compared to monthly installments.

- ✅ Compare widely: Use both BimaTalk and official calculators.

FAQs – Term Insurance Premium Calculation

Q1: Is an online term insurance premium quote final?

No. It’s only an estimate. The insurer may adjust after reviewing medical reports.

Q2: Can I buy directly from the calculator results?

Yes. Most calculators link to a purchase page. Just read the policy terms first.

Q3: Does adding riders increase premium?

Yes, but riders like accidental cover or critical illness add valuable protection.

Q4: Which insurer offers the cheapest premium in India?

It varies by your age, health, and coverage needs. Always compare across at least two calculators.

Conclusion

Now you know how to calculate term insurance premium online in 2025 step by step. Online calculators like BimaTalk, LIC, and HDFC Life make it quick and easy to estimate your costs. By entering details like age, income, and lifestyle, you can instantly see premiums, compare plans, and pick the best one.

Remember, your term insurance is your family’s financial safety net. Taking just 10 minutes today to calculate and compare premiums can save you money for decades and guarantee peace of mind.

👉 Start now: Use the BimaTalk Term Insurance Premium Calculator to find your best-fit policy today!

Last Updated on August 25, 2025 by Singh Sumit

1 thought on “How to Calculate Term Insurance Premium Online in 2025 (Step-by-Step Guide)”