Introduction: Why Diabetics Need Specialized Health Insurance in India

Diabetes is one of the fastest-growing health concerns in India, often called the “Diabetes Capital of the World.” India will have over 100 million diabetics in 2025. It faces a dual challenge. Rising healthcare costs is one part of the challenge. The need for long-term medical management is the other.

This makes finding the Best Health Insurance for Diabetics in India not just important, but essential. Unlike standard policies, diabetic-friendly plans cover pre-existing conditions and regular check-ups. They also cover diagnostic tests and insulin costs. These plans even include diabetes-related complications like kidney or heart diseases.

But how do you pick the right policy? Let’s break down the essential things every diabetic and their family needs to know.

Understanding Diabetes and Its Financial Burden

Rising Prevalence of Diabetes in India

According to the Indian Council of Medical Research (ICMR), every 1 in 10 Indians is diabetic. Millions more are pre-diabetic. Sedentary lifestyles, stress, and poor diets are fueling this crisis.

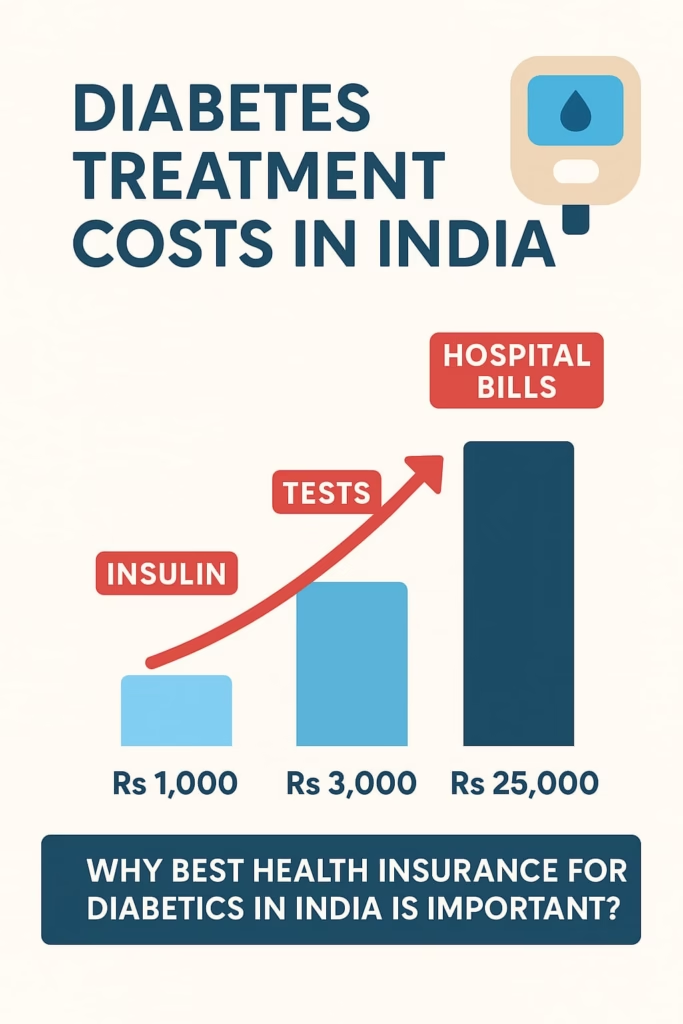

Cost of Managing Diabetes Without Insurance

The financial burden of diabetes is staggering:

- Regular blood tests (HbA1c, lipid profile, sugar monitoring): ₹10,000–₹15,000 annually

- Insulin and medications: ₹2,000–₹6,000 monthly

- Doctor consultations: ₹500–₹1,500 per visit

- Complication treatment (heart surgery, dialysis, eye surgery): ₹1,00,000–₹5,00,000

👉 Without insurance, a diabetic patient in India may spend ₹50,000–₹2,00,000 annually.

This is why the Best Health Insurance for Diabetics in India is a financial safety net.

Key Features of the Best Health Insurance for Diabetics in India

When evaluating diabetic-friendly insurance plans, look for:

1. Coverage for OPD, Tests, and Medications

Top plans now include Outpatient Department (OPD) coverage for insulin, sugar test strips, diagnostic tests, and routine check-ups.

2. Pre-Existing Disease (PED) Waiting Period

Most insurers impose a 12–48 month waiting period for pre-existing conditions. Some diabetic plans reduce this to 12–24 months.

3. Cashless Hospitalization

With a cashless network of 5,000+ hospitals, diabetic patients can access timely treatment without upfront payments.

