Introduction to Family Health Insurance in India

Health insurance in India has transformed dramatically over the past decade. In 2025, families are no longer just looking for basic hospitalization coverage. They want cashless hospitalization. Families also desire digital health insurance policies, telemedicine coverage, and preventive healthcare benefits. Rising medical costs have increased the importance of choosing the right Family Health Insurance in India. Lifestyle diseases and awareness of wellness also contribute to this growing need.

There are many insurers, features, and fine print. The big question is important. How do you choose the best Family Health Insurance in India? It is crucial for your loved ones in 2025.

This guide walks you step by step through everything you need to know. It includes factors to compare and the latest trends. You’ll learn about common mistakes to avoid. Insider tips will also help you select the most suitable Family Health Insurance in India and protect your loved ones.

Why Family Health Insurance in India is Essential in 2025

Medical inflation in India is rising at nearly 15% per year. A single hospitalization in a metro city can cost anywhere between ₹5 lakh to ₹10 lakh. Without insurance, such expenses can wipe out savings and investments.

In 2025, the scope of health insurance has expanded beyond just hospitalization. Families now expect:

- Cashless hospitalization across a wide network of hospitals

- OPD cover for consultations, diagnostics, and medicines

- Telemedicine coverage for virtual doctor visits

- Maternity and newborn coverage

- Preventive healthcare benefits such as free annual health checkups

- Wellness rewards for maintaining a healthy lifestyle

Choosing the best health insurance for your family in India involves more than covering emergencies. It is also about ensuring long-term wellness.

Key Factors to Consider Before Choosing Family Health Insurance

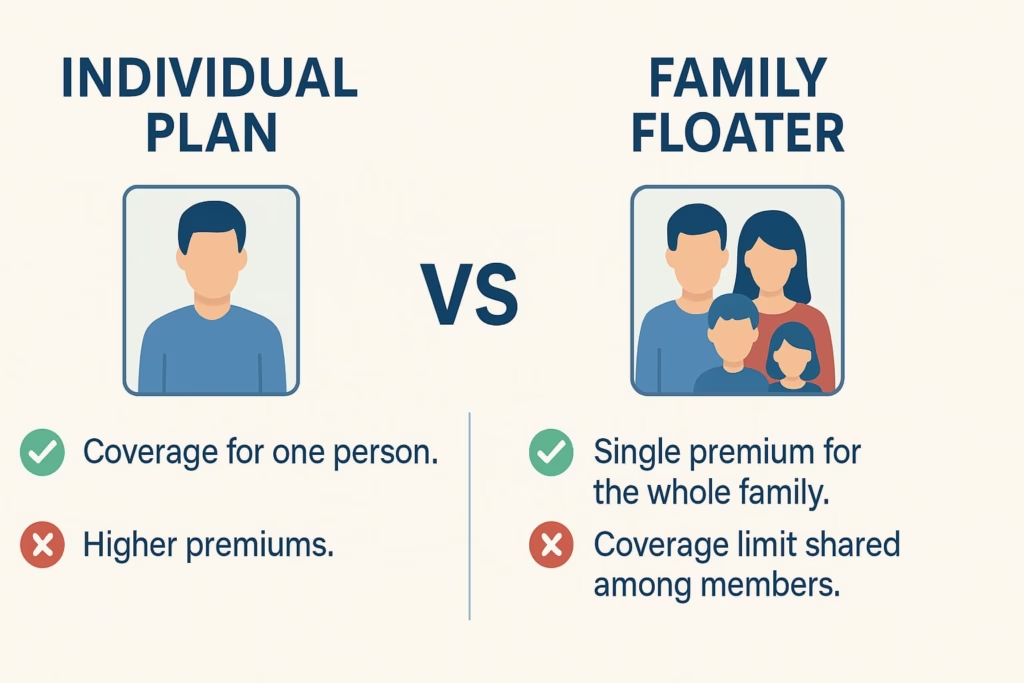

Coverage Options: Individual vs Family Floater Plans

- Individual Plan: Each member gets a separate sum insured. Good if family members are older or have medical conditions.

