Introduction

For most Indians, buying a house is not just a financial goal. It is also a matter of pride and emotional security. Property prices are rising. Weather conditions are unpredictable. Risks of theft or fire are increasing. Thus, safeguarding that investment has become crucial. This is where home insurance plays a vital role.

In this guide, we’ll explore the Best Home Insurance Companies of 2025 in India. We will compare their rates, coverage, and claim processes. Our aim is to help you choose the right policy to protect your dream home.

Why Home Insurance is Crucial in India in 2025

Rising Property Values

India’s urban housing market has seen rapid growth, especially in metro cities like Mumbai, Delhi, and Bengaluru. A fire or natural disaster could cause financial losses worth crores if your property isn’t insured.

Natural Disasters & Climate Risks

India is prone to floods, cyclones, and earthquakes. Events like the Kerala floods and Odisha cyclones have highlighted the need for strong home insurance coverage.

Theft & Vandalism

Urban areas are not free from break-ins. Best Home Insurance Companies of 2025 in India are offering theft protection that covers household goods, jewelry, and expensive electronics.

Key Features to Look for in Home Insurance Policies

Before exploring the Best Home Insurance Companies of 2025, let’s review the must-have features:

- Fire & Allied Perils Coverage – Protection against fire, lightning, explosion, riots, and terrorism.

- Natural Calamity Coverage – Flood, cyclone, earthquake, and storm damage.

- Burglary & Theft Cover – Loss of valuables inside the house.

- Liability Cover – Protection if a guest is injured on your premises.

- Add-on Riders – Coverage for rent loss, temporary accommodation, or valuable assets.

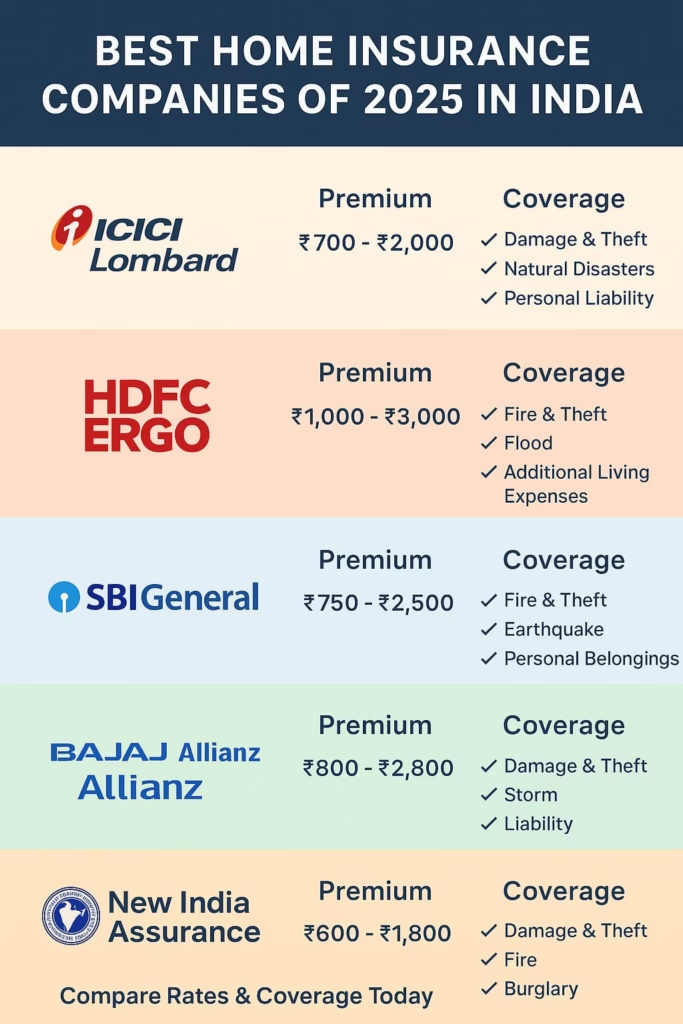

Best Home Insurance Companies of 2025 in India

Here are the top-rated insurers offering comprehensive home insurance policies in 2025:

