Introduction: Why Digital Car Insurance is the Future in India

The Indian motor insurance industry has undergone a massive transformation over the last decade. With the increasing adoption of smartphones, internet penetration, and tech-savvy consumers, Digital Car Insurance in India 2025 has become the new standard for buying, renewing, and claiming car insurance.

Gone are the days of standing in long queues, filling out endless forms, and waiting weeks for claim settlement. Today, you can complete the entire car insurance process online—from purchase to renewal and even claims—within minutes. This not only saves time but also ensures transparency, competitive pricing, and paperless convenience.

In this guide, we’ll take you step by step through the process of buying, renewing, and claiming car insurance online in 2025 while comparing the pros and cons of digital vs traditional insurance methods.

What is Digital Car Insurance in India 2025?

Digital car insurance is simply a paperless, online process of buying, renewing, and managing your car insurance policy without the need for physical paperwork or in-person visits.

Insurance providers, aggregators, and online-first companies like Acko, Digit, HDFC ERGO, and ICICI Lombard now offer seamless digital platforms where policyholders can:

- Buy car insurance instantly

- Renew expired or active policies in minutes

- File claims online with digital document upload

- Track claim status in real time

This online-first model has not only streamlined customer experience but also reduced frauds, improved policy accessibility, and offered more competitive pricing.

Benefits of Digital Car Insurance in India 2025

Convenience & Paperless Process

No more lengthy paperwork or physical verification. Everything is handled digitally through secure portals and mobile apps.

Instant Policy Issuance & Renewals

Instead of waiting for days, your digital car insurance policy is issued instantly once the payment is made online.

Faster Claim Settlements

Online claim filing with photo and video uploads accelerates the process, ensuring faster claim settlements.

Transparency & Easy Comparison

Policyholders can compare premiums, features, and add-ons across multiple insurers instantly before making a decision.

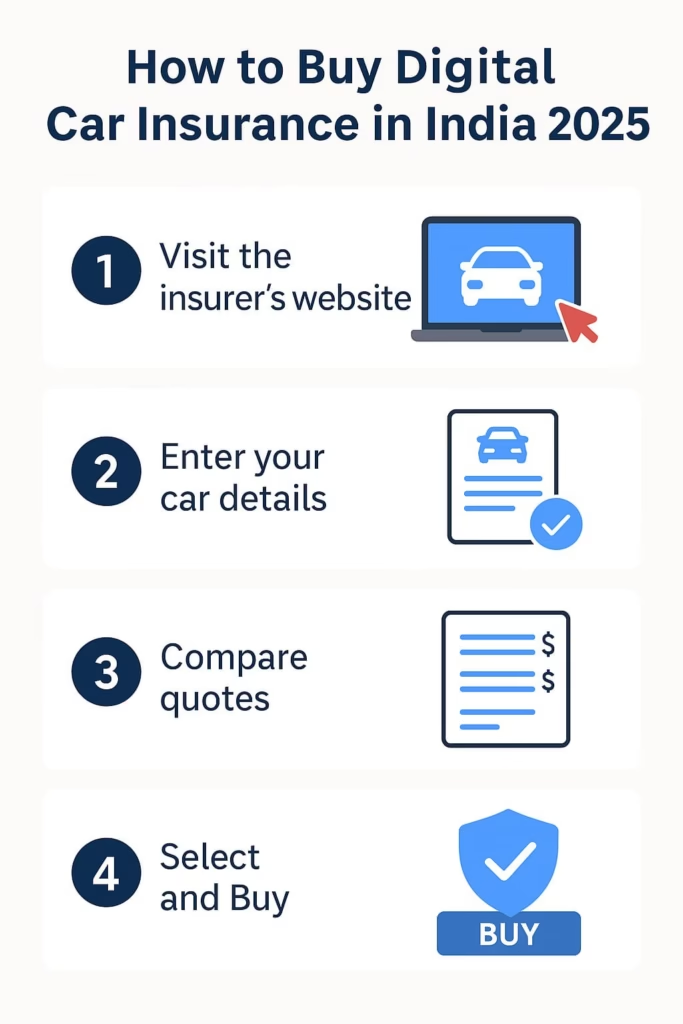

Step-by-Step Guide to Buy Car Insurance Online in 2025

Step 1: Visit Insurer or Aggregator Website

Start by visiting an insurer’s official website (like HDFC ERGO, ICICI Lombard) or aggregator platforms.