- Family Floater Plan: A single sum insured shared among all members. Cost-effective for young families.

👉 Trending Tip 2025: Many insurers now offer AI-based claim settlement. They provide zero co-payment on family floater plans. These features make them attractive for urban families.

Network Hospitals and Cashless Hospitalization Benefits

Cashless hospitalization remains one of the most important factors. A good plan should cover:

- Over 10,000+ network hospitals across India

- Tie-ups with tier-2 and tier-3 city hospitals

- Specialized hospitals for maternity and pediatric care

Always check the insurer’s claim settlement ratio and reviews of their cashless process.

Pre-existing Disease Coverage and Waiting Periods

- Most policies have a waiting period of 2–4 years for pre-existing diseases.

- In 2025, some insurers offer reduced waiting periods or even instant coverage for lifestyle diseases with extra premiums.

Maternity & Newborn Coverage

Maternity costs in India have doubled in recent years. Plans offering maternity and newborn coverage are essential for young couples.

🔗 Also read: Top 3 Best Maternity Insurance Plans in India (2025) for New Parents

OPD, Preventive Healthcare, and Telemedicine Coverage

The best family plans in 2025 now include:

- OPD cover for consultations & diagnostics

- Telemedicine coverage for online doctor visits

- Preventive healthcare benefits like annual health check-ups

- Wellness rewards such as premium discounts for staying healthy

Comparing Premiums, Sum Insured & Co-payment Clauses

How Premiums are Calculated

Premiums depend on:

- Age of family members

- Location (metro vs non-metro)

- Lifestyle habits

- Pre-existing medical conditions

👉 Digital insurers are also using AI-based underwriting to personalize premiums.

Zero Co-payment vs High Deductibles

- Zero co-payment: insurer pays 100% of hospital bills.

- High deductible: lower premium but higher out-of-pocket costs.

✅ For families, zero co-payment plans are more beneficial despite slightly higher premiums.

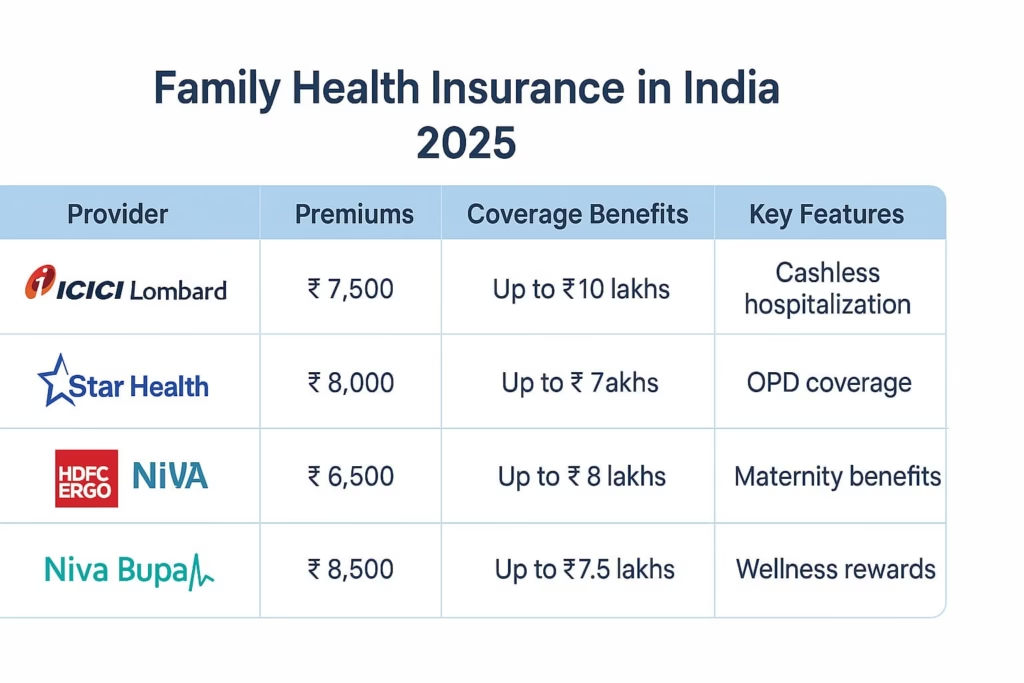

🏥 Best Family Health Insurance in India – 2025 Comparison

| Insurance Provider | Coverage Highlights | Premium Range (Annual) | Best For |

|---|---|---|---|

| ICICI Lombard | Cashless hospitalization, OPD cover, wellness rewards | ₹12,000 – ₹28,000 | Balanced family coverage |

