Introduction

Health insurance is one of the most important financial safety nets, but life circumstances often change. Some policyholders discover better premium options, while others move to group health insurance offered by their employers. Many families also choose specialized plans for children, parents, or senior citizens.

In such cases, cancelling your existing policy becomes the right decision. Thankfully, in 2025, insurers have simplified the process. This change allows you to cancel a health insurance policy online in India without lengthy paperwork. You also don’t need to visit a branch.

This complete guide will walk you through the steps to cancel a health insurance policy online in India, explain refund timelines, and share expert tips to avoid mistakes while switching or cancelling your coverage.

Why People Cancel Health Insurance Policies in India

- Switching to employer-provided group insurance – Many salaried employees rely on group health insurance offered by companies. It’s cheaper but has limited flexibility. (👉 Read our detailed breakdown: Group Health Insurance vs Individual Health Insurance: Complete Pros & Cons Guide 2025)

- Better plans in the market – Policyholders often find policies with stronger cashless hospital networks, better add-ons, or higher claim settlement ratios. (👉 Learn more: Cashless Hospital Network in Health Insurance: How It Works in India)

- Changing family needs – Marriage, childbirth, or elderly parents may push you to cancel and buy a family floater or senior citizen plan. (👉 See our analysis: Best Health Insurance Plans for Senior Citizens in India)

- Dissatisfaction with customer service – Delayed claims, hidden charges, or poor hospital coverage often frustrate policyholders.

Important Terms to Know Before Cancellation

Before following the steps to cancel a health insurance policy online in India, it’s important to understand a few technical terms:

- Free Look Period – A 15-day window (from policy issuance) where you can cancel for a full refund.

- Surrender Value – The refund available after the free look period; usually partial.

- Policy Lapse – Automatic termination due to non-payment, not the same as cancellation.

- Portability Option – Instead of cancelling, you can port your policy to another insurer, retaining benefits like no-claim bonuses.

7 Verified Steps to Cancel a Health Insurance Policy Online in India

Here’s a detailed walkthrough of the digital cancellation process.

Step 1: Review Your Policy Documents Thoroughly

Start by reading your health insurance policy document carefully. Look for:

- Cancellation rules

- Refund eligibility

- Clauses on portability

👉 This is the first step in the steps to cancel a health insurance policy online in India, and skipping it may lead to refund issues.

Step 2: Check Your Free Look Period Eligibility

If you’re within 15 days of buying the policy (30 days for online purchases in some cases), you’re eligible for a full refund, minus stamp duty and medical checkup charges.

👉 Canceling during this period is the smoothest step in the process of cancelling health insurance online in India.

Step 3: Visit the Insurer’s Official Website or Mobile App

Never use third-party links or unverified emails. Always log in to your insurer’s:

- Official website (look for “https://” for security)

- Mobile app (downloaded from Play Store or App Store)

👉 According to IRDAI, policyholders should always use official channels when completing the steps to cancel a health insurance policy online in India to avoid fraud.

Step 4: Login and Access Policy Services Section

After logging in, go to “My Policies”, “Policy Services”, or “Manage Policy”.

Look for a tab like “Cancellation Request” or “Policy Termination”.

Every insurer uses slightly different terms, but the option is always present.

Step 5: Fill Out the Cancellation Request Form

Here, you’ll need to provide:

- Policy number

- Reason for cancellation

- Bank account details for refund (if required)

👉 Filling out this form is one of the most important steps to cancel a health insurance policy online in India because errors here can delay refunds.

Step 6: Upload Necessary Documents and Submit Request

Mandatory documents usually include:

- Policy copy

- ID proof (Aadhaar/PAN)

- Cancelled cheque or bank statement

After submission, the system generates a reference number. Save this—it’s your proof of cancellation.

Step 7: Track Refund Status & Confirmation

Refunds during free look period are usually processed in 5–7 working days. Post free-look period, refunds (surrender value) may take 15–30 days.

👉 The final step in the steps to cancel a health insurance policy online in India is tracking the refund until confirmation.

What Happens After Cancellation?

