Group Health Insurance vs Individual Health Insurance is a crucial comparison. You must make it when planning your healthcare coverage in 2025. Both options protect you against rising medical costs, but they differ in flexibility, cost, and long-term benefits. Knowing the pros and cons of each will help you choose the right policy for your needs.

What is Group Health Insurance?

Group Health Insurance is a policy provided by an employer, association, or organization. It covers a group of people, typically employees, and sometimes their families.

Key Features of Group Health Insurance:

- Premiums are often paid partially or fully by the employer

- Minimal or no pre-policy medical tests

- Immediate coverage from the day you join the organization

- Sometimes includes maternity benefits and coverage for pre-existing diseases

What is Individual Health Insurance?

Individual Health Insurance is a policy you buy directly from an insurance company. It covers you for medical expenses. You can optionally include your family. You can choose the sum insured, add-ons, and insurer based on your needs.

Key Features of Individual Health Insurance:

- You control the insurer, coverage, and features

- Lifetime renewability options

- Ability to include riders such as critical illness cover, personal accident cover, and OPD benefits

- Valid regardless of job changes or retirement

📌 Read next: Best Health Insurance Plans in India 2025

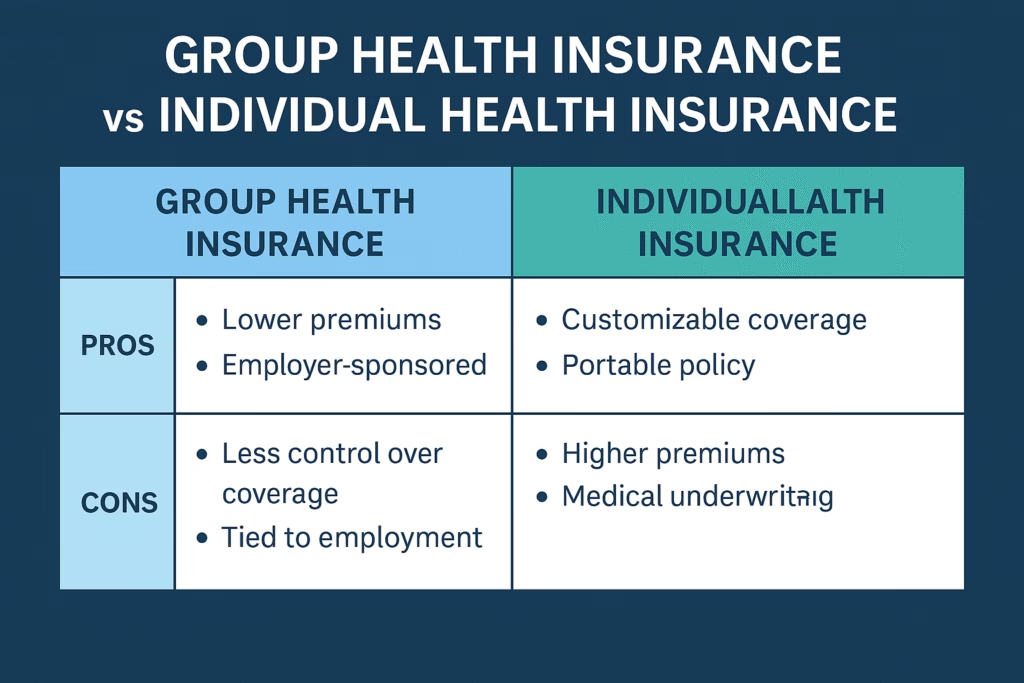

Pros and Cons of Group Health Insurance

✅ Pros

- Cost-Effective – Many employers fully or partially cover the premium.

- Instant Coverage – No waiting periods for most pre-existing illnesses.

- Easy to Get – No health checks or complex paperwork.

- Family Coverage – Many companies offer family floater options.

❌ Cons

- Ends with Employment – If you change or lose your job, coverage ends.

- Limited Coverage Amount – Sum insured is often ₹2–5 lakh, which may not be enough for serious treatments.

- Less Flexibility – The employer chooses the insurer and plan; customization is limited.

📌 Read next: How to Port Health Insurance Policies

Pros and Cons of Individual Health Insurance

✅ Pros

- Complete Control – You choose your sum insured, riders, and insurer.

- Portability – Policy remains valid even if you change jobs or cities.

- Customizable – Add maternity cover, OPD benefits, or critical illness riders as needed.

- Higher Sum Insured – You can opt for ₹10 lakh or more, ensuring better protection.

❌ Cons

- Higher Premiums – You pay the full amount.

- Waiting Periods – Pre-existing diseases often have a 2–4 year waiting period.

- Medical Tests – Required for certain ages or high coverage amounts.

📌 Read next: Tips to Reduce Health Insurance Premiums

Which One Should You Choose?

There’s no one-size-fits-all answer. It depends on your lifestyle, job stability, budget, and health needs.