| Insurance Company | Unique Features | Ideal For |

|---|---|---|

| ICICI Lombard | Affordable plans, online policy issuance | Middle-class families |

| HDFC ERGO | Covers rented & owned homes, wide add-ons | Apartment owners |

| SBI General Insurance | Strong branch network, easy claims | Tier-2 and Tier-3 city homeowners |

| Bajaj Allianz | Discounts for long-term policies | Families seeking long cover |

| New India Assurance | Govt-owned, wide trust base | Budget-conscious buyers |

1. ICICI Lombard Home Insurance

ICICI Lombard is one of the Best Home Insurance Companies of 2025 in India. It offers fire, burglary, and natural calamity protection. Policies can be purchased online with instant issuance.

✅ Pros: Wide coverage, quick settlement

❌ Cons: Limited customization in basic plan

2. HDFC ERGO Home Insurance

HDFC ERGO is well-known for its “Home Shield” policy, covering both rented and owned homes. It also provides add-ons for valuables like art, jewelry, and electronics.

✅ Pros: Covers both owners & tenants, 24/7 support

❌ Cons: Slightly higher premiums in metros

3. SBI General Home Insurance

Backed by the State Bank of India, this insurer has a strong reach in smaller towns and cities. Its Householders’ Package Policy includes structural and contents insurance.

✅ Pros: Strong branch network, trusted brand

❌ Cons: Digital claim settlement can be slow

4. Bajaj Allianz Home Insurance

Bajaj Allianz offers flexible long-term policies that provide coverage up to 20 years. It also has discounts for installing safety measures like fire alarms.

✅ Pros: Long-term coverage, multi-discount options

❌ Cons: Premium calculation can be complex

5. New India Assurance Home Insurance

As a government-backed insurer, New India Assurance has affordable policies and enjoys consumer trust. It covers structural and contents insurance at competitive rates.

✅ Pros: Affordable plans, govt reliability

❌ Cons: Limited digital services

Comparing Rates of Best Home Insurance Companies of 2025

| Company | Approx. Annual Premium (₹) | Coverage Value (₹) |

|---|---|---|

| ICICI Lombard | ₹2,500 – ₹6,000 | Up to ₹50 lakhs |

| HDFC ERGO | ₹3,000 – ₹8,000 | Up to ₹1 crore |

| SBI General | ₹2,000 – ₹5,000 | Up to ₹50 lakhs |

| Bajaj Allianz | ₹2,800 – ₹7,000 | Up to ₹1 crore |

| New India Assurance | ₹1,800 – ₹4,500 | Up to ₹50 lakhs |

(Premiums vary depending on location, home value, and add-ons.)

Coverage Options in 2025: What’s New in India?

- Smart Home Protection – Covers IoT devices like CCTV, fire alarms, and smart locks.

- Eco-Friendly Add-Ons – Coverage for solar panels and energy-efficient systems.

- Temporary Rent Cover – Provides financial support for renting another property if your house is damaged.

- Cyber Theft Cover – Some insurers now protect against online financial fraud linked to home transactions.

