GST Cut on Life and Health Insurance in India is set to be a game-changer for policyholders. This much-awaited move will save families up to ₹9,000 annually on premiums, making essential coverage more affordable. If implemented, the proposed tax reduction will lower financial strain on households. It will also guarantee people keep life and health coverage without compromise.

Understanding the GST Cut on Life and Health Insurance?

What’s the Current Situation?

- All life and health insurance premiums attract 18% GST.

- This tax inflates costs — especially on long-term and high-value plans.

What’s Proposed for 2025?

- Life Insurance Policies → GST may be reduced to 12% or 5%, depending on type.

- Health Insurance Policies → Family floater and senior citizen plans could see GST down to 5%.

This means policyholders would directly save thousands annually, without compromising on coverage.

How Much Could You Save with the GST Cut on Life and Health Insurance?

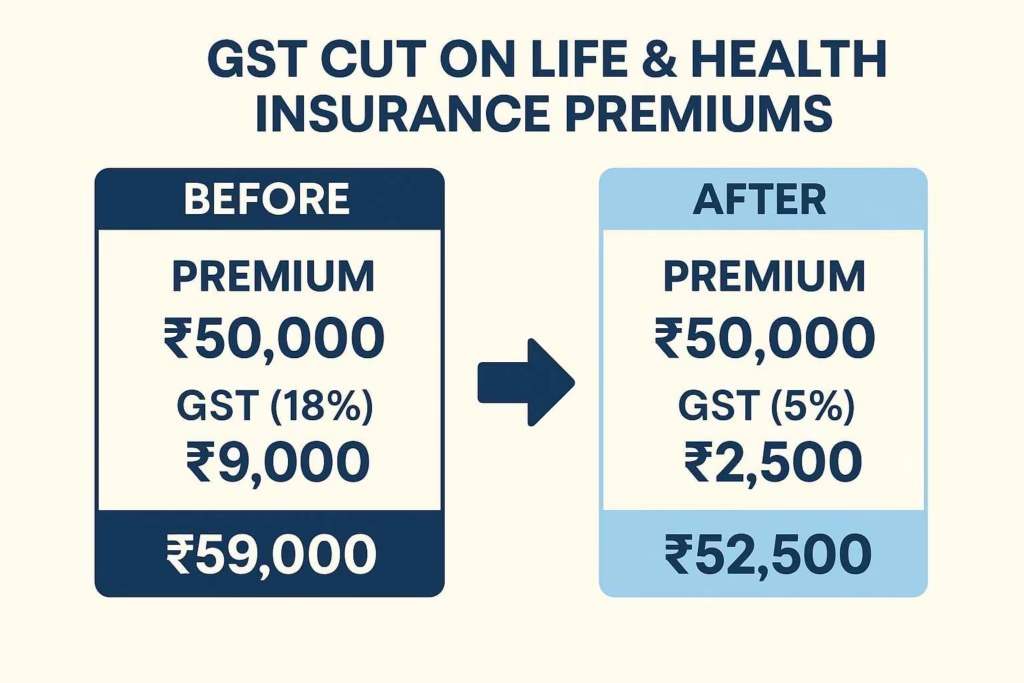

Let’s break it down with a practical example:

- Current Health Insurance Premium: ₹50,000/year

- At 18% GST: ₹9,000 extra (total = ₹59,000)

- At 5% GST: ₹2,500 extra (total = ₹52,500)

- ✅ Savings = ₹6,500 annually

Families with both life and health insurance can save up to ₹9,000 a year.

Why is the GST Cut on Life and Health Insurance Important?

- Insurance Becomes Affordable for Middle Class

Lower premiums encourage wider adoption among India’s growing middle-income households. - Improved Financial Security

With reduced costs, more families can maintain uninterrupted coverage. - Government aims to enhance financial inclusion. This gives a boost to those goals.

This aligns with India’s mission to expand insurance penetration under IRDAI’s “Insurance for All by 2047” initiative.

Impact of GST Cut on Life and Health Insurance: Life Coverage

Term Plans Become Cheaper

A ₹15,000 annual premium will drop by almost ₹2,000 if GST reduces from 18% to 5%.

Endowment & Savings Plans Gain Popularity

High-value policies like endowment plans often struggle due to higher costs. A GST cut could renew interest in long-term savings products.