Step 2: Enter Vehicle & Personal Details

Provide your car’s registration number, RTO details, fuel type, model, and personal details like age and driving history.

Step 3: Choose Coverage Type

Select between third-party insurance, comprehensive insurance, or standalone OD policy. Add-ons like zero depreciation, roadside assistance, and engine protection can also be included.

Step 4: Compare Premiums & Select Best Plan

Aggregator websites make it easy to compare premiums, claim ratios, and benefits across insurers.

Step 5: Make Online Payment & Get Policy Instantly

Complete the payment online, and the soft copy of your policy is emailed to you immediately.

Step-by-Step Guide to Renew Digital Car Insurance in 2025

Why Timely Renewal Matters

Renewing your car insurance before expiry helps you avoid penalties, maintain your No Claim Bonus (NCB), and ensure continuous coverage.

How to Renew Car Insurance Online

Simply log in to your insurer’s portal, review existing coverage, make changes (if needed), and pay online. The renewed policy will be issued instantly.

Benefits of Digital Renewal

- Retains accumulated NCB

- Avoids policy lapse penalties

- Ensures uninterrupted claim coverage

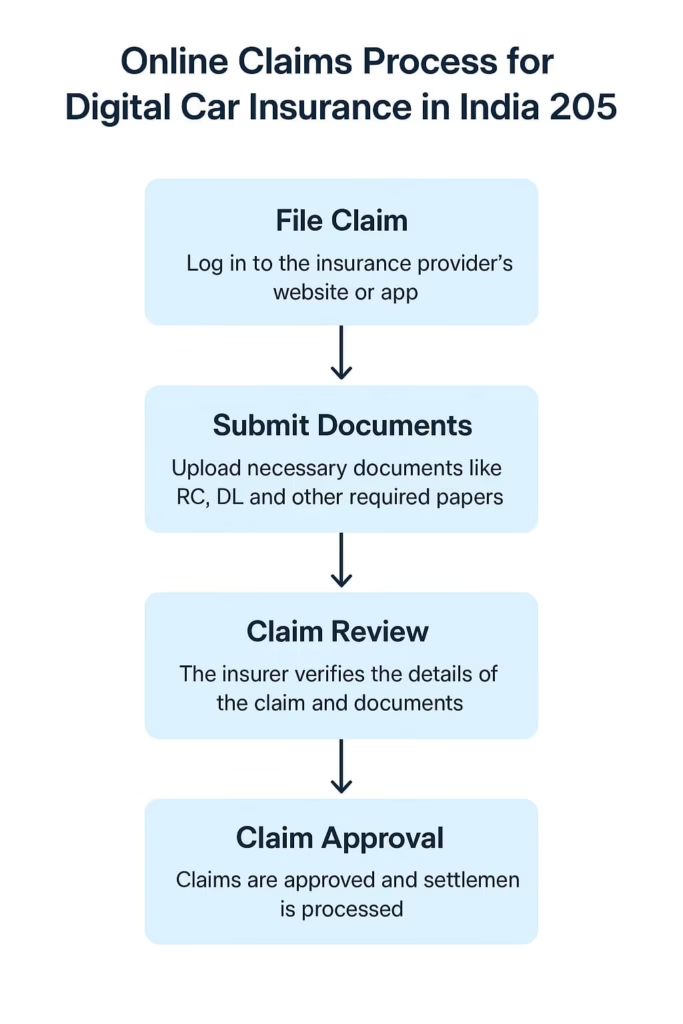

Step-by-Step Guide to File a Car Insurance Claim Online

Step 1: Notify Insurer Immediately

Log in to the insurer’s mobile app or website and initiate a claim request.

Step 2: Submit Documents Online

Upload required documents like RC, driving license, FIR (if needed), and damage photos/videos.

