For Indian students, stepping into higher education is not only about chasing academic dreams. It’s also about adapting to a new lifestyle. Along with freedom and opportunities, it brings financial responsibilities—especially regarding health. Rising medical costs in India have made it nearly impossible for students and their families to manage emergencies without insurance. From sudden illnesses to accidents, healthcare bills can quickly pile up.

This is where Best Budget Health Plans for Indian Students play a vital role. These plans are specially designed to provide affordable healthcare coverage. This ensures students can focus on studies without the constant worry of unexpected medical expenses. In 2025, awareness of student-friendly plans is increasing. Options are also becoming wider. Indian insurers are providing plans that perfectly balance low premiums and comprehensive coverage.

In this guide, we’ll dive deep into the best budget health plans available for Indian students. We will compare insurers and explore benefits. Additionally, we will share practical tips to help you make an informed decision.

Why Health Insurance is Crucial for Indian Students in 2025

Healthcare in India is advancing, but with that comes higher costs. A simple hospital visit can cost ₹5,000–₹10,000, while a three-day hospitalization can easily cross ₹50,000. For a student living on a budget, such expenses are overwhelming.

Rising Medical Costs for Young Adults

- Consultation charges at private hospitals: ₹500–₹1,500 per visit

- Diagnostic tests: ₹2,000–₹5,000 for common tests like MRI or CT scan

- Accidental injuries: Emergency treatments often cost ₹25,000+

- Hospitalization for viral fever or dengue: ₹30,000–₹70,000

Without insurance, families end up using savings or loans, adding stress to already high education expenses.

Student Lifestyle and Health Risks

Indian students today face unique health challenges due to:

- Stress and anxiety from competitive academics

- Unhealthy eating habits and fast-food culture

- Limited physical activity

- Higher exposure to road accidents while commuting

All these factors highlight the importance of choosing the Best Budget Health Plans for Indian Students in 2025.

Features of Budget-Friendly Student Health Plans

Budget health plans for students are not merely low-cost versions of regular health insurance. They are tailored policies with student needs in mind.

Key Features

- Affordable Premiums – Premiums between ₹3,000–₹5,000 annually

- Cashless Hospitalization – Coverage in top hospitals across India

- Day-Care Procedures – Coverage for treatments not requiring overnight stay

- Mental Health Coverage – Growing demand among students in 2025

- Accidental Injury Coverage – Higher risk among young adults

- OPD Benefits – Some plans cover doctor visits and minor treatments

- Global Coverage – For students planning overseas education

These features make Best Budget Health Plans for Indian Students both affordable and practical.

Top 5 Insurers Offering the Best Budget Health Plans for Indian Students in India

Let’s explore the top insurers offering affordable yet comprehensive student health insurance in India this year.