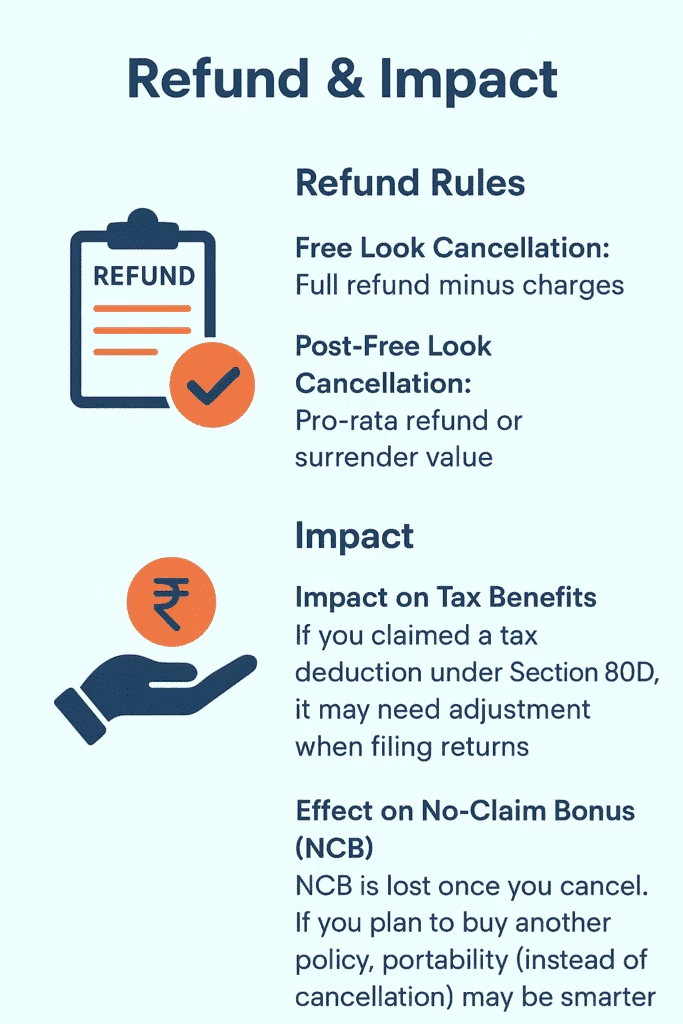

Refund Rules

- Free Look Cancellation: Full refund minus charges.

- Post-Free Look Cancellation: Pro-rata refund or surrender value.

Impact on Tax Benefits

If you claimed a tax deduction under Section 80D, it may need adjustment when filing returns.

Effect on No-Claim Bonus (NCB)

NCB is lost once you cancel. If you plan to buy another policy, portability (instead of cancellation) may be smarter.

Tips to Cancel Smoothly (And Avoid Mistakes)

- Compare before cancelling – Switching to a policy with a poor cashless hospital network can cost you during emergencies.

- Port instead of cancel – If you just want a better insurer, consider portability to retain benefits.

- Save all communication – Screenshots, emails, reference IDs.

- Check refund breakdown – Ensure deductions are transparent.

Alternatives to Online Cancellation

Not comfortable with digital platforms? You can:

- Call customer care – Use toll-free numbers.

- Visit a branch office – Submit a written application.

- Send registered post/email – For formal proof.

Frequently Asked Questions

1. How long does it take for a refund?

Refunds vary depending on when you follow the steps to cancel a health insurance policy online in India. Free Look: 5–7 days. Otherwise: 15–30 days.

2. Can I reinstate after cancellation?

Some insurers allow reinstatement within a grace period, but underwriting rules apply.

3. Is portability better than cancellation?

Yes—portability is often smarter than following all the steps to cancel a health insurance policy online in India, especially if you want to retain NCB.

4. Will claim history affect future insurance?

Yes. Insurers review your past claims during underwriting.

5. Should senior citizens cancel policies?

Instead of following the steps to cancel a health insurance policy online in India, consider switching to a senior citizen plan. (👉 Read: Best Health Insurance Plans for Senior Citizens in India)

Conclusion: Be Smart When Cancelling Insurance

The steps to cancel a health insurance policy online in India are simple if you follow the process carefully—review your policy, check the free look period, use the official portal, and save every reference ID.

But before cancelling, always evaluate alternatives. Sometimes porting your plan or upgrading coverage is smarter than cancelling outright.

For detailed comparisons and smart insurance choices, visit BimaTalk. And for regulatory clarity, always refer to IRDAI official guidelines.

Best

thanks