Buying car insurance is mandatory in India, but most people settle for the bare least. They believe a basic policy is enough—until a claim exposes the gaps in coverage. Suddenly, the policyholder ends up paying ₹2–3 lakhs from their own pocket, even after having insurance.

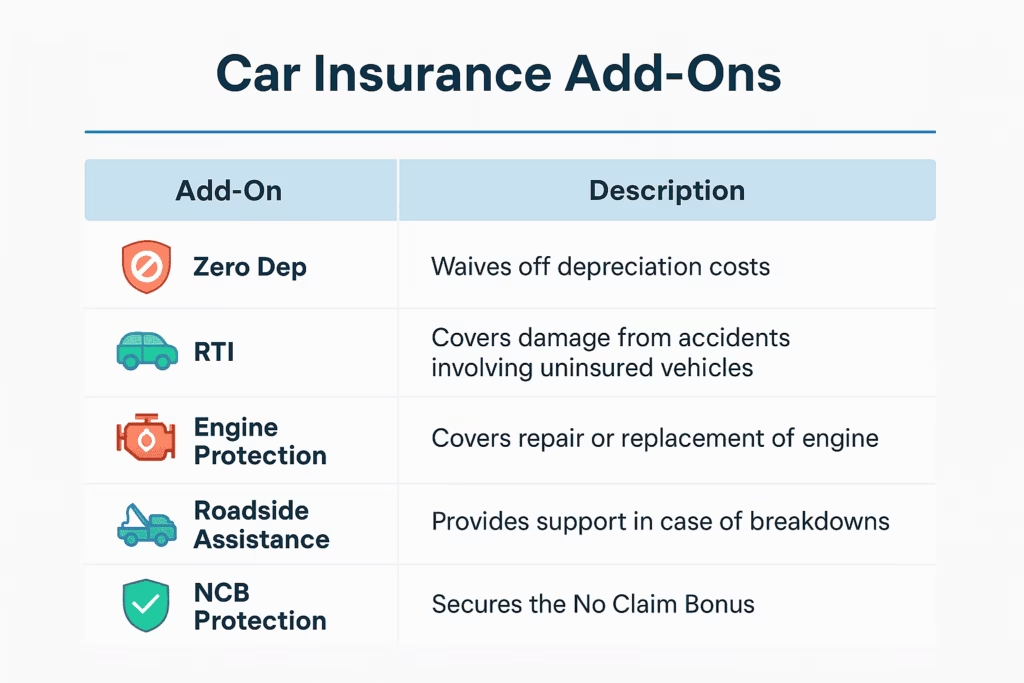

That’s where Car Insurance Add-Ons come in. These optional covers may look like small extras, but in reality, they transform your insurance into a comprehensive safety net.

In this guide, we’ll break down the top 5 Car Insurance Add-Ons in India. You’ll learn what they do, why they matter, and real-life scenarios where they can save you lakhs. And don’t miss Add-on #3—it’s the most overlooked but also the most powerful.

Why Standard Car Insurance Isn’t Enough

The gaps in basic coverage

The gaps in basic coverage

A regular comprehensive policy covers accidents, theft, and third-party liability, but it still has major exclusions. For example, it won’t cover depreciation losses, engine damage from floods, or provide roadside help when you’re stranded at midnight.

This is why many drivers face heavy out-of-pocket expenses despite “being insured.”

Comprehensive vs. Third-Party Coverage Explained

Before adding extras, it’s important to understand the difference between third-party and comprehensive insurance.

- Third-party insurance only covers damage to others.

- Comprehensive insurance covers your own car too—but with limits.

👉 To learn more, check our detailed guide: [Comprehensive vs. Third-Party Coverage Explained].

This is where Car Insurance Add-Ons fill the gap and make a policy truly effective..

The Top 5 Car Insurance Add-Ons Every Driver Should Consider

1️⃣ Zero Depreciation Cover – Protect Against Depreciation Losses

Why it matters

Every car part depreciates with time. During a claim, insurers deduct 30–50% of the part’s value, leaving you to pay the difference.

Best suited for new cars

If your car is less than 5 years old, this add-on makes sure you get the full cost of repairs. The payout does not include depreciation cuts.

Real-world example

A bumper replacement worth ₹20,000 may give you only ₹12,000 under a standard policy. With Zero Depreciation Cover, you receive the full ₹20,000.

2️⃣ Engine Protection Cover – Must-Have in Monsoon Cities

Common exclusions in standard policies

Engine damage from floods, oil leakage, or hydrostatic lock is not covered under normal insurance.

Who benefits most

- Car owners in flood-prone cities like Mumbai, Chennai, or Kolkata.

- Owners of luxury cars with high repair costs.

Case study

A Mumbai driver spent ₹1.8 lakh repairing his flooded engine. With Engine Protection Cover, he would have paid nothing.

📖 External resource: Policybazaar on Engine Protection Cover

3️⃣ Return to Invoice (RTI) Cover – The Hidden Gem 💰

Why RTI is overlooked

Most policyholders don’t realize this. In case of theft or total loss, insurers only pay the depreciated value. They do not pay the original cost.

Ideal situations for RTI

- Brand-new cars (up to 3–5 years old).

- High-value cars prone to theft or accidents.

Example of total loss/theft

You bought a car for ₹12 lakh. After 2 years, it’s valued at ₹9 lakh. If stolen:

- Without RTI → ₹9 lakh payout

- With RTI → Full ₹12 lakh payout

📖 External resource: The Economic Times on RTI Cover

4️⃣ Roadside Assistance – Peace of Mind on Every Drive

Services typically included

Towing, tyre replacement, jumpstarting a dead battery, on-site fuel delivery, and taxi arrangements.

Who needs it the most

- Highway travelers

- Night commuters

- People living in remote areas

Example scenario

Imagine your tyre bursts at 11 pm on a highway. With Roadside Assistance, one phone call gets help at your location.

📖 External resource: Times of India on Roadside Assistance

5️⃣ NCB Protection – Preserve Your Discounts

How NCB works

The No Claim Bonus (NCB) reduces your renewal premium by up to 50% if you don’t make claims. But one accident can erase this benefit.

Why protecting it makes sense

With NCB Protection, you can make a few claims while keeping your discount intact.

Internal resource

For a deeper breakdown, check: [What Is a No Claim Bonus (NCB) in Car Insurance?]

📖 External resource: HDFC ERGO on NCB Protection

Quick Comparison Table of Car Insurance Add-Ons

| Add-On | Best For | Key Benefit |

|---|---|---|

| Zero Depreciation | New cars (<5 years) | Full repair cost, no depreciation cuts |

| Engine Protection | Flood-prone cities | Covers costly engine damage |

| RTI | New or luxury cars | Full invoice value in total loss |

| Roadside Assistance | All car owners | 24/7 emergency support |

| NCB Protection | Safe drivers | Keeps premium discounts intact |

Why These Car Insurance Add-Ons Are Worth Every Rupee

- Cost vs. savings: Each add-on may raise your premium slightly, but the savings during claims can be in lakhs.

- Peace of mind: They protect against unexpected, high-cost risks that standard insurance ignores.

Selecting add-ons should be based on your car age, city, and driving style.

- New cars: Zero Dep + RTI + Engine Protection.

- Flood-prone areas: Engine Protection is non-negotiable.

- Frequent travelers: Roadside Assistance.

👉 For a step-by-step guide, check: [How to Choose the Right Car Insurance Plan]

FAQs on Car Insurance Add-Ons

Q1. Do Car Insurance Add-Ons make insurance expensive?

Yes, but the cost increase is small compared to potential savings of ₹2–3 lakhs.

Q2. Can I add Car Insurance Add-Ons mid-policy?

Generally, no. Add-ons can only be chosen during purchase or renewal.

Q3. Which Car Insurance Add-On is most important?

For new cars: Zero Depreciation & Engine Protection. For luxury cars: RTI.

Q4. Do Car Insurance Add-Ons apply to EVs?

Yes, plus some insurers offer battery protection for EVs.

Q5. Is RTI useful after 5 years?

Not really—depreciation becomes too steep.

Final Take: Spend a Little, Save a Lot

Car Insurance Add-Ons are not just extras—they’re lifesavers for your finances. Spending a few extra rupees on the right add-ons today can save you ₹2–3 lakhs tomorrow.

And if you only pick one, make it Return to Invoice (RTI) Cover—the hidden gem that most people regret ignoring.

💡 Curious about your exact premium? Use our Car Insurance Premium Calculator (right side of this page) before you buy.

Last Updated on August 24, 2025 by Singh Sumit

1 thought on “5 Car Insurance Add-Ons That Can Save You ₹2–3 Lakhs – Nobody Tells You #3”