| Star Health | Wide network hospitals, maternity cover, low co-pay | ₹10,000 – ₹25,000 | Families with maternity needs |

| HDFC ERGO | Preventive healthcare, telemedicine, AI-based claims | ₹11,000 – ₹26,000 | Tech-savvy urban families |

| Niva Bupa | High sum insured, reduced waiting periods | ₹13,000 – ₹30,000 | Families with elderly parents |

| Compare More Plans → | Explore top Family Health Insurance in India policies | Check Policybazaar Comparison | Best for detailed comparisons |

Latest Trends in Health Insurance (2025)

- AI-based claim settlement – faster, paperless approvals

- Digital health insurance & e-cards – no physical paperwork

- Wellness rewards & preventive care – discounts, free apps, premium reductions

Mistakes to Avoid

- Choosing the lowest premium plan without checking coverage

- Ignoring pre-existing disease clauses

- Not checking hospital network size

- Overlooking maternity & OPD cover

- Not reading the fine print for exclusions

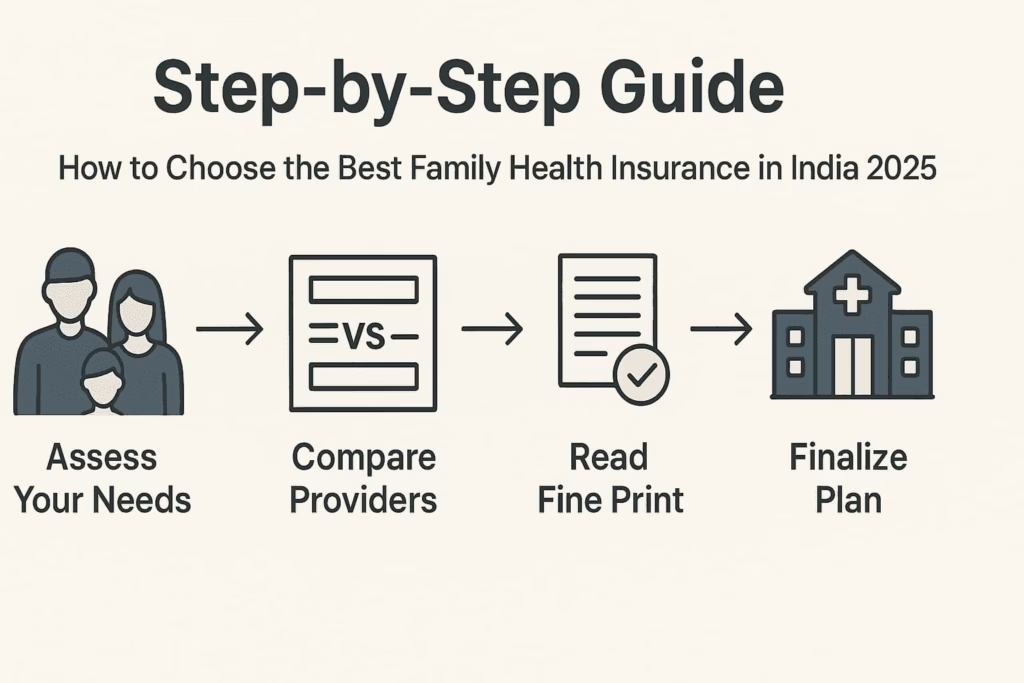

Step-by-Step Guide to Choosing the Best Family Plan

- Assess your family’s healthcare needs – age, size, future risks.

