Introduction: Why Home Insurance Quotes Matter in 2025

Your home is more than just a physical space — it’s your family’s safe haven. With rising risks… securing your property has become a necessity. That’s why getting Home Insurance Quotes in India 2025 is essential for families who want affordable protection.. This is why Home Insurance Quotes in India 2025 are in high demand. Comparing multiple quotes helps homeowners choose the most affordable and reliable plan that balances premium costs with coverage benefits.

If you’re also considering which company to buy from, check out our detailed guide on the Best Home Insurance Companies of 2025: Compare Rates & Coverage for deeper insights.

What Are Home Insurance Quotes?

Definition & Key Elements

A home insurance quote is an estimate of how much you’ll need to pay for a policy based on your property’s details. Quotes usually include:

- Premium cost (monthly or annual).

- Coverage details (fire, theft, natural disasters, liability).

- Add-ons and exclusions.

Difference Between Premiums and Quotes

While a premium is the final amount you pay, a quote is only an estimate. It may change depending on property value, add-ons, and risk factors.

Importance of Home Insurance in India

Rising Risks: Natural Disasters & Theft

India is prone to floods, earthquakes, and cyclones, especially in metro cities. Having a home insurance policy ensures you’re financially secure against sudden loss.

Financial Security & Peace of Mind

Home insurance not only protects your property but also covers the cost of repairs, reconstruction, or theft. Knowing you have reliable coverage provides long-term peace of mind.

Coverage Options in 2025: What’s New in India?

Policies in 2025 have become smarter and more customizable.

- Fire & Theft Protection – Standard across all insurers.

- Natural Disaster Coverage – Now includes flood, earthquake, and cyclone-specific policies.

- Liability & Add-ons – Covers damage to third-party property, jewelry, and electronics.

Most Home Insurance Quotes in India 2025 include fire, theft, and natural disaster protection, but not all cover liability and add-ons.

Factors That Influence Home Insurance Quotes in India

When you request Home Insurance Quotes in India 2025, insurers evaluate several factors before calculating the premium. Knowing these can help you anticipate costs.

Property Location & Value

- Homes in metro cities like Mumbai, Delhi, and Chennai often have higher premiums because of real estate costs and greater exposure to natural risks.

- A villa in Bengaluru will likely attract a higher quote than a small apartment in Indore.

Type of Home: Apartment vs Independent House

- Apartments usually cost less to insure because of shared security and maintenance.

- Independent houses, especially in flood-prone or remote areas, often attract higher insurance quotes.

Policy Duration & Add-ons

- A longer-term policy (3–5 years) usually gets a discount compared to annual renewals.

- Add-ons like jewelry cover, electronic gadget protection, or personal accident cover increase the premium amount.

How to Compare Home Insurance Quotes in India (Step-by-Step)

If you’re looking at multiple Home Insurance Quotes in India 2025, here’s how to compare them effectively:

Step 1: Collect Multiple Quotes Online

Use aggregator sites like PolicyBazaar or visit insurer websites such as HDFC ERGO, ICICI Lombard, and SBI General to get instant digital quotes.

Step 2: Analyze Coverage vs Cost

Don’t just pick the cheapest quote — evaluate what’s included. For example, a slightly higher premium may offer wider protection against floods or earthquakes.

Step 3: Check Claim Settlement Ratio

The claim settlement ratio shows how many claims an insurer successfully honors. A higher ratio means a better chance of smooth payouts.

Step 4: Look for Add-ons & Exclusions

Always read exclusions carefully. Some plans may not cover damage from wear and tear, terrorism, or unoccupied houses.

Best Platforms to Get Home Insurance Quotes Online

In 2025, homeowners have many ways to compare and secure the best plan:

Insurer Websites

- ICICI Lombard – Competitive premiums and quick settlement.

- HDFC ERGO – Digital-first, easy online application.

- SBI General – Trusted with strong coverage options.

- Bajaj Allianz – Known for customer support.

Aggregator Portals

- PolicyBazaar – Lets you compare multiple quotes in one go.

- Coverfox – Simple interface for quick buying decisions.

- BankBazaar – Offers insurance bundled with financial services.

Home Insurance Premium Trends in India (2025)

The demand for Home Insurance Quotes in India 2025 has grown rapidly as families prioritize financial safety. According to the IRDAI (Insurance Regulatory and Development Authority of India), awareness of home insurance in urban areas has significantly increased, driving insurers to offer digital-first policies.

Affordable Plans for Middle-Class Families

Insurers now provide policies starting as low as ₹2,000 annually for small apartments.

Premium Costs in Metro vs Tier-2 Cities

- Metro cities: Premiums range between ₹4,000 – ₹10,000 depending on property value.

- Tier-2 cities: Quotes are significantly cheaper, ranging between ₹1,500 – ₹5,000.

Digital-First Insurance Plans

Many insurers now offer discounts for online-only plans. These allow customers to instantly generate quotes, purchase policies, and file claims digitally.

Common Mistakes to Avoid When Comparing Quotes

Even when reviewing multiple Home Insurance Quotes in India 2025, people often make these mistakes:

- Ignoring Exclusions – A low-cost policy may exclude natural disaster coverage.

- Focusing Only on Price – Cheap quotes often have limited benefits.