Best approach in 2025:

- Have both – Use your group plan for basic, immediate coverage and your individual plan for long-term protection.

- If budget is tight, start with your employer’s group policy and gradually buy an individual policy.

- For families, individual or family floater plans are better for long-term security.

FAQs on Group Health Insurance vs Individual Health Insurance

1. Can I have both Group and Individual Health Insurance?

Yes. Having both provides layered protection — group policy first, then individual plan for extra coverage.

2. Does group health insurance cover my family?

Many companies offer family coverage, but it may come at an extra cost.

3. What happens if I leave my job?

Your group policy ends, but you may be able to port it to an individual plan.

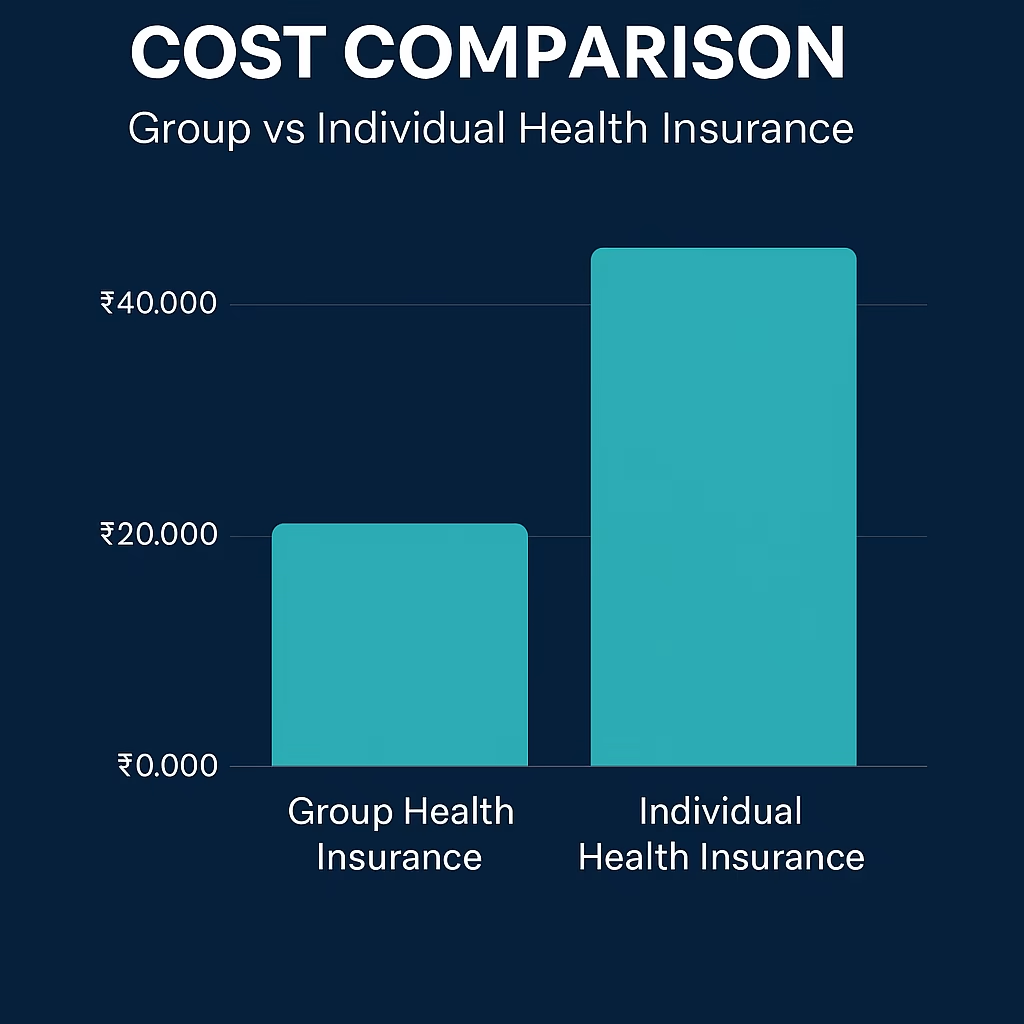

4. Which is cheaper?

Group insurance is cheaper but offers less flexibility. Individual plans cost more but give you control.

5. Can I port a group health plan?

Yes, IRDAI allows porting to individual health plans with the same insurer or a different one.

External Resources

Final Thoughts

In the Group Health Insurance vs Individual Health Insurance debate, a combination of both is the smartest choice for most Indians. This approach allows individuals to take advantage of the benefits of both policies. Your group policy offers low-cost or free coverage while you’re employed, while your individual plan ensures lifelong protection and customization.

Think of group health insurance as your first line of defense and individual health insurance as your long-term safety net. By combining them, you get the best of both worlds — affordability, flexibility, and security.

Last Updated on August 15, 2025 by Singh Sumit

1 thought on “Group Health Insurance vs Individual Health Insurance: Complete Pros & Cons Guide 2025”