4. Preventive Care & Wellness Programs

Some insurers offer wellness add-ons like:

- Free annual HbA1c and cholesterol checks

- Diet & lifestyle counseling

- Gym/yoga discounts

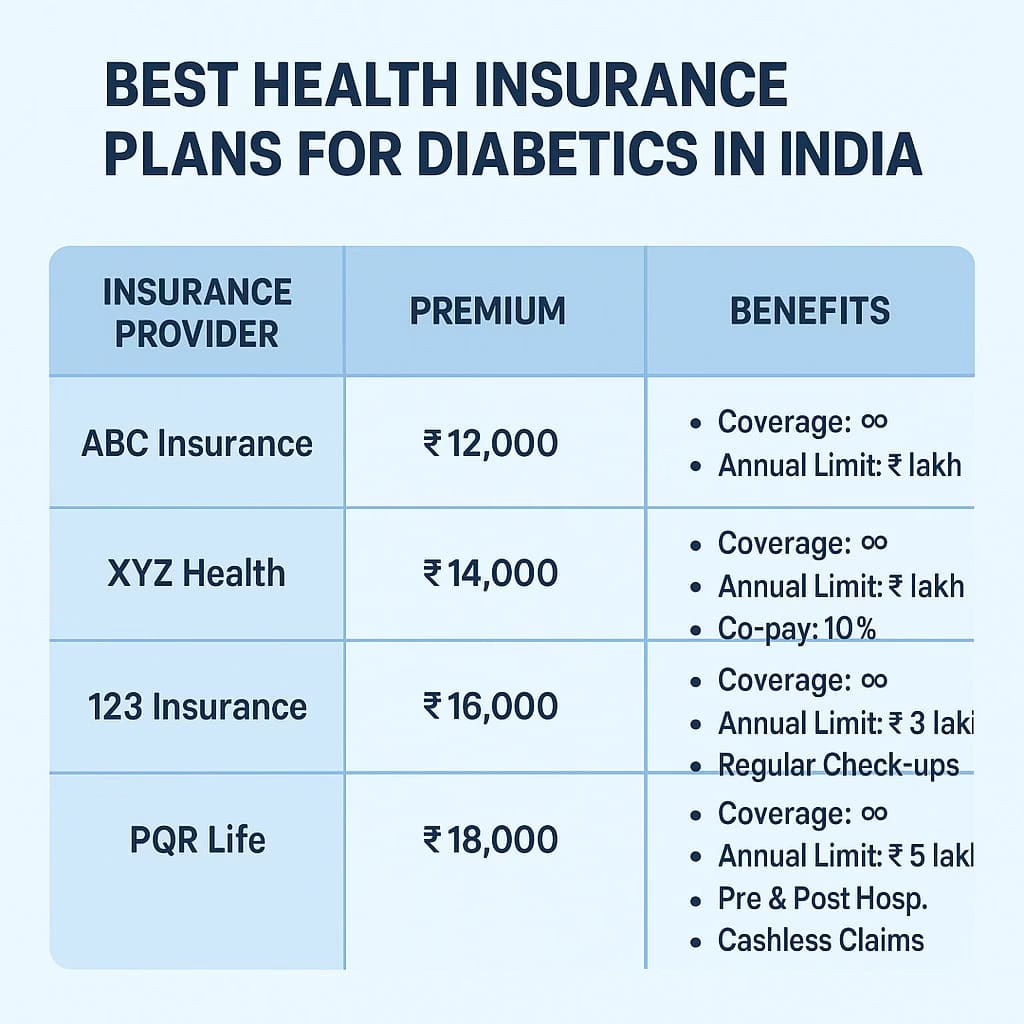

Best Health Insurance for Diabetics in India: Top Plans for 2025

Here are some of the most popular options available in India today:

Plan A: Diabetes Comprehensive Care

- Covers both Type 1 & Type 2 diabetes

- Sum insured: ₹5–₹20 lakh

- Shorter waiting period of 12 months

- Free annual health check-ups

Plan B: Family Floater with Diabetes Add-ons

- Covers entire family plus diabetic member

- Cashless hospitalization at 6,000+ hospitals

- OPD coverage for medicines and tests

Plan C: Senior Citizen Diabetes-Friendly Plan

- Designed for people above 60 years

- Includes coverage for co-morbidities (hypertension, kidney problems)

- Lower co-pay clauses for easier claims

Cost Comparison of Diabetic Health Insurance in India

| Age Group | Average Premium (₹ per year) | Annual Out-of-Pocket Cost Without Insurance |

|---|---|---|

| 25–35 years | ₹12,000–₹15,000 | ₹25,000–₹40,000 |

| 36–50 years | ₹18,000–₹25,000 | ₹50,000–₹80,000 |

| 51–65 years | ₹25,000–₹40,000 | ₹90,000–₹1,50,000 |

| 65+ years | ₹35,000–₹60,000 | ₹1,50,000–₹2,50,000 |

👉 Clearly, opting for the Best Health Insurance for Diabetics in India saves significantly over time.

