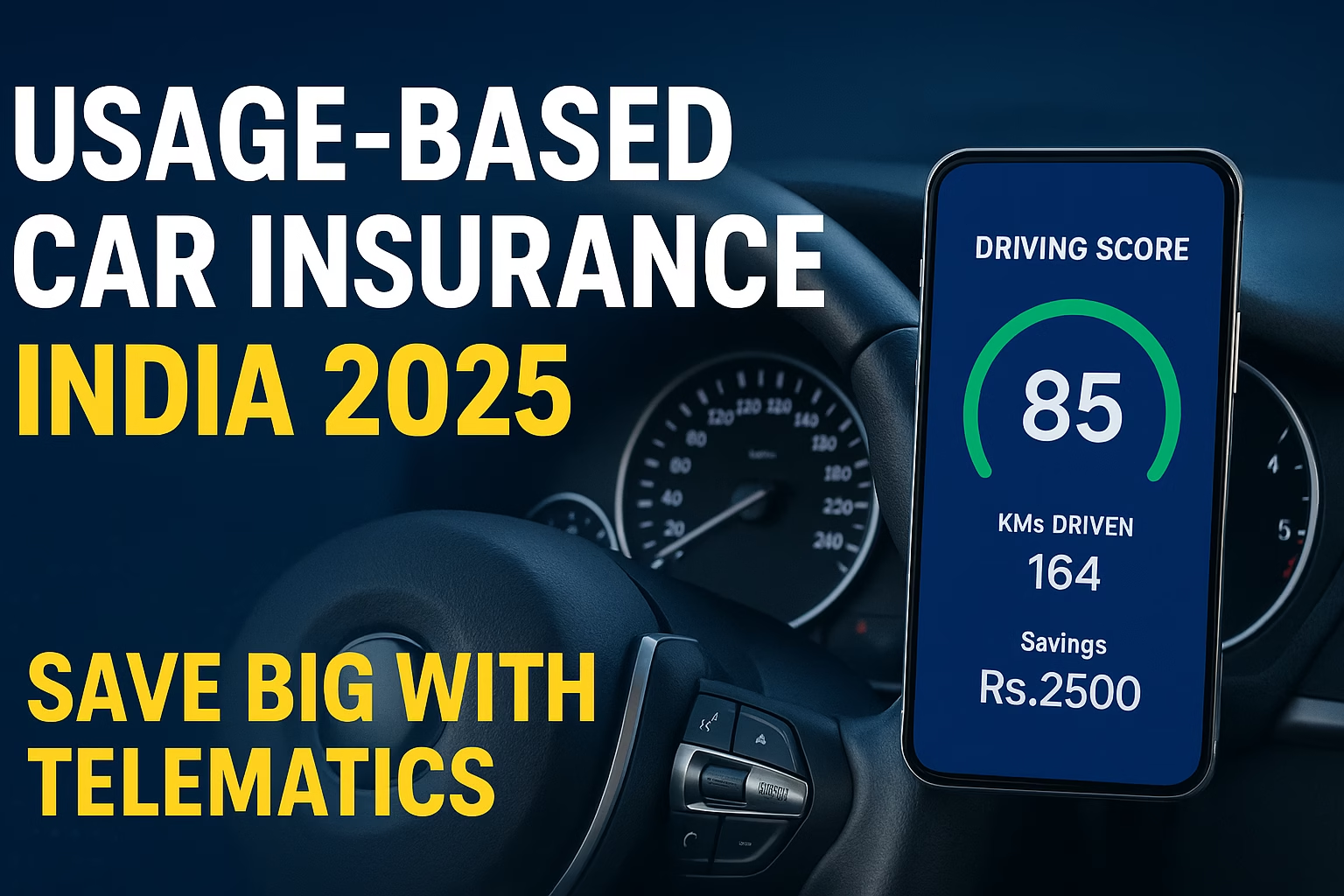

Top 10 Benefits of Usage-Based Bike Insurance India in 2025: The Future of Smarter Riding

Introduction: Why Bike Insurance Needs a Smart Upgrade Usage-Based Bike Insurance India is transforming the way two-wheeler owners think about coverage in 2025. For years, traditional bike insurance charged the same flat premium. It did not matter if you rode daily in heavy traffic or just took your scooter out on weekends. This one-size-fits-all model … Read more