- Overlooking Claim Settlement Ratio – Always check an insurer’s track record before finalizing.

How to Save on Home Insurance in 2025

Here are some smart hacks to reduce your premium without compromising on coverage:

Bundle Policies

Combine your home insurance with car or health insurance to get a discount.

Install Security Systems

CCTV cameras, fire alarms, and anti-theft locks can reduce premiums by 5–10%.

Opt for Longer Tenure Policies

Buying a 3- or 5-year policy upfront usually attracts better rates.

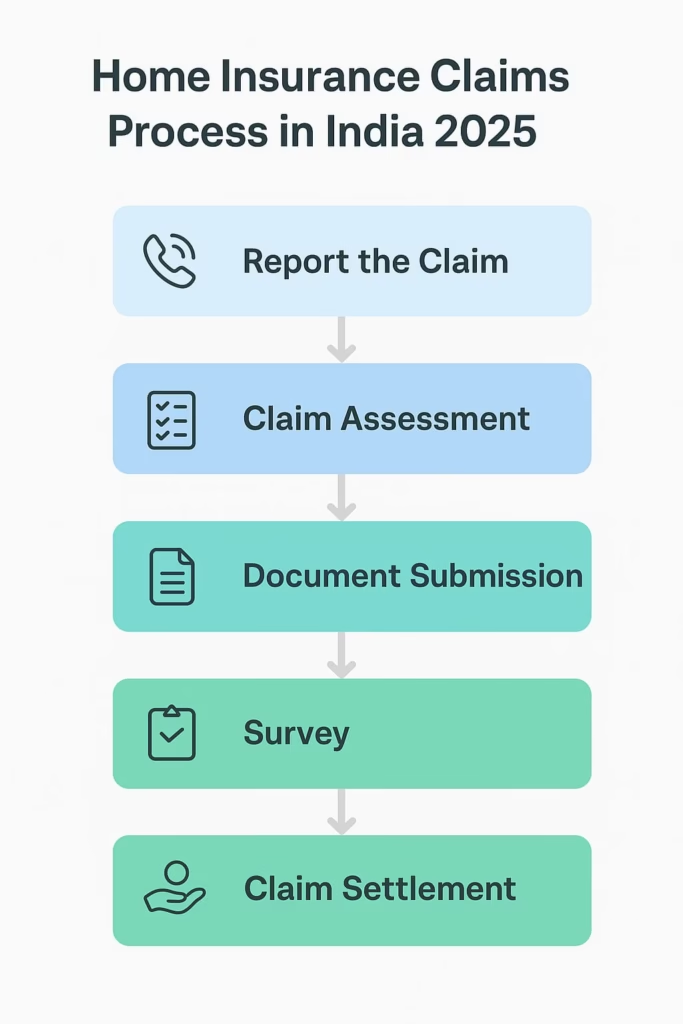

Claim Settlement Process in Home Insurance

Understanding the claim settlement process ensures a smoother experience when needed.

Filing a Claim

Report the incident immediately and submit required documents (FIR, damage photos, invoices).

Survey & Verification

The insurer appoints a surveyor to assess the damage and validate the claim.

Final Settlement

Once approved, the insurer transfers the compensation directly to your account.

Internal Link: Best Home Insurance Companies of 2025

While comparing Home Insurance Quotes in India 2025, it’s equally important to know which insurers offer the best services.

👉 Check our full guide on Best Home Insurance Companies of 2025: Compare Rates & Coverage to discover top-rated insurers.

Expert Tips: Choosing the Best Quote in India

- Always request at least 3–4 quotes before finalizing.

- Consider long-term benefits instead of short-term affordability.

- Prioritize insurers with 24/7 claim support and high settlement ratios.

FAQs on Home Insurance Quotes in India 2025

Q1. What is the average cost of home insurance in India 2025?

👉 The average annual premium ranges between ₹2,000 – ₹10,000, depending on property size, location, and coverage.

Q2. Can I buy home insurance completely online?

👉 Yes, most insurers offer instant digital quotes and policy issuance online.

Q3. Are natural disasters covered under home insurance quotes?

👉 Yes, but you must check if the quote includes flood, earthquake, or cyclone coverage.

Q4. Which insurer gives the best home insurance quotes in India 2025?

👉 Leading options include HDFC ERGO, ICICI Lombard, SBI General, Bajaj Allianz, and New India Assurance.

Q5. How do I lower my home insurance quote in India?

👉 Install safety devices, choose longer policy terms, and avoid unnecessary add-ons.

Q6. What documents are required to get a home insurance quote?

👉 Basic property details, proof of ownership, and estimated property value.

Conclusion: Protecting Your Home Smartly in 2025

Getting the right Home Insurance Quotes in India 2025 is not just about price — it’s about ensuring your property, family, and future remain secure. By comparing quotes online, analyzing coverage, and avoiding common mistakes, homeowners can find affordable yet comprehensive protection.

As risks increase in urban India, investing in the right plan today ensures long-term peace of mind. Don’t just settle for the first quote you see — compare, evaluate, and choose smartly.

For a complete breakdown of trusted insurers, check our guide on the Best Home Insurance Companies of 2025: Compare Rates & Coverage.

Last Updated on September 2, 2025 by Singh Sumit