Step 3: Cashless Repairs & Claim Settlement

Insurers send surveyors digitally and process claims at cashless network garages. This ensures fast, hassle-free repairs.

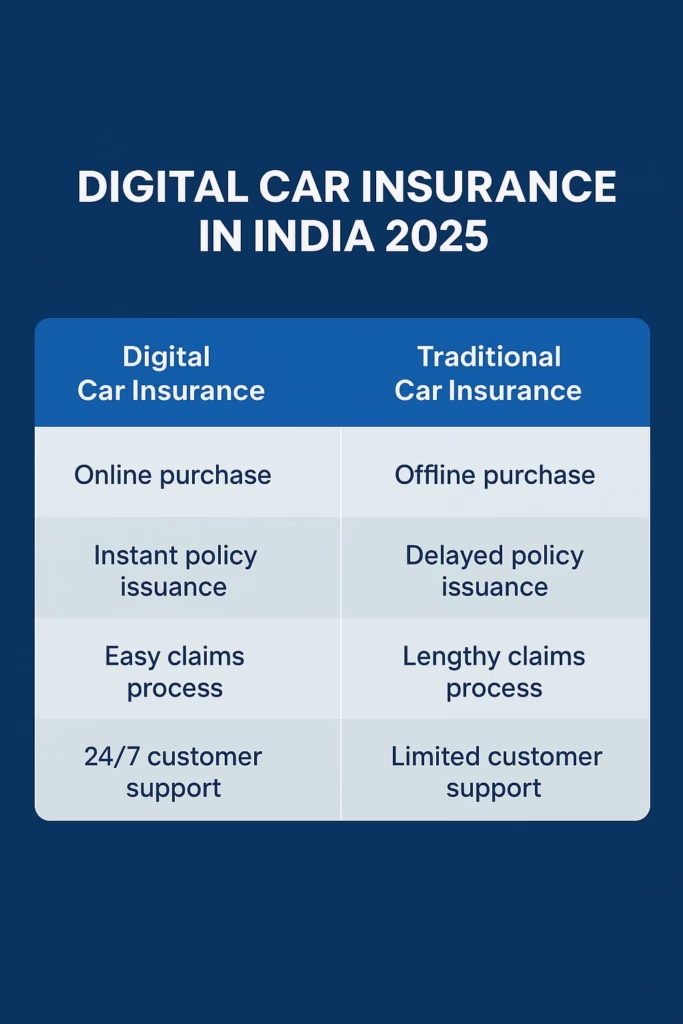

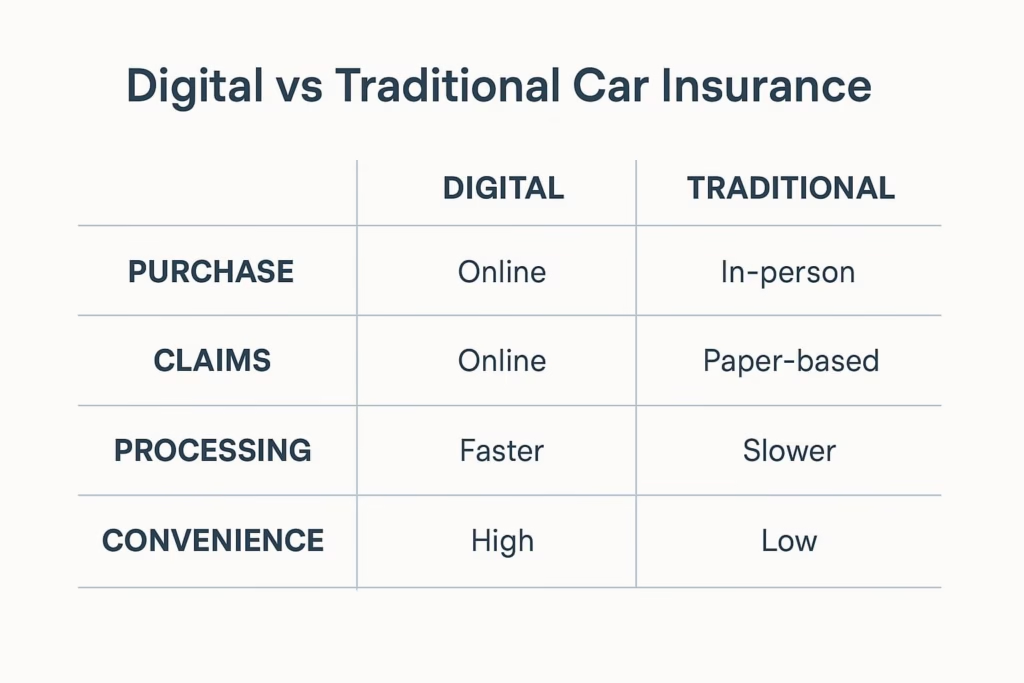

Digital Car Insurance vs Traditional Car Insurance

Comparison Table of Digital vs Offline Process

| Feature | Digital Car Insurance 2025 | Traditional Car Insurance |

|---|---|---|

| Policy Purchase | Online, instant | Offline, time-consuming |

| Renewal | Instant, paperless | Manual, paperwork |

| Claim Filing | Digital upload | Physical submission |

| Speed | Fast (minutes to hours) | Slow (days to weeks) |

| Transparency | High | Low |

| Cost | Competitive | Higher (due to agents) |

Which One is Better in 2025?

With speed, convenience, and cost-effectiveness, Digital Car Insurance in India 2025 is the smarter option for most car owners.

Top Digital Car Insurance Companies in India 2025

HDFC ERGO Digital Car Insurance

Known for fast claim settlement and user-friendly mobile app.

ICICI Lombard Digital Car Insurance

Strong network of cashless garages and reliable customer support.

Acko, Digit & Other Online-First Insurers

Low-cost premiums with fully digital claim processes.

Challenges of Digital Car Insurance in India 2025

Cybersecurity & Data Privacy Risks

Data leaks and cyber fraud are potential risks in a digital-first environment.

Limited Human Support

Some policyholders still prefer human agents for claim guidance.

Over-Reliance on Technology

If systems fail, delays in claims and renewals may occur.

Tips to Choose the Best Digital Car Insurance in India

Compare Multiple Insurers Online

Always compare premiums, features, and claim settlement ratios.

This is especially true for Digital Car Insurance in India 2025 where options are many.

Check IRDAI Registration & Ratings