1. ICICI Lombard Student Health Insurance

- Premium: Starting at ₹3,500 per year

- Coverage: ₹2–5 lakh

- Benefits: Hospitalization, accidental injuries, critical illness cover

- Unique Advantage: 24×7 student helpline and wide hospital network

2. HDFC ERGO Student Health Plan

- Premium: ₹4,200 onwards annually

- Coverage: ₹2–10 lakh

- Benefits: Mental health support, OPD, and diagnostic tests

- Why Choose: Covers both domestic and overseas students

3. Star Health Student Care Policy

- Premium: ₹3,000 annually

- Coverage: ₹2–5 lakh

- Benefits: Accident cover, day-care procedures, and OPD services

- Highlight: Lowest premium in the student segment

4. Bajaj Allianz Student Insurance

- Premium: ₹3,800 per year

- Coverage: ₹3–8 lakh

- Benefits: Hospitalization, travel-related coverage, accidental cover

- Plus Point: Ideal for students studying away from hometown

5. Reliance Health Insurance for Students

- Premium: ₹3,200 annually

- Coverage: ₹2–6 lakh

- Benefits: Medical emergencies, accidental injuries, critical illnesses

- Special: Student discounts for policyholders under 25 years

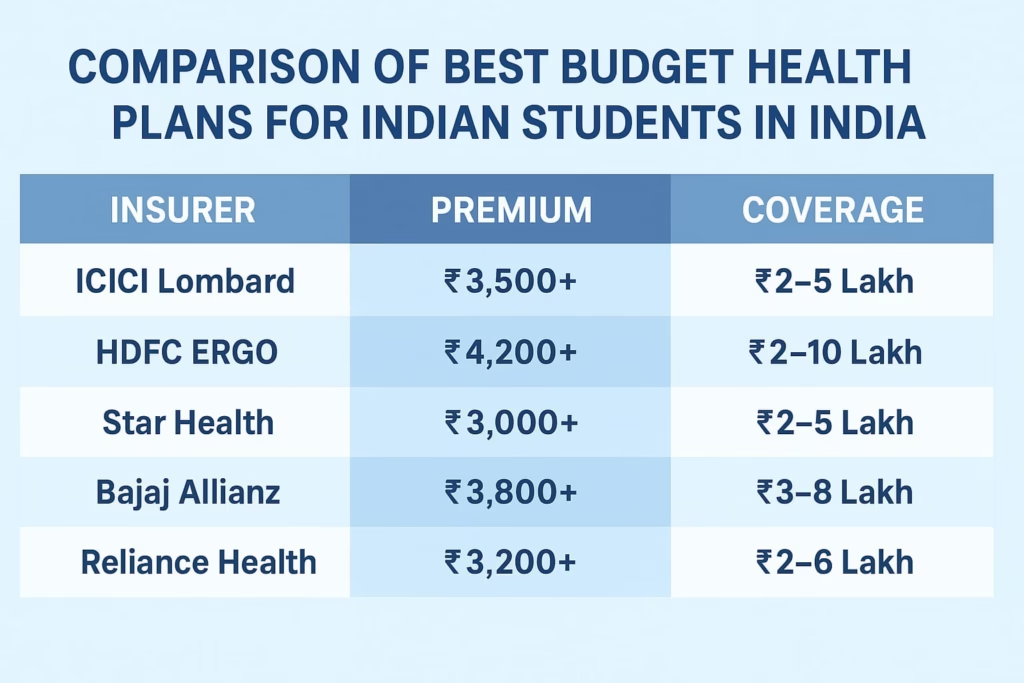

Comparison Table: Best Budget Health Plans for Indian Students

| Insurer | Premium (₹) | Coverage | Key Benefit |

|---|---|---|---|

| ICICI Lombard | 3,500+ | ₹2–5 Lakh | Wide hospital network |

| HDFC ERGO | 4,200+ | ₹2–10 Lakh | Mental health coverage |

| Star Health | 3,000+ | ₹2–5 Lakh | Affordable student-focused |

| Bajaj Allianz | 3,800+ | ₹3–8 Lakh | OPD + travel coverage |

| Reliance Health | 3,200+ | ₹2–6 Lakh | Discounts for students |

Case Study: Benefits of the Best Budget Health Plans for Indian Students

Rahul, a 20-year-old engineering student from Bangalore, met with a bike accident in 2024. His hospital bill reached ₹85,000. Luckily, he had a Star Health Student Care Plan that covered ₹70,000 of his treatment. His family only paid ₹15,000 out of pocket, saving them from financial stress.

This real-life example shows why Best Budget Health Plans for Indian Students are more than just policies—they’re financial lifesavers.

How to Choose the Best Budget Health Plan for Students

Step 1: Define Coverage Needs

Students with a history of medical issues should opt for higher coverage.

Step 2: Compare Premiums Online

Websites like Policybazaar and Coverfox help compare premiums and features.

Step 3: Check Hospital Network

Make sure the insurer has tie-ups near the student’s college or university.

Step 4: Review Claim Settlement Ratio

Look for insurers with a CSR of 90%+ to ensure hassle-free claims.

Step 5: Look for Student-Specific Benefits

Some policies cover mental health, OPD visits, and travel—all useful for students.

Before buying, always assess whether the policy qualifies as one of the Best Budget Health Plans for Indian Students.

Cost-Saving Tips for Student Health Insurance

- Buy policies at a younger age for lower premiums

- Avoid unnecessary riders that increase costs

- Consider family floater plans if you already have family insurance

- Use online discounts and student offers while purchasing

These strategies help ensure you get the Best Budget Health Plans for Indian Students without overspending.

Internal Links for Related Reading

If you’re exploring broader health insurance options, check these guides:

- Best Health Insurance for Diabetics in India: Essential Things You Need to Know (2025 Guide)

- How to Choose the Best Health Insurance for Your Family in India (2025 Guide)

External Authority Reference

For official health insurance regulations and student-related guidelines, visit IRDAI (Insurance Regulatory and Development Authority of India).

FAQs on Best Budget Health Plans for Indian Students

Q1. What is the cheapest health insurance plan for Indian students?

The cheapest among the Best Budget Health Plans for Indian Students is Star Health’s plan starting at ₹3,000 annually.

Q2. Can students get mental health coverage?

Yes, HDFC ERGO and ICICI Lombard offer mental health coverage in 2025.

Q3. Do student health plans cover accidents?

Yes, almost all of the Best Budget Health Plans for Indian Students cover accidental injuries.

Q4. Can I include a student in my family health insurance?

Yes, but a dedicated student plan offers more student-centric benefits.

Q5. Are student plans available for studying abroad?

Yes, HDFC ERGO and Bajaj Allianz have overseas student coverage.

Q6. What’s the ideal coverage amount for a student in India?

A ₹3–5 lakh coverage amount is ideal in the Best Budget Health Plans for Indian Students segment.

Q7. How do I buy a student health insurance policy online?

You can compare and purchase via portals like Policybazaar, Coverfox, or insurer websites.

Q8. Do these plans cover pre-existing conditions?

Most don’t, or they have a waiting period of 2–4 years.

Q9. Are there special discounts for students?

Yes, insurers like Reliance offer student-specific premium discounts.

Q10. What documents are required to buy a student health plan?

Basic KYC documents, age proof, and student ID are usually required.

Conclusion: Why Every Student in India Needs Health Insurance

The Best Budget Health Plans for Indian Students in 2025 offer more than just affordable premiums. They provide safety, stability, and peace of mind. Premiums are as low as ₹3,000 annually. Students can secure themselves against medical emergencies. They are also protected from accidental injuries and mental health challenges.

Parents benefit from reduced financial stress, while students gain the confidence to pursue their studies without fear of sudden expenses.

In a world where healthcare costs are rising, investing in a budget health plan for students is not optional—it’s essential. Choosing wisely today can save lakhs of rupees tomorrow.

Last Updated on September 1, 2025 by Singh Sumit