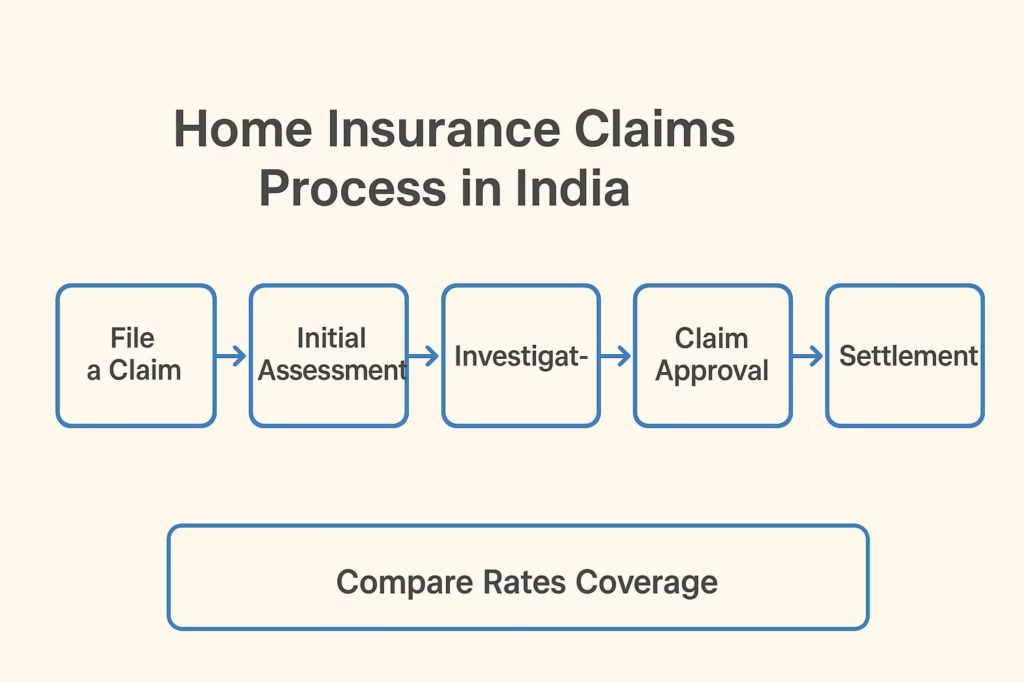

How to Choose the Best Home Insurance in India

- Evaluate the Insurer’s Claim Settlement Ratio (CSR) – Higher CSR means smoother claims.

- Check Coverage vs Premium – Cheapest is not always the best.

- Look for Add-On Benefits – Loss of rent, alternative accommodation, burglary cover.

- Read Policy Exclusions – Many policies exclude gradual wear & tear or war-related damages.

Money-Saving Tips for Home Insurance in 2025

- Bundle with motor or health insurance for discounts.

- Install safety devices to get lower premiums.

- Choose long-term policies (up to 20 years) for cost savings.

- Opt for higher deductibles if you can manage small expenses yourself.

Internal & External Resources

- Best Health Insurance Plans for Senior Citizens in India (2025 Guide)

- Best Health Insurance for Diabetics in India: Essential Things You Need to Know (2025 Guide)

- For regulatory guidance, visit IRDAI – Insurance Regulatory and Development Authority of India.

FAQs on Best Home Insurance Companies of 2025

Q1: Which is the best home insurance company in India for 2025?

HDFC ERGO and ICICI Lombard are the most popular choices for metro homeowners. SBI General and New India Assurance are better for smaller towns.

Q2: How much does home insurance cost in India?

The annual premium ranges from ₹2,000 – ₹8,000 depending on property value and coverage.

Q3: Can tenants buy home insurance in India?

Yes, companies like HDFC ERGO allow tenants to insure household contents even if they don’t own the property.

Q4: Does home insurance cover jewelry and electronics?

Yes, but you may need to declare and opt for add-ons for high-value items.

Q5: Which insurer has the best claim settlement ratio in 2025?

HDFC ERGO and ICICI Lombard have some of the highest CSRs in the Indian home insurance market.

Q6: Is flood and earthquake damage included in home insurance?

Not always. Many insurers offer them as add-on covers. Always check your policy terms.

Conclusion

The Best Home Insurance Companies of 2025 in India are making policies more affordable, digital-friendly, and comprehensive. Whether you live in a metro city or a small town, the right policy choice offers peace of mind. It also guarantees financial security.

By comparing rates, coverage, and claim processes, you can select the best insurer. Make sure it balances affordability and protection for your home.

1 thought on “Best Home Insurance Companies of 2025: Compare Rates & Coverage”