📌 Internal Link: Read our guide on becoming an IRDAI-certified insurance agent in 2025.

Impact of GST Cut on Life and Health Insurance: Health Coverage

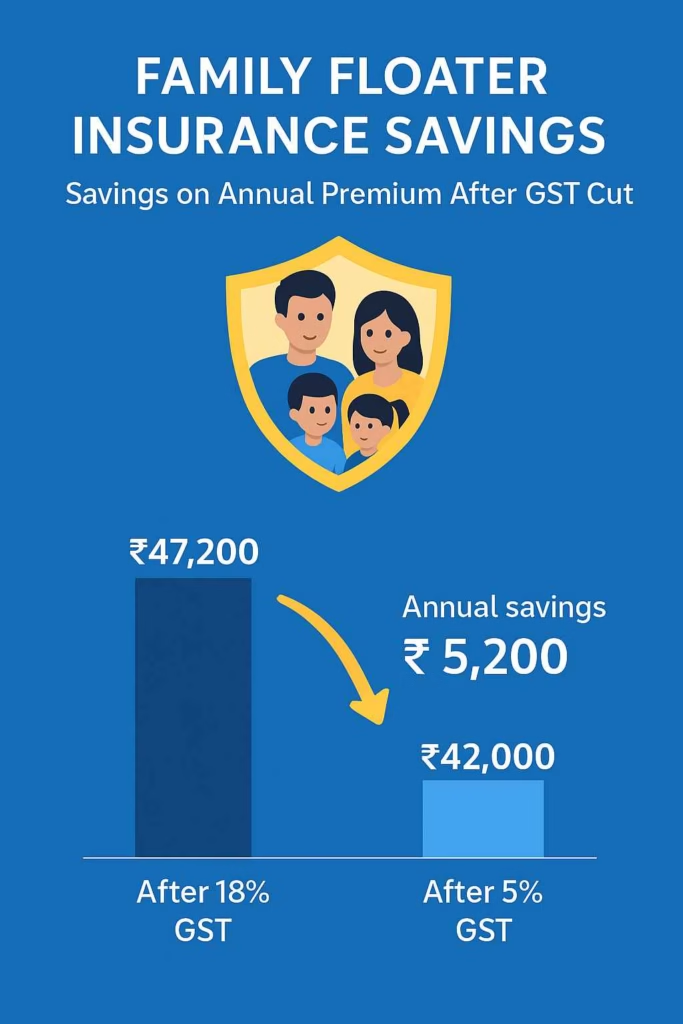

Family Floater Policies

- Average premium: ₹40,000/year

- Savings after GST cut: ₹3,000–₹5,200

This makes comprehensive family coverage accessible without heavy financial strain.

