Cashless Hospital Network in Health Insurance is one of the biggest benefits you get when buying a health insurance policy. You don’t have to worry about paying a huge medical bill on the spot during an emergency. Your insurer directly settles the bill with the hospital.

In India, cashless hospitalization has become the preferred choice for many policyholders. Still, it is crucial to understand exactly how it works and how to make the most of it.

In this guide, we’ll break down what the cashless hospital network is. We will explain how it functions. We will discuss its benefits. We will also provide tips to avoid claim rejections.

🩺 What Is a Cashless Hospital Network in Health Insurance?

A cashless hospital network is a list of hospitals. These hospitals have tied up with your health insurance provider to offer direct billing for medical services.

When you get admitted to one of these hospitals, you don’t have to pay the medical expenses upfront. This excludes the non-covered costs. Your insurance company settles the bill directly with the hospital, as per the terms of your policy.

💡 Internal Link Tip: We offer a full guide on choosing the right policy. Check our article — Best Health Insurance Plans for Senior Citizens in India 2025.

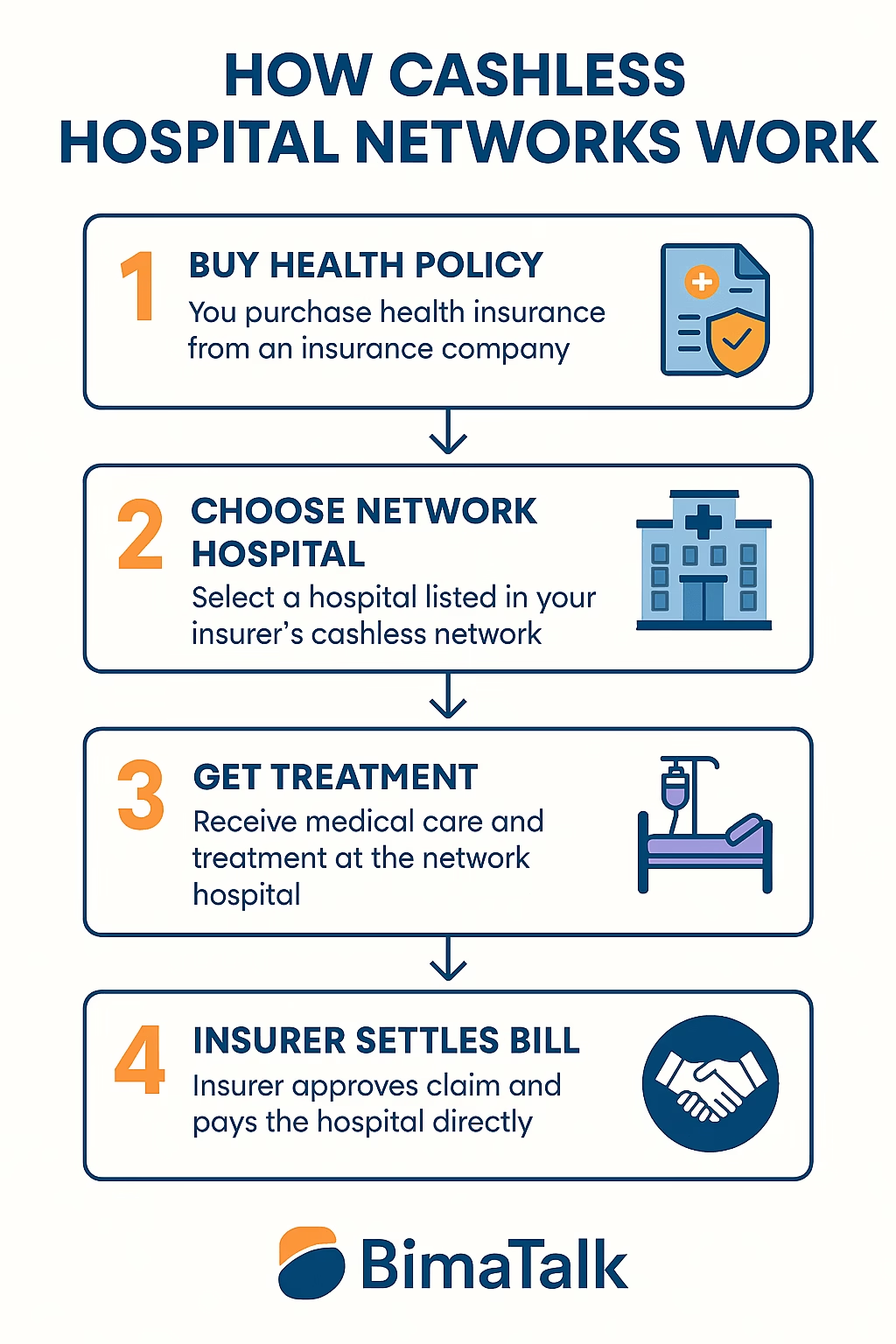

🔍 How the Cashless Hospital Network Works in India

Understanding the process is the first step to avoiding confusion during emergencies.

Here’s how it typically works:

- Choose a Network Hospital

Check your insurer’s list of empanelled hospitals. This list is available on their website or mobile app. - Show Your Health Card

When you visit a network hospital, present your health insurance card at the insurance desk. You can alternatively provide your policy number. - Pre-Authorization Request

The hospital sends a pre-authorization request to the insurer. They also send it to their Third-Party Administrator (TPA). This request details the estimated cost of treatment. - Approval & Treatment

Once approved, you receive cashless treatment, meaning the insurer will directly settle the bill. - Discharge & Settlement

At discharge, the final bill is sent to the insurer for settlement. You only pay for non-covered items like registration fees, food for attendants, or personal amenities.

