Introduction: Why Critical Illness Insurance in India Matters

Life is unpredictable. Imagine you’re healthy, working hard, paying EMIs, and saving for your dream home. Suddenly, you’re diagnosed with cancer, a heart condition, or another severe illness. Treatment costs in India can easily run into ₹10–₹25 lakh, excluding income loss.

This financial burden pushes many families into debt. Critical Illness Insurance in India prevents this crisis by offering a lump-sum payout upon diagnosis. This ensures you can focus on recovery instead of worrying about money.

What Is Critical Illness Insurance in India?

Critical Illness Insurance is a health policy. It pays you a one-time lump-sum amount if you’re diagnosed with a listed illness. According to IRDAI, these commonly include:

- Cancer

- Heart attack

- Stroke

- Kidney failure

- Major organ transplant

Unlike standard health insurance, the payout is not linked to hospital bills. Once you receive the claim, you can use the money for:

- Paying EMIs

- Covering daily expenses

- Specialized treatment abroad

- Home care post-treatment

This flexibility is why Critical Illness Insurance in India is gaining popularity among professionals and families.

Who Needs Critical Illness Insurance in India the Most?

This insurance is not just for senior citizens — it’s essential for working professionals too.

- Sole Breadwinners – Protects the family’s income if you’re unable to work.

- Business Owners & Self-Employed – Offers financial support when income halts.

- People with High EMIs – Prevents loan defaults during illness.

- Young Professionals – Lock in lower premiums by buying early.

- Families with a History of Lifestyle Diseases – Higher risks of heart disease, diabetes complications, or cancer.

How Does Critical Illness Insurance in India Work?

Here’s the standard process:

- Buy a Policy – Either standalone or as a rider with term/life insurance.

- Diagnosis – If diagnosed with a covered illness, submit claim documents.

- Survival Period – Usually 14–30 days post-diagnosis.

- Lump-Sum Payout – Credited directly to your account.

- Usage – Free to spend as required.

👉 Example: With a ₹20 lakh policy, a cancer diagnosis results in ₹20 lakh being credited to your account. You don’t need to show hospital bills.

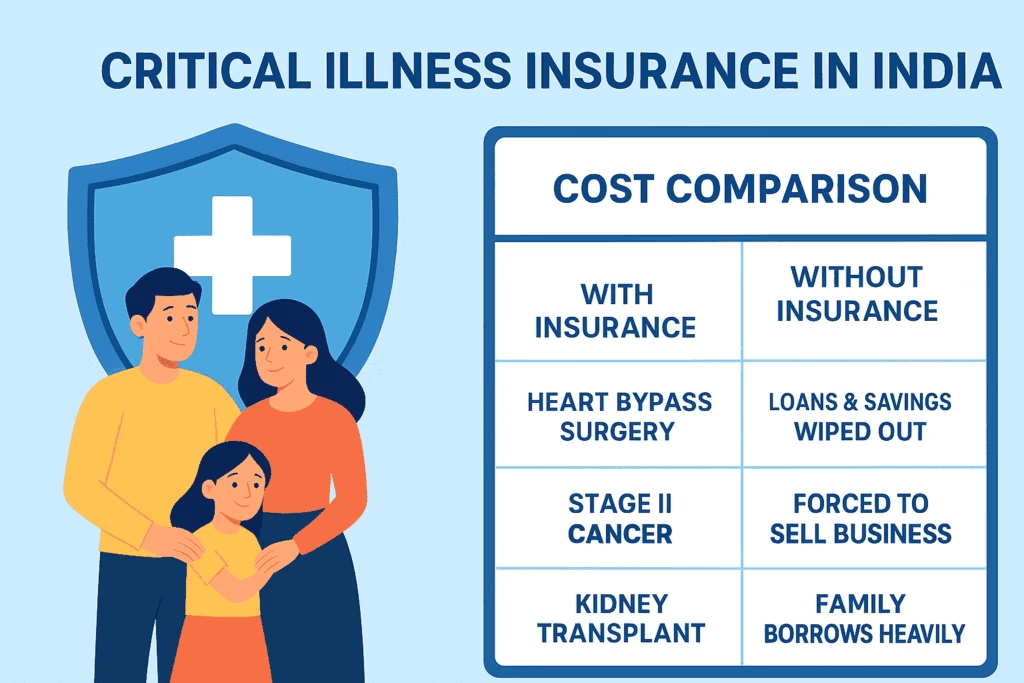

When Critical Illness Insurance in India Saves You Lakhs

| Situation | With Insurance | Without Insurance |

|---|---|---|

| Heart bypass surgery (40-year-old IT professional) | ₹15 lakh payout covers surgery + recovery | Loans & savings wiped out |

| Stage II cancer (shop owner) | ₹20 lakh payout funds top hospital treatment | Forced to sell business |

| Kidney transplant (homemaker) | ₹12 lakh payout covers surgery & aftercare | Family borrows heavily |

How Much Coverage Should You Take?

Experts recommend:

- 10–15× your annual income, OR

- The sum of your:

- Outstanding loans (home + personal)

- Two years’ household expenses

- Estimated treatment costs for major illnesses

💡 Use a Critical Illness Calculator to find your ideal cover.

Premium Costs of Critical Illness Insurance in India

Premiums are affordable if purchased young:

- Age 30: ₹20 lakh cover = ₹3,000–₹5,000/year

- Age 45: Same cover = ₹8,000–₹12,000/year

The annual cost is small compared to the lakhs it can save you in emergencies.

Common Mistakes to Avoid

- Relying only on employer-provided health cover.

- Choosing low coverage (₹5 lakh isn’t enough).

- Ignoring exclusions like early-stage cancer.

- Delaying purchase — premiums rise with age and medical checks get stricter.

Best Resources to Learn More

- National Health Portal India – Critical Illness Costs

- Read: 5 Best Term Insurance Plans in India (2025)

- Explore: Top 5 Tips to Save Money on Insurance Premiums in 2025

FAQs About Critical Illness Insurance in India

Q1: Is Critical Illness Insurance the same as health insurance?

No. Health insurance reimburses hospital bills, while CII provides a lump-sum payout.

Q2: What illnesses are covered?

Cancer, heart attack, stroke, kidney failure, major organ transplant, paralysis, Alzheimer’s, and more.

Q3: Can I buy it after diagnosis?

No. It must be purchased beforehand.

Q4: Should I buy standalone or as a rider?

Standalone offers higher coverage. Riders are cost-effective but capped.

Q5: Is the payout taxable in India?

Generally tax-free under Section 10(10D) of the Income Tax Act.

Q6: Is it worth buying if I already have health insurance?

Yes. Health insurance covers hospital bills, while CII covers income loss and lifestyle costs.

Final Takeaway

Critical Illness Insurance in India is more than an add-on policy — it’s a financial survival plan. It protects your family from debt, ensures your EMIs stay on track, and gives you peace of mind during recovery.

👉 The earlier you buy, the cheaper and more beneficial it is. Don’t wait for a diagnosis — secure your future with Critical Illness Insurance today.

Last Updated on August 21, 2025 by Singh Sumit

Good