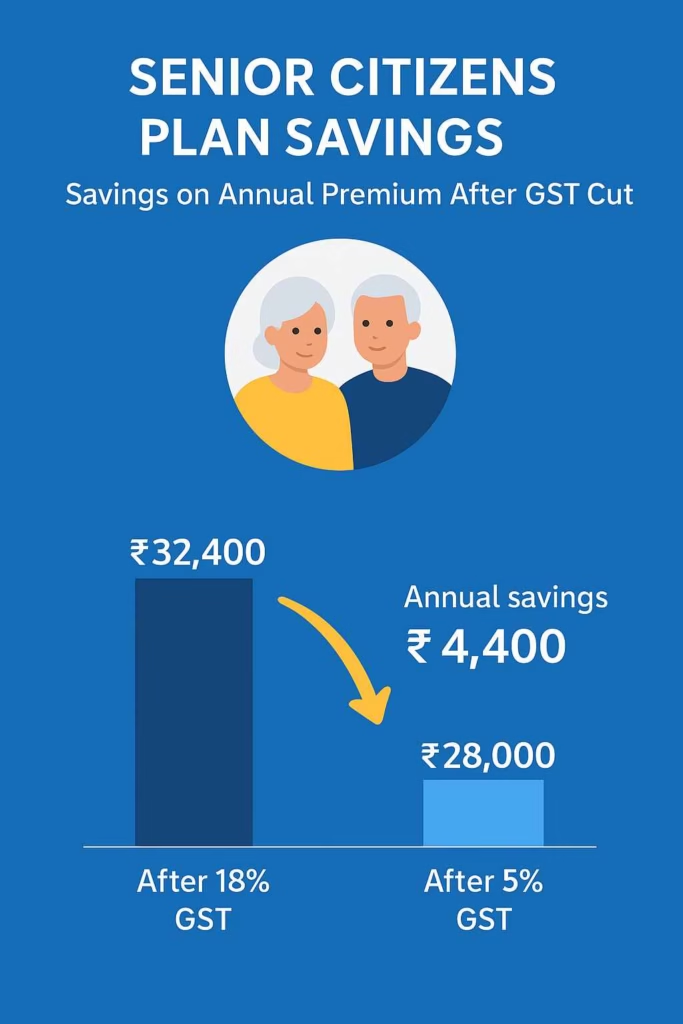

Senior Citizen Plans

- Premiums: ₹50,000–₹1,00,000 annually

- Possible savings: ₹5,000–₹12,000

This is a big relief for retirees living on fixed incomes.

📌 Internal Link: Check our Best Health Insurance for Diabetics in India – 2025 Guide.

Comparison: Old GST vs Proposed GST

| Policy Type | Base Premium | 18% GST | 12% GST | 5% GST | Savings |

|---|---|---|---|---|---|

| Term Life Plan | ₹15,000 | ₹17,700 | ₹16,800 | ₹15,750 | Up to ₹1,950 |

| Family Floater | ₹40,000 | ₹47,200 | ₹44,800 | ₹42,000 | Up to ₹5,200 |

| Senior Citizen Plan | ₹80,000 | ₹94,400 | ₹89,600 | ₹84,000 | Up to ₹10,400 |

Possible Challenges to the GST Cut on Life and Health Insurance

- Government Revenue Loss – A reduced GST rate means lower tax collection.

- Implementation Delays – Policy changes may take time to pass through Parliament.

- Partial Reductions – The cut might apply only to select insurance categories.

How Policyholders Should Prepare

Even before official approval of the GST Cut on Life and Health Insurance, you can:

- Compare existing policies for better value

- Opt for long-term premium payment plans

- Discuss upcoming changes with your insurance advisor

Expert Opinions

- IRDAI’s Take – Supports affordability to drive higher insurance penetration.

- Industry Analysts – Predict a 10–15% growth in insured population if GST cuts are implemented.

📌 External Link: Ministry of Finance – Official GST Updates

FAQs – GST Cut on Life and Health Insurance

FAQs – GST Cut on Life and Health Insurance

Q1: When will the GST Cut on Life and Health Insurance take effect?

A: The government has not yet confirmed a date; it depends on parliamentary approval.

Q2: Will the GST cut apply to all insurance types?

A: It will start with life and health insurance, with possible extensions later.

Q3: How much can I save with the GST cut?

A: Families save up to ₹9,000 annually depending on their policy mix.

Q4: How can I maximize savings from the GST cut?

A: Lock in multi-year plans to benefit from lower GST rates long term.

Q5: Will the GST cut affect senior citizen policies?

A: Yes, premiums for seniors will drop significantly, improving affordability.

Q6: Does the GST cut align with government insurance goals?

A: Absolutely. It supports higher insurance penetration and financial inclusion.

Final Thoughts

In conclusion, the GST Cut on Life and Health Insurance has the potential to transform the insurance landscape in India. By reducing GST from 18% to as low as 5%, policyholders save up to ₹9,000 annually. This move would make policies more affordable and encourage millions of Indians to invest in long-term life and health protection.

Policyholders should keep an eye on government announcements until the reform is officially implemented. They need to compare policy options. Additionally, they should be ready to adjust coverage for optimal savings.

.

Last Updated on September 4, 2025 by Singh Sumit

Gst should be removed

Thanks

yes

What’s up i am kavin, its my first occasion to commenting anyplace, when i read this paragraph

i thought i could also make comment due to this good

piece of writing.

Hi Kavin, welcome, and thank you for sharing your first comment here! 🎉 I’m really glad you found this piece valuable. That’s exactly why I write—to make complex topics like Usage-Based Bike Insurance in India easier to understand. Your engagement motivates me to keep creating more helpful content. Looking forward to hearing more of your thoughts in the future!