Best Insurance Providers for Diabetics in India

- Provider A: Strong hospital network, reduced waiting period

- Provider B: Affordable premiums with wellness add-ons

- Provider C: Specialized senior citizen plans with diabetic focus

For more details, check the IRDAI official portal: IRDAI Consumer Education

Factors to Consider Before Buying Health Insurance for Diabetics

- Waiting Periods & Exclusions: Check for congenital & chronic exclusions.

- Coverage Amount: Choose a sum insured of at least ₹10–₹20 lakh.

- Add-ons & Riders: Critical illness riders cover heart & kidney issues.

- Claim Settlement Ratio: Always above 90% for hassle-free claims.

Benefits of Specialized Diabetic Health Insurance

- ✅ Financial Protection: Against unpredictable emergencies.

- ✅ Access to Cashless Care: Across India.

- ✅ Preventive Coverage: Regular health check-ups included.

- ✅ Peace of Mind: Focus on health, not expenses.

Best Health Insurance for Diabetic Senior Citizens

Senior citizens with diabetes face higher risks and costs. Specialized senior plans provide:

- Lower co-payments

- Broader coverage for co-morbidities

- Flexible premiums

👉 Learn more here: Best Health Insurance Plans for Senior Citizens in India (2025 Guide)

How to Choose the Right Policy

Use this quick checklist:

- Compare waiting periods

- Evaluate OPD coverage

- Check co-payment clauses

- Review claim ratios

👉 Full guide here: How to Choose the Best Health Insurance for Your Family in India (2025 Guide)

GST Cut on Health Insurance 2025: Good News for Diabetics

The 2025 GST cut on health insurance has reduced policy costs significantly. Policyholders can now save up to ₹9,000 annually on premiums.

👉 Read full analysis: GST Cut on Life and Health Insurance 2025: How Policyholders Can Save ₹9,000 Annually

Real-Life Case Studies

- Case 1: 42-year-old IT professional with Type 2 diabetes saved ₹70,000 last year with insurance.

- Case 2: Senior citizen in Delhi got ₹2.5 lakh dialysis fully covered.

- Case 3: Family floater plan covered diabetic spouse + healthy family at affordable cost.

Common Myths About Health Insurance for Diabetics

- ❌ “Too expensive” → ✅ Actually affordable with GST cut & tax deductions.

- ❌ “Doesn’t cover diabetes” → ✅ Modern plans cover both Type 1 & Type 2.

- ❌ “Claims take too long” → ✅ Digital claim settlement in 24–72 hours.

Alternatives to Diabetic Insurance

- Self-funding: Personal savings or emergency funds.

- Corporate Group Insurance: Many employers offer diabetic coverage.

- Government Initiatives: Ayushman Bharat covers certain treatments.

FAQs: Best Health Insurance for Diabetics in India

Q1. Can I get health insurance if I already have diabetes?

✅ Yes, diabetic-friendly plans cover existing conditions after waiting period.

Q2. What’s the usual waiting period?

👉 Between 12–48 months depending on insurer.

Q3. Are insulin & tests covered?

✅ Yes, under OPD benefits.

Q4. Can senior citizens with diabetes get coverage?

✅ Yes, through special senior citizen plans.

Q5. Do premiums cost more for diabetics?

👉 Yes, but the coverage outweighs costs.

Q6. Can I save tax with diabetic insurance?

✅ Yes, under Section 80D of the Income Tax Act.

Conclusion: Why the Best Health Insurance for Diabetics in India Matters

The cost of diabetes management is only rising in India. The Best Health Insurance for Diabetics in India provides:

- Cost savings through bundled coverage

- Cashless hospitalization across networks

- Preventive and wellness benefits

- Financial security and peace of mind

For diabetics and their families, health insurance is not a luxury—it’s a necessity in 2025.

👉 Explore more guides:

- Best Health Insurance Plans for Senior Citizens in India (2025 Guide)

- How to Choose the Best Health Insurance for Your Family in India (2025 Guide)

- GST Cut on Life and Health Insurance 2025: How Policyholders Can Save ₹9,000 Annually

Last Updated on August 29, 2025 by Singh Sumit

Safee

sure

Polocy done

Thanks

sure policy is mandatory

take