Ensure the insurer is IRDAI-approved and check online reviews.

Evaluate Add-On Covers

Choose add-ons based on your driving habits and region (e.g., zero dep, roadside assistance).

Internal Resources to Learn More About Car Insurance

They complement your knowledge of Digital Car Insurance in India 2025.

- What Is a No Claim Bonus (NCB) in Car Insurance? Explained for 2025

- Private vs Public Car Insurance Companies in India: Which One Should You Trust in 2025?

- Usage-Based Car Insurance in India 2025: Save Big with Telematics

External Authority Resource

For verified car insurance guidelines, visit the official IRDAI Website.

FAQs on Digital Car Insurance in India 2025

Q1. What is the biggest benefit of digital car insurance?

👉 Instant issuance, paperless process, and faster claims.

Q2. Can I renew an expired car insurance policy online?

👉 Yes, most insurers allow online renewals for expired policies.

Q3. How secure is buying car insurance online in 2025?

👉 Very secure if purchased from IRDAI-registered insurers.

Q4. Do digital car insurers provide 24/7 claim support?

👉 Yes, most leading insurers have AI-powered claim tracking and 24/7 assistance.

Q5. Can I get discounts while buying car insurance online?

👉 Yes, many insurers offer exclusive digital discounts and NCB benefits.

Q6. Which digital car insurance company is best in 2025?

👉 HDFC ERGO, ICICI Lombard, Acko, and Digit are among the top choices.

Conclusion: Why Digital Car Insurance is the Smarter Choice in 2025

The shift towards Digital Car Insurance in India 2025 is inevitable and beneficial. With instant policies, quick renewals, and hassle-free claim settlements, going digital saves time, money, and effort.

While traditional insurance still exists, the convenience, transparency, and affordability of digital car insurance make it the smarter choice for today’s tech-driven car owners.