- Compare insurers & claim settlement ratios – CSR above 90% preferred.

- Read the fine print – room rent limits, treatment caps, exclusions.

🔗 Helpful Reads:

- Switch Health Insurance Providers in India (2025 Guide)

- Term Insurance VS Whole life insurance – Know the Difference

- Top 3 Best Maternity Insurance Plans in India (2025) for New Parents

Real-Life Case Study

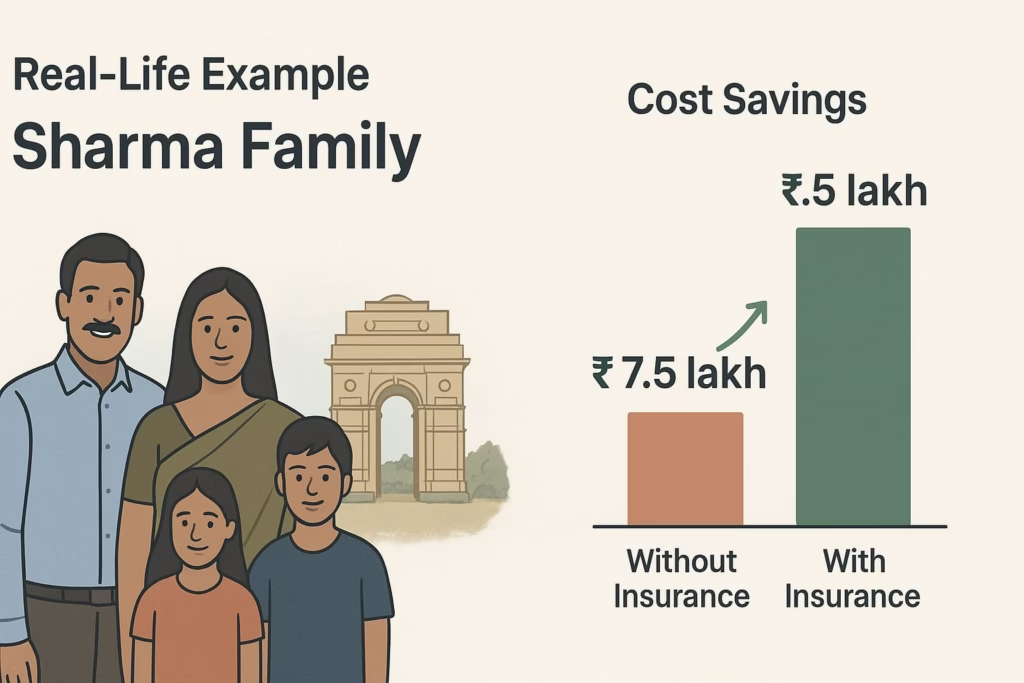

Case Study: The Sharma Family (Delhi)

The Sharma family in Delhi is a real-life example of how Family Health Insurance in India can make a difference. Their family floater policy saved them ₹7.5 lakh in 2024, covering both hospitalization and maternity care.Without insurance, the same expenses would have wiped out their emergency savings. This shows why choosing the right health insurance plan in India is essential for financial security in 2025.

FAQs on Family Health Insurance

Q1. What is the right age to buy family health insurance?

The best time is when family members are young and healthy, as premiums are lower.

Q2. Is cashless hospitalization available across India?

Yes, top insurers offer 10,000+ cashless hospitals in metros and small towns.

Q3. Can I switch health insurers without losing benefits?

Yes, via health insurance portability under IRDAI.

Q4. Should I choose family floater or individual plans?

Floater plans are great for young families; individual plans suit elderly parents.

Q5. What are wellness rewards?

These include premium discounts, free health check-ups, and fitness incentives.

Conclusion

When evaluating Family Health Insurance in India, don’t just compare premiums. Look for plans that include cashless hospitalization, preventive healthcare, OPD cover, and wellness benefits. This ensures long-term financial security for your loved ones.

Last Updated on August 30, 2025 by Singh Sumit

10 thoughts on “How to Choose the Best Health Insurance for Your Family in India (2025 Guide)”