💡 Benefits of Using a Cashless Hospital Network

A cashless hospital network in health insurance offers several advantages:

- No Upfront Payment Stress – Avoid arranging large sums during emergencies.

- Faster Admission – Network hospitals prioritize cashless patients because the process is standardized.

- Peace of Mind – Focus on recovery instead of paperwork.

- Nationwide Coverage – Many insurers have thousands of network hospitals across India.

📊 Example: Insurers like HDFC ERGO, Star Health, and ICICI Lombard have more than 10,000 hospitals in their network.

🔗 External Resource: IRDAI Hospital Network Guidelines – Learn how insurance networks are regulated in India.

🏥 Types of Cashless Hospital Network Access

Not all cashless access is the same. In India, there are typically two types:

- Planned Cashless Hospitalization

- Used for scheduled treatments like surgery, maternity, or knee replacement.

- Approval can be obtained 3–5 days in advance.

- Emergency Cashless Hospitalization

- For sudden events like accidents, heart attacks, or strokes.

- Pre-authorization is processed within a few hours, but approval depends on full documentation.

⚠️ Common Reasons for Cashless Claim Rejections

Even with a cashless hospital network, claims can be denied if you’re not careful.

- Hospital Not in Network – Always check the updated list before admission.

- Policy Exclusions – Certain treatments like cosmetic surgery or dental care may not be covered.

- Waiting Period – Some conditions (like pre-existing diseases) have a waiting period before coverage starts.

- Incomplete Documentation – Missing reports or incorrect forms delay approvals.

💡 Internal Link Tip: Avoid these pitfalls by reading our Guide to Why Term Insurance Claims Get Denied.

📌 How to Find the Best Cashless Hospital Network in Health Insurance

When selecting a health insurance plan, the cashless hospital network should be a top priority. Here’s how to evaluate it:

- Check Hospital Coverage in Your City – Having a large network nationwide is good. However, you also need options close to home.

- Look for Specialty Hospitals – Especially if you have specific medical needs.

- Verify Reputation – Choose hospitals with good reviews and qualified staff.

- Consider Insurer Partnerships – Some insurers partner with premium hospitals for faster claim processing.

📋 Steps to Make the Most of Your Cashless Hospital Network

To ensure a smooth cashless experience:

- Keep your health insurance ID card handy.

- Maintain updated copies of your medical history.

- Call your insurer’s helpline immediately during admission.

- Keep a small emergency fund for non-covered expenses.

- Review the list of network hospitals once every 6 months.

🔄 Cashless Hospital Network vs. Reimbursement Claims

Many people confuse the two.

- Cashless – Insurer pays the hospital directly.

- Reimbursement – You pay first, then file a claim to get your money back.

Choosing a plan with a strong cashless hospital network saves you from financial strain during emergencies.

🏆 Best Health Insurance Providers with Large Cashless Hospital Networks in India (2025)

| Insurance Provider | No. of Network Hospitals | Claim Settlement Speed |

|---|---|---|

| HDFC ERGO | 12,000+ | 90% within 2 hours |

| Star Health | 14,000+ | 85% within 4 hours |

| ICICI Lombard | 10,600+ | 92% within 2 hours |

| Niva Bupa | 8,500+ | 88% within 3 hours |

| Care Health | 11,000+ | 89% within 2 hours |

💡 Internal Link Tip: Compare these in detail here — Best Health Insurance Plans in India 2025.

FAQ – Cashless Hospital Network in Health Insurance (India)

1. What is a cashless hospital network in health insurance?

A cashless hospital network is a list of hospitals partnered with your insurance company where you can get treatment without paying upfront. The insurer directly settles the bill with the hospital, as per your policy terms.

2. How does cashless hospitalization work in India?

When you visit a network hospital, you show your health insurance card or policy details. The hospital contacts the insurer or their TPA (Third Party Administrator) for approval. Once approved, you get treatment without paying from your pocket (except for non-covered expenses).

3. What is the difference between cashless and reimbursement claims?

In cashless claims, the insurer pays the hospital directly. In reimbursement claims, you pay first, then submit bills to the insurer for repayment.

4. How can I find my insurer’s cashless hospital network?

You can check your insurance company’s official website, mobile app, or contact their customer care. Many insurers also provide a downloadable hospital list.

5. Are all treatments covered in cashless hospitals?

Not always. Some treatments may need pre-authorization or may be excluded under your policy. Always read your policy wording and confirm with the insurer before admission.

6. What documents are required for cashless hospitalization?

Typically, you’ll need:

- Health insurance card/policy number

- Photo ID proof

- Doctor’s admission note or referral

- Completed pre-authorization form

7. Can I get cashless treatment in a non-network hospital?

No. Cashless benefits apply only to hospitals in your insurer’s network. For non-network hospitals, you’ll need to pay upfront and file for reimbursement.

8. Why is it important to choose a policy with a wide hospital network?

A larger network increases your chances of finding a partnered hospital nearby, especially during emergencies, ensuring quicker and hassle-free treatment.

📍 Final Thoughts

A cashless hospital network in health insurance offers significant benefits during a medical emergency in India. It is one of the biggest advantages you can have. Choose a policy with a wide and reputable network. Understand the claim process. Keep your documents ready. By doing so, you can ensure that your treatment is smooth, quick, and stress-free.

Remember — the best health insurance policy is not just about premium or coverage. It is also about how efficiently it supports you in real-life emergencies.

For a deeper dive into insurance choices, visit BimaTalk.com — your trusted guide to smart financial decisions.

Last Updated on August 15, 